Trade War, Wine, & Gold

October 16, 2025

Each week, the Stokes Family Office staff puts together a list of our favorite news and updates on all things wealth management. From financial planning, portfolio construction, tax and estate planning, retirement plan services to anything we found interesting. Enjoy this week’s curated list for your weekend reading!

US-China Trade War 3.0? Now What

Sonu Varghese: Just as we were bracing for some stock market volatility after a whopping 35% 6-month rally for the S&P 500, we got the perfect catalyst: tariffs. President Trump announced on Friday that he will be imposing additional 100% tariffs on Chinese goods.

Three Things Cullen Roche Is Thinking About

Roche breaks down his thoughts on the AI bubble, TIPS ladders in ALM strategies, and what the gold surge is telling us.

California’s Wine Industry Is in Crisis

WSJ: Changing drinking habits, falling prices, tariffs, and the weather are forcing winemakers to do the unthinkable: rip up the vines.

Related:

Three Lessons From a Three-Year-Old Bull Market

Fisher Investments: Sunday, October 12, was a mini-milestone of sorts. The global bull market celebrated its third birthday—and we will commemorate the occasion by imparting three investment lessons from these three years.

Same But Different: The AI Bubble That Isn’t (Quite)

Mark Crothers: Comparisons to the dot-com bust are rife. We’ve got speculative fever, massive market concentration, and that same cocktail of hype and FOMO that makes normally sane people do irrational things. But I think, if you look a bit deeper, it’s different.

Gold’s Role Reconsidered: What Drives Its Value And Returns?

Larry Swedroe: Gold gleams in investment portfolios worldwide, revered as a timeless safe haven and inflation hedge. But does this precious metal live up to its lustrous reputation? New research from Claude Erb and Campbell Harvey challenges conventional wisdom about gold, revealing a more complex—and less reassuring—reality for investors.

Related:

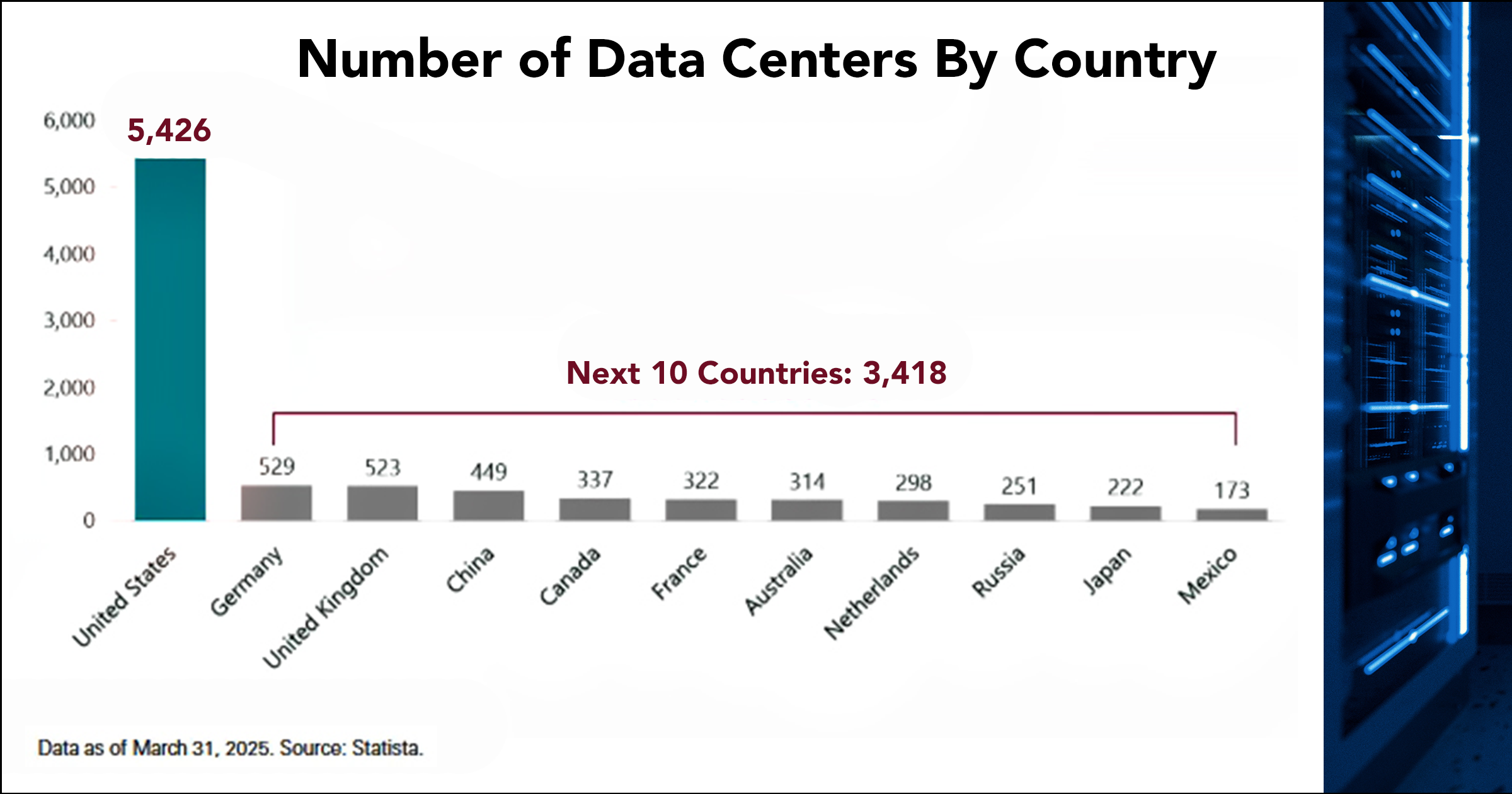

America remains the global leader in AI with ~2,000 more data centers than the next 10 largest countries combined. Via ClearBridge

Stokes Family Office is 100% Family Owned, and has been continually operating in the New Orleans Area for over 35 years. As a family office, we are focused on family wealth, financial planning, and tax planning. We are your local experts for Gulf South wealth management. Want to hear more from our team? Check out the Lagniappe Podcast.

*Stokes Family Office does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.