SFO Quarterly Review: Q2 2025

July 7, 2025

Q2 Review: Battle-Tested Stocks Hit New Highs Heading into the Second Half

The S&P 500 surged 10.6% in Q2 – its best quarter since 2023 – led by a roaring comeback in tech. Despite an early plunge on tariff fears, stocks finished June at record highs.

Key themes of the quarter: an AI-fueled rally, trade-war turbulence, a brief Middle East conflict, and a resilient U.S. economy showing both strength and subtle cracks.

Let’s unpack this wild quarter with an eye on what’s next, in the candid, data-driven style you expect from us.

From Tariff Tantrum to Record Rally

Q2 2025 was one for the books – a quarter that began in panic and ended in euphoria. In early April, President Trump’s much-hyped “Liberation Day” tariffs went into effect, and Wall Street braced for impact. On April 2, instead of “liberation,” investors felt obliteration: the S&P 500 plunged as sweeping new import taxes rattled markets. In a matter of days, the index careened into a deep correction, briefly dipping under the 5,000 mark. Financial talking heads even murmured about a repeat of Black Monday 1987 and a protracted bear market. Thankfully, that doom didn’t come to pass. As has become the norm, a sharp drop was followed by a stunning rally, underscoring why timing the market is a fool’s errand.

Then, almost as quickly as it fell, the market found its footing. By mid-April, President Trump announced a 90-day tariff pause (a tactical retreat from the harshest measures), and investors breathed a sigh of relief. What followed was a ferocious rebound. Blink and you might have missed it: the S&P 500 went on to surge 10.6% from April through June, its strongest quarter since late 2023. The index notched a new all-time closing high of 6,204.95 on June 30. The tech-heavy Nasdaq fared even better, soaring 17.8% in Q2, while even the staid Dow posted a solid +5%. Investors who stayed the course through the volatility were amply rewarded by quarter’s end.

Chart courtesy of Stockcharts.com

What fueled this dramatic comeback? In a word, optimism. A calmer tone on trade negotiations (with hopes of deals by the next tariff deadline), cooling inflation data, tax cuts, and hints that the Federal Reserve might cut rates later in the year all helped flip the script. By late June, “animal spirits” were running high again. To put it simply, the bull market got its mojo back in Q2, proving once more that this market has been battle-tested and came out stronger.

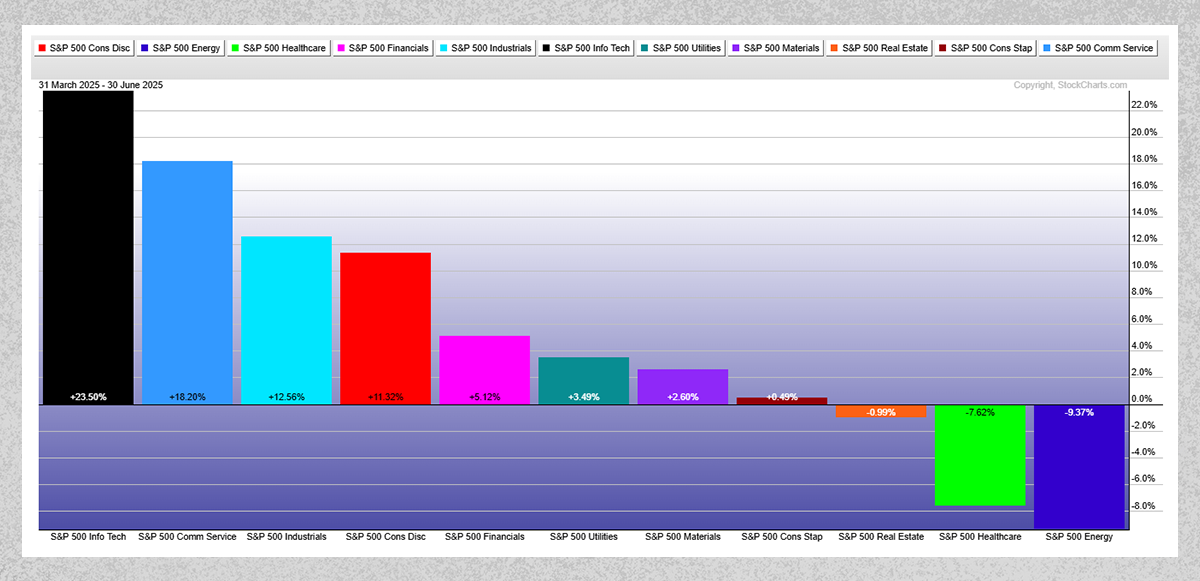

Tech Leads the Charge (Again)

If the first quarter was about pain in Big Tech, Q2 was about payback. The Magnificent Seven mega-cap stocks – Apple, Microsoft, Alphabet (Google), Amazon, Tesla, Meta, and NVIDIA – roared back to life after a rough start to the year. The Information Technology sector was the top-performing group in the S&P 500, soaring 24% in Q2, with the tech-adjacent Communication Services sector not far behind (+18%). High-flying growth names regained their swagger, powering much of the index’s gains.

Chart courtesy of Stockcharts.com

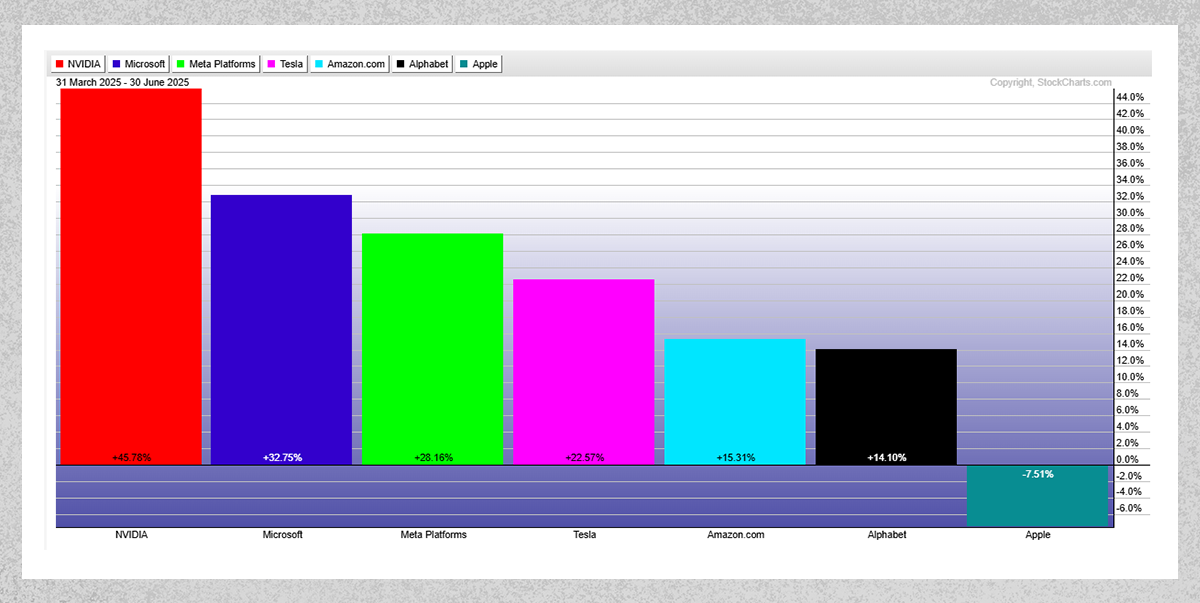

NVIDIA was the standout star: the chipmaker rallied 46% in the quarter, reclaiming its title as the world’s most valuable semiconductor company. Microsoft and Meta Platforms weren’t far behind, each jumping nearly 30%. Amazon, Google, and Tesla also notched double-digit percentage gains roughly in line with the broader market, restoring confidence after their Q1 swoon. The one laggard was the prior year’s champion, Apple – which ironically turned out a bit rotten this quarter, dipping about –7.5%.

Chart courtesy of Stockcharts.com

All told, big tech’s resurgence provided the engine for the market’s climb. The leadership of these household-name stocks – from cloud computing giants to electric car makers – underscores that investors are still willing to pay up for growth and quality. By June’s end, the Magnificent Seven had added roughly $2 trillion in combined market cap from their spring lows.

But tech’s triumph wasn’t just limited to the usual suspects. The quarter’s rally had a distinctly 2020s twist: it was turbocharged by AI fever.

AI Arms Race: Surprise Winners Emerge

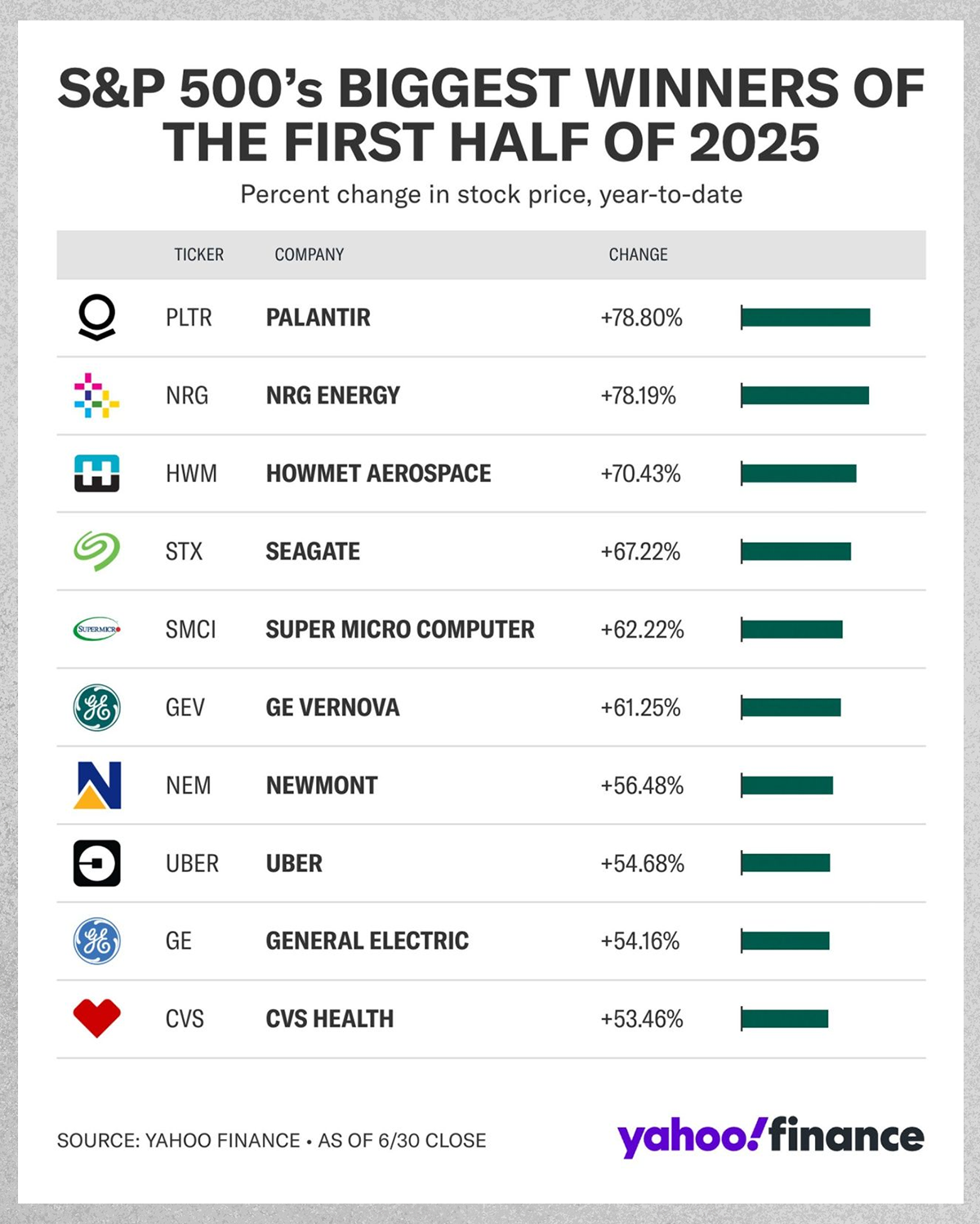

It’s foolish to ignore the artificial intelligence frenzy driving today’s market. Q2 proved that AI isn’t just hype – it’s minting winners in real time. The best-performing S&P 500 stocks of the year all shared an AI angle, some of them in surprising industries.

Take Palantir (PLTR), for example. The data analytics and software firm – long seen as doing “D.O.G.E.’s work” – has been on an absolute tear. Palantir’s shares swelled over 80% in the first half of 2025, making it the top S&P 500 performer so far. By June, the company’s market value surpassed that of Coca-Cola, an almost unthinkable feat for a firm that only went public a few years ago. Investors are giddy about Palantir’s role in big government contracts and its ventures into AI-driven software. (In one recent deal, Palantir announced that it’s partnering with a nuclear energy project to optimize operations, an AI twist on a traditional industry.) In short, Palantir has convinced the market that it’s the prime example of AI in action, and its stock is being treated accordingly.

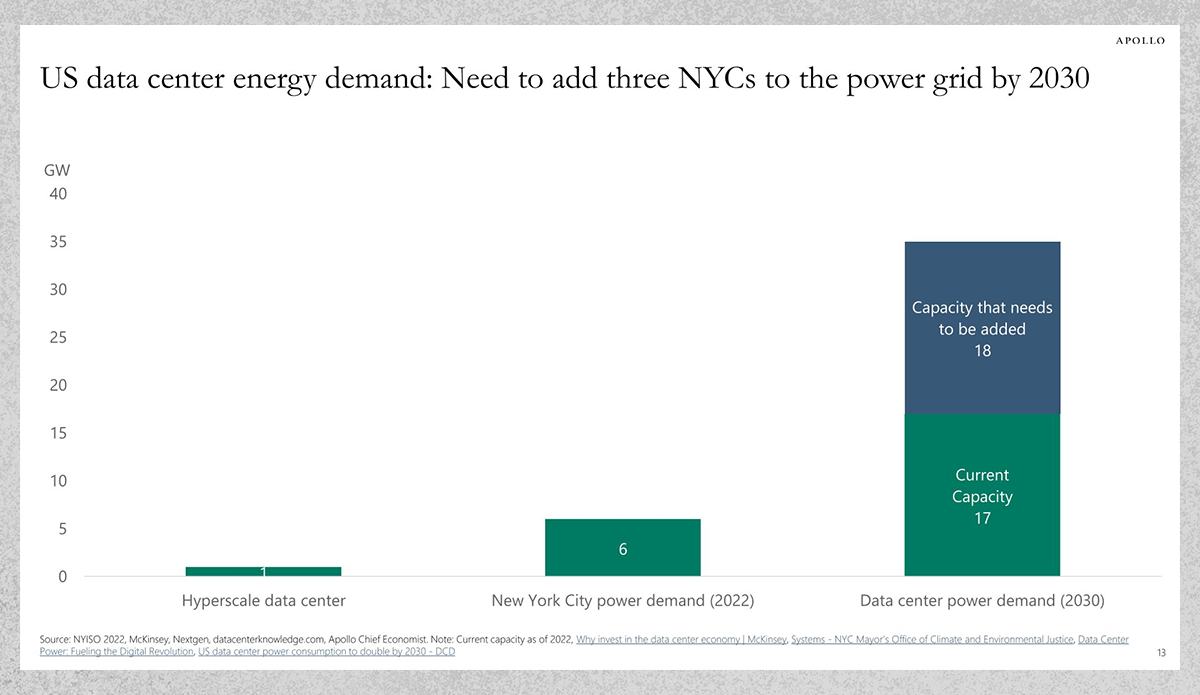

Another unlikely AI winner: NRG Energy (NRG). Yes, a utility company was the second-best performing large-cap stock in the S&P this year, up about 78% through June. NRG is a power producer focused on nuclear generation. Why would a utility soar on the AI trend? Simple: if the U.S. is going to lead in artificial intelligence, we’ll need massive electricity to run all those data centers. Reliable power is the backbone of the digital economy, and NRG’s nuclear focus positions it as a crucial player in this AI arms race.

The broader point: the AI boom is spilling over beyond just the megacap tech titans. Chipmakers, cloud service providers, data storage firms, and even old-line industrial companies with an AI angle saw huge boosts. For instance, Seagate Technology (STX), a maker of data storage hardware, jumped over 60% in H1, benefiting from surging demand for high-capacity drives to feed AI’s insatiable appetite for data. Even venerable names like GE Vernova (GE’s spin-off focused on power equipment) and Newmont Mining (a gold miner) found themselves among the top 10 S&P gainers, each up around 50-60%. In GE Vernova’s case, the tie-in is providing turbines and infrastructure for power generation (again, supporting the data/AI boom), and for Newmont, gold’s rally (more on that later) gave it a shine.

Source: Apollo Global

Bottom line: AI mania was a major driving force in Q2’s market rebound. It lifted not only the obvious candidates (like NVIDIA) but also some dark horses. As the AI arms race presses on, it will be fascinating to see what secondary and tertiary trends emerge.

Tariffs & Trade: The Looming Wild Card

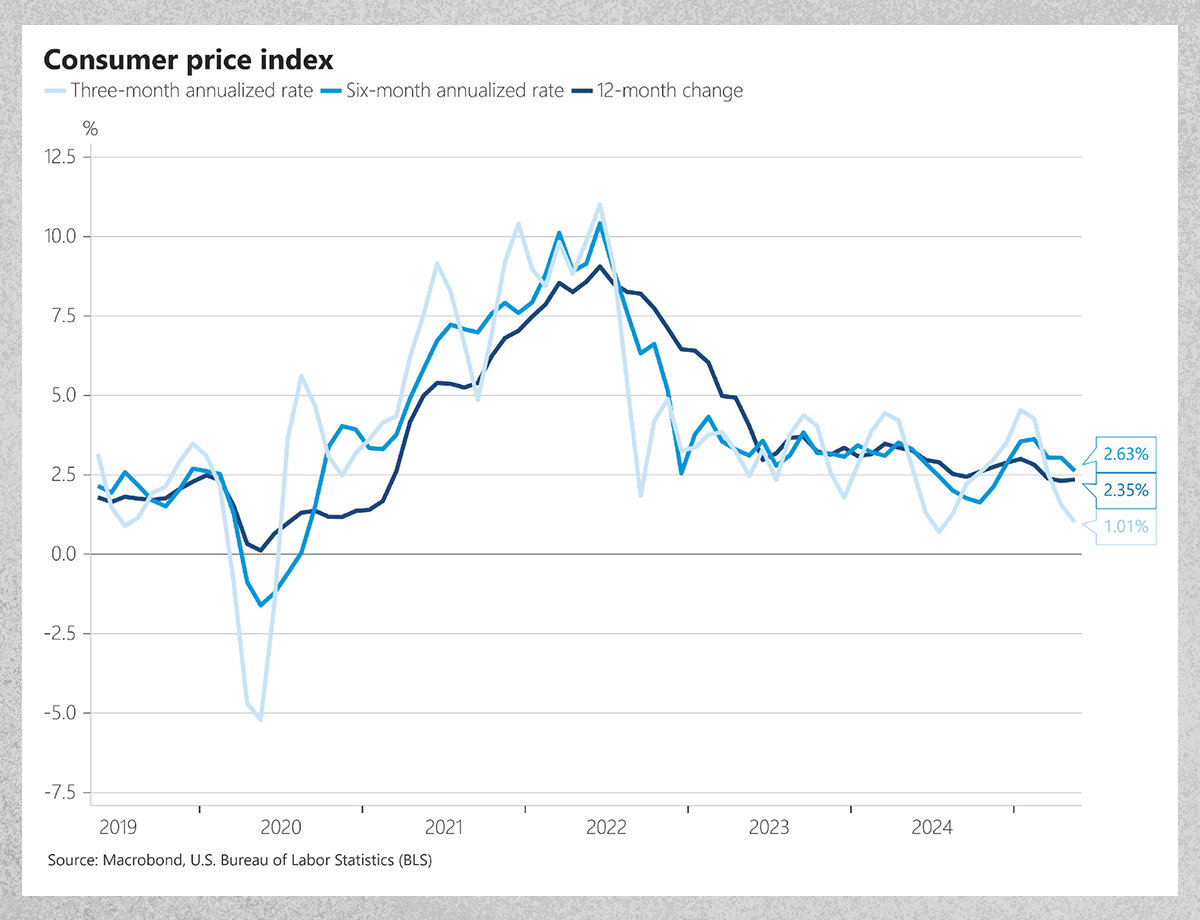

While AI provided a big tailwind, tariffs were the major headwind – or at least the big uncertainty – hanging over the market. The good news so far? Despite all the heated trade rhetoric, higher import duties have yet to meaningfully derail the economic data. The May Consumer Price Index report, for instance, showed little immediate impact from the new tariffs. Inflation has actually been coming in better than expected in recent months, to the surprise of many experts.

Source: Nick Timiraos, WSJ

But that could change as we move through summer. As it stands, the U.S. is now shouldering an effective average tariff rate of roughly 14%, up from about 2% before the trade war escalated. That’s the highest tariff burden Americans have seen since the 1930s, an astonishing jump for a span of just a few months. And the clock is ticking. President Trump set a July 9 deadline for negotiating tariff relief with various trading partners, after which some of those paused “Liberation Day” tariffs could snap back into force. In other words, we could be just days away from another flare-up in the trade battle if deals aren’t reached.

For now, markets are betting that worst-case scenarios will be averted. Prediction markets and economists largely foresee inflation staying relatively manageable – around ~3.3% for 2025 (higher than previously thought, but not disastrous). Looking further out, forecasts suggest inflation could dip back toward 2.4% in 2026, near the Fed’s target, once the one-time price effects of tariffs wash through. In short, many believe the tariff-driven price surge will be short-lived.

However, that rosy view assumes tariffs don’t spiral higher or persist indefinitely. If the trade war drags on or escalates, all bets are off. Already, we hear anecdotal reports of companies scrambling to rejigger supply chains and consumers starting to see higher prices on imported goods. The effective tariff rate near 14% tells us there’s significant pressure in the pipeline – it just might not have fully hit consumers’ wallets yet.

So consider us cautiously watching this space. Trade policy remains the big wildcard for the second half of the year. A favorable resolution – say, tariff relief deals with key partners – could remove a major overhang and boost confidence. Conversely, a collapse in negotiations or new tariff salvos could upset the market’s current optimism. Our stance: hope for the best, but be prepared for some bumps. As always, a well-diversified portfolio and a focus on quality can help weather whatever tariff-related turbulence lies ahead.

Geo-Politics & Oil: A Pop & A Drop

As if AI excitement and trade wars weren’t enough, Q2 threw another curveball: an unexpected flare-up in the Middle East that sent oil prices on a wild ride. In mid-June, a brief conflict ignited between Israel and Iran – a conflict that some feared could evolve into a broader regional war. For a moment, markets braced for an oil shock.

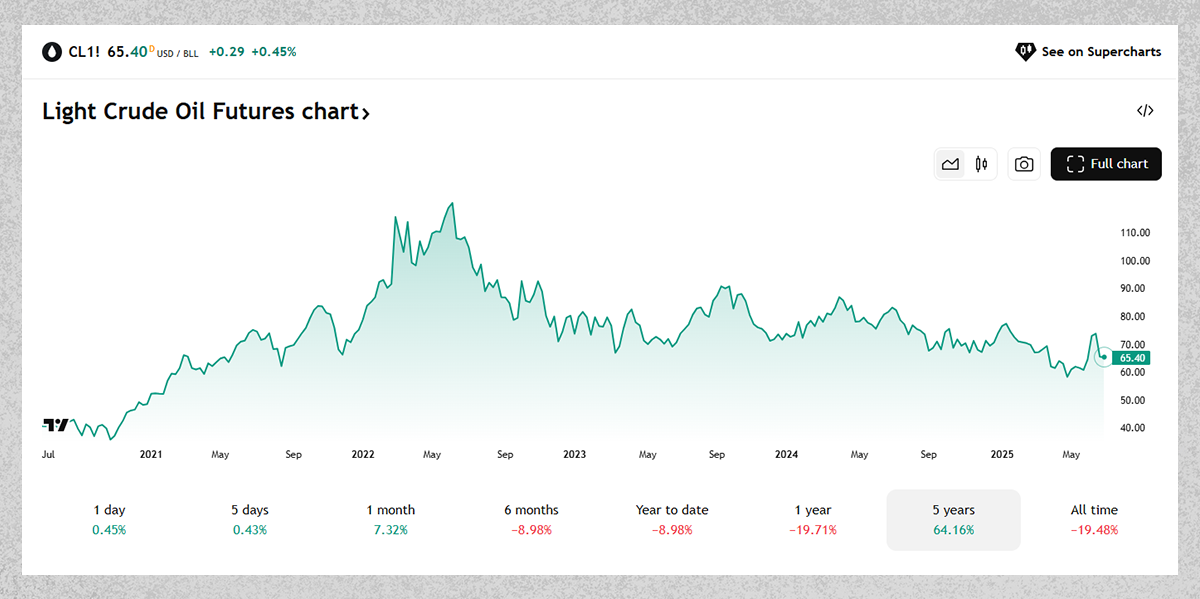

The initial reaction was swift: crude oil spiked dramatically on the headlines of missile strikes and military escalation. Brent crude, the global benchmark, leapt from the low $70s to around $78 per barrel in a matter of days – its highest level in about five months. Energy traders, conditioned by history, started whispering about the potential for $100+ oil if the Strait of Hormuz were to be closed or if Iran’s exports were completely choked off.

But then, almost as quickly, the crisis defused. The conflict, while scary, turned out to be mercifully short-lived – essentially a “12-day war.” By late June, U.S. diplomacy (and a few well-timed show-of-force airstrikes) helped broker a ceasefire between Israel and Iran. Iran’s retaliation remained limited, and it became clear that neither side wanted an all-out war. With that, the oil market’s panic abated in a hurry.

Once traders realized the worst-case scenarios (like a major disruption of Middle East oil flows) were off the table, oil prices plunged back down. Brent gave up its entire panic gain and then some – falling from ~$78 at its peak back into the mid-$60s. U.S. crude (WTI) similarly tumbled, ending the quarter around $65 a barrel after briefly spiking above $77. In fact, by the end of June, oil had round-tripped to near its lowest levels of the year. The message: the global oil market, which had been tight at the margins, swiftly re-priced once the immediate threat passed.

Source: TradingView

For consumers, this outcome was a blessing. Instead of a summer gas price spike, we’re seeing the opposite. As of early July, U.S. gasoline prices are running almost 10% lower than this time last year, thanks to that dip in crude. It’s an unexpected tailwind for households’ budgets during peak driving season.

The big picture here is that geopolitics can still move markets – but in this instance, cooler heads and rapid resolution prevented a crisis. It’s a stark contrast to, say, the 1970s oil shocks or even 2022’s Russia-Ukraine impact. The quick containment of the Israel-Iran conflict meant that any oil supply fears were short-lived.

Of course, the Middle East remains a perennial source of risk. We wouldn’t bet that this brief episode is the last geopolitical jolt we’ll see. But Q2’s lesson was encouraging: energy markets proved resilient. For now, the oil market is back to focusing on fundamentals rather than fear. And fundamentally, oil is not in short supply – a fact reflected in prices that, after all the commotion, are roughly where they started the quarter.

Inflation & The Fed: Powell vs. Trump

Amid all the market excitement, the macroeconomic backdrop continues to be a tale of two narratives. On one side, we have encouraging data showing inflation easing and the consumer hanging tough. On the other, we have political theater – notably the very public spat between President Trump and Fed Chair Jerome Powell – that threatens to complicate the outlook for interest rates.

Let’s start with the data. Inflation, while still above the Fed’s 2% goal, is not running away. In fact, by late Q2 some measures of price increases had cooled notably. Headline consumer inflation is hovering just above 3% year-over-year, a far cry from the 9% rate we saw about three years ago. “Core” inflation (excluding food and energy) is stickier, but even there the trajectory has been down. As mentioned, despite all the new tariffs, price impacts have been modest so far as many companies appear to be absorbing costs or finding workarounds. Oil and gasoline, which often drive inflation psychology, are range-bound to down. And importantly, interest rates fell during Q2: the 10-year Treasury yield slid from around 4.5% in March to about 4.2% by the end of June. Easier financing conditions could help take pressure off consumers and businesses alike.

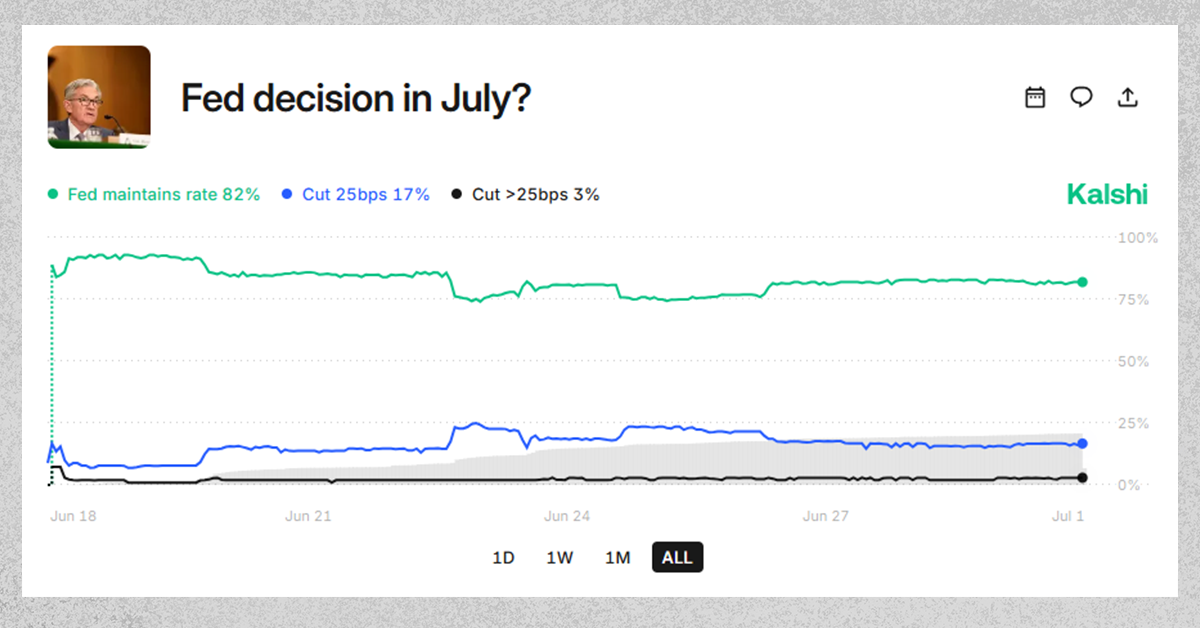

All of this puts the U.S. Federal Reserve in a bit of a quandary ahead of its next policy meeting (scheduled July 29-30). On one hand, Chair Powell and many on the Fed’s rate-setting committee have been adamant that they need to see clear and convincing evidence of sustained 2% inflation before cutting rates. Powell has said repeatedly that it’s “too soon” to declare victory on inflation and that the Fed won’t rush to ease policy until they’re confident price stability is assured. In practice, this has meant a cautious approach: the Fed paused its rate cuts earlier this year and has held the federal funds rate steady at 4.25–4.50% since the spring. Powell’s stance is essentially, “we’ll wait and see a few more months of data.”

Source: Kalshi

On the other hand, a growing chorus within the Fed – and an even louder one outside it – is itching for rate cuts sooner. Fed Governor Chris Waller (who is widely considered a candidate to succeed Powell as Fed chair next year) caused a stir in June by saying he would consider supporting a rate cut as early as the July meeting if the data allowed. Likewise, Vice Chair Miki Bowman, a Trump appointee, made an unexpected dovish turn and indicated she’s open to a July cut, citing signs that inflation is contained and concern about rising risks to the job market. Their arguments: with inflation slowing and tariffs not causing as much pain as feared, the Fed has room to trim rates to sustain the expansion – especially if the labor market shows cracks (more on that shortly).

And then there’s President Trump, who has been anything but subtle about his views on Fed policy. Trump’s term for Powell ends next May, and he’s already floated that he has “two or three” candidates lined up to replace him – presumably with someone more aligned to Trump’s liking for looser policy. The market widely expects the Fed will face intense political pressure to ease, and traders have been betting that by September, a rate cut is highly likely. Indeed, by late June, the bond market was sending a clear signal: the 2-year Treasury yield (most sensitive to Fed moves) fell notably, and the dollar index sank to a multi-year low on anticipation of easier Fed policy.

So we have a classic tension: Powell wants to wait for proof; Trump wants action now. Who will win out? In our view, the data will ultimately drive the Fed’s decision – and so far, that likely points to a compromise timeline: no cut in July, but perhaps an easing by September if trends hold. Powell is not blind to political realities, but he’s also keen to maintain the Fed’s credibility. He won’t cut simply to appease the White House; doing so could risk the Fed’s inflation-fighting reputation. However, should inflation remain tame and if job growth cools further, Powell will have the cover to cut rates later in the year on the merits.

For investors, this Fed drama is mostly background noise. Our take: by year-end, we likely see at least one rate reduction, especially if tariffs continue to cloud the outlook. The Fed’s own members are increasingly leaning dovish (even Austan Goolsbee, Chicago Fed President, noted in June that if tariff inflation doesn’t show up, the Fed can resume cuts – he called it sticking to the “golden path”). Barring any upside surprise in inflation, the path of least resistance for rates is downward. That would be a welcome tailwind for both stocks and bonds – and perhaps one reason the market was willing to rally strongly in Q2 despite all the other headwinds.

Resilient Economy…With Cracks Showing

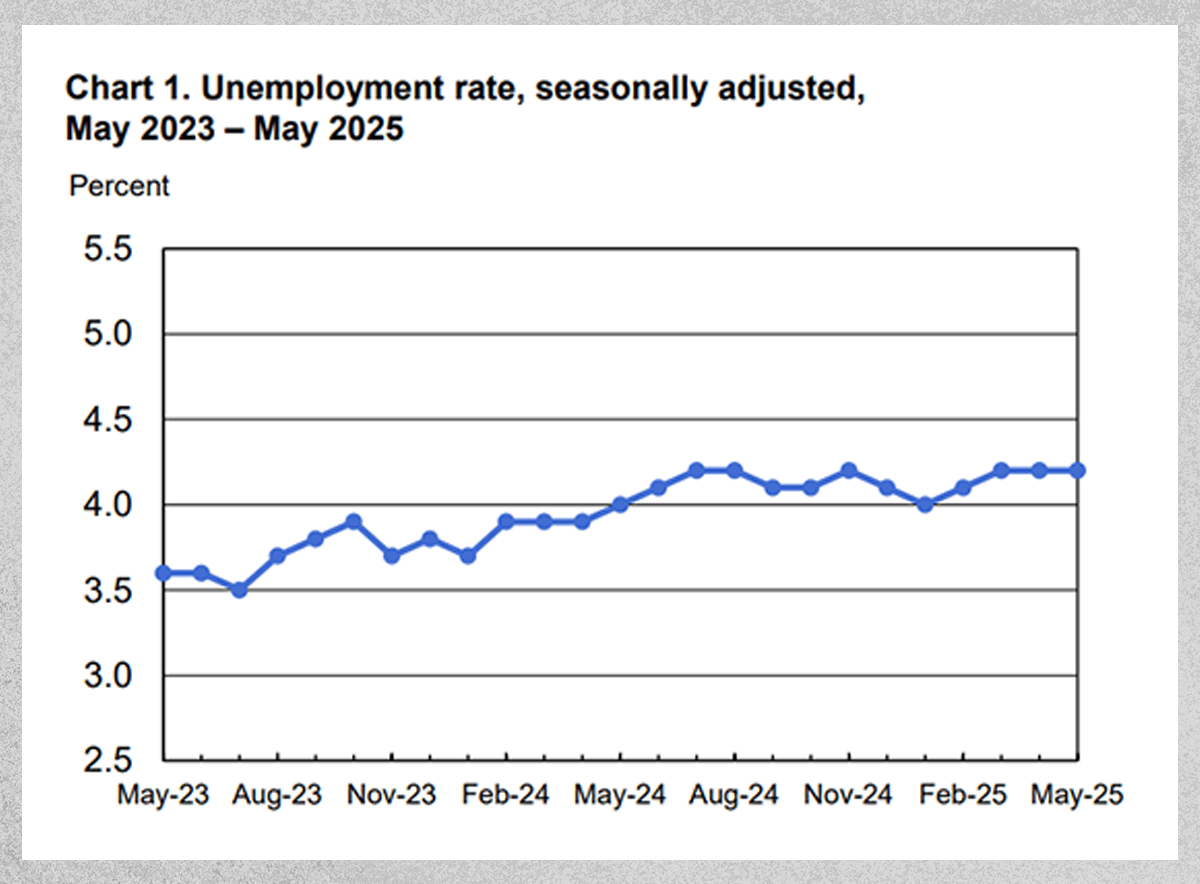

Through all the turmoil, the U.S. economic data in Q2 was a mixed bag – resilient on the surface, but with a few warning signs emerging underneath. On the positive side, consumer spending held up reasonably well, manufacturing had pockets of strength, and the housing market even showed some flickers of life thanks to slightly lower mortgage rates. Most importantly, employment – the beating heart of the economy – remained solid, at least by the most-watched metrics. The unemployment rate has been fluctuating in the low 4% range. At 4.2%, it’s around a level economists traditionally consider “full employment,” meaning most who want a job can find one. Job openings are still plentiful (though down from peak), and wages are growing modestly ahead of inflation, supporting consumers.

However, when we scratch just a bit below the surface, we can see the labor market is not quite as ironclad as it was a year ago. Layoffs, while still low historically, are on the rise. Weekly jobless claims data – a high-frequency indicator – began to drift upward in Q2. In fact, the number of Americans continuing to claim unemployment benefits hit about 1.97 million in mid-June, the highest level since late 2021. This suggests it’s taking unemployed folks a bit longer to find new jobs than it did in the red-hot job market of 2022. It’s an early sign of some softening: when continuing claims rise, it often means the labor market’s momentum is slowing.

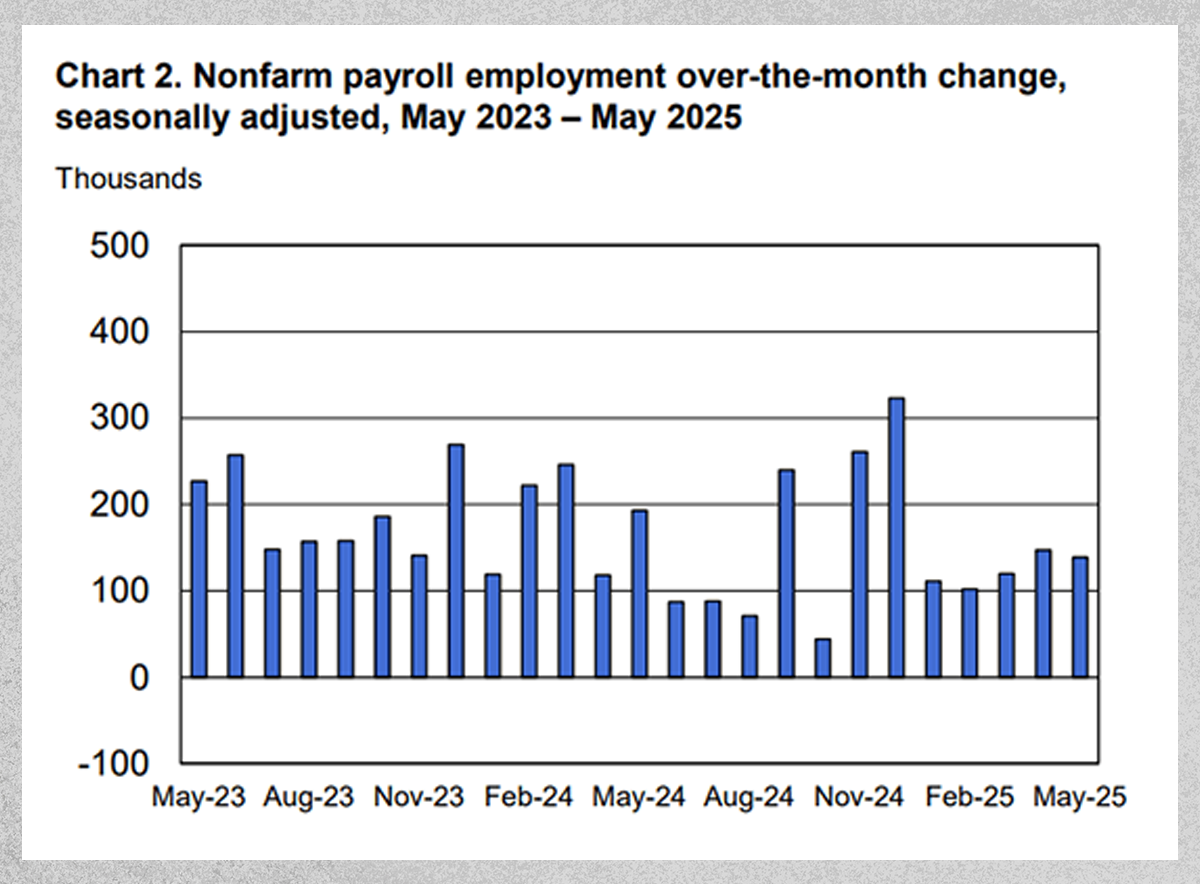

Source: BLS

More starkly, corporate announcements of job cuts have spiked. According to Challenger, Gray & Christmas (an outplacement firm that tracks layoffs), U.S. employers announced nearly 100,000 layoffs in May alone – up a whopping 47% compared to May of last year. For the first five months of 2025, total announced job cuts were about 696,000, which is 80% higher than the same period in 2024. The cuts have been widespread: technology and finance had big layoffs earlier, and now they’re being joined by sectors like retail, services, and even nonprofits. A lot of this has ties to the government’s cost-cutting drive. Tariffs and an overall drop in business confidence have also been cited as reasons companies are trimming headcount.

So far, these layoffs haven’t dramatically moved the needle on the unemployment rate – yet. The job market is cooling, but from extremely hot to just warm. We’re not seeing mass layoffs on the scale of a recession, but the gradual uptick in unemployment claims and layoff announcements does raise our antenna. For instance, the Federal Reserve’s own models and many forecasters predict the unemployment rate will tick up to perhaps 4.3–4.5% by year-end. That’s not a spike, but it is a turn in direction. We’ll be watching each monthly jobs report closely for signs of any acceleration in weakness. Thus far, monthly job gains have slowed but remain positive; job growth is averaging around ~150k per month recently, down from 300k+ last year. If that trend decelerates further – say we get a few sub-100k readings or an outright negative month – that would confirm the cracks are widening.

To be clear, recession is not a foregone conclusion. Consumers still have spending power, corporate balance sheets are generally healthy, and crucially, the Fed is poised to ease if the labor market sags more. We’ve said before that a soft landing (lower inflation without a full-blown recession) is possible, and indeed some data – like robust durable goods orders and stabilizing housing – give hope that the economy can weather these headwinds. But it’s a delicate balance. For now, we’d characterize the economy entering Q3 as resilient but not invincible. The cracks are forming – higher continuing claims, more WARN notices (advance layoff notices), softer hiring – and they warrant attention.

Our playbook in times like these is to stay diversified and focus on quality assets. If the job market and economy do weaken more, expect the Fed to react (which could actually be bullish for stocks and bonds). If, conversely, the economy proves sturdier than feared, then earnings and fundamentals should hold up and support equities even as rates normalize. In either scenario, a balanced approach – some offense, some defense – seems wise for the second half.

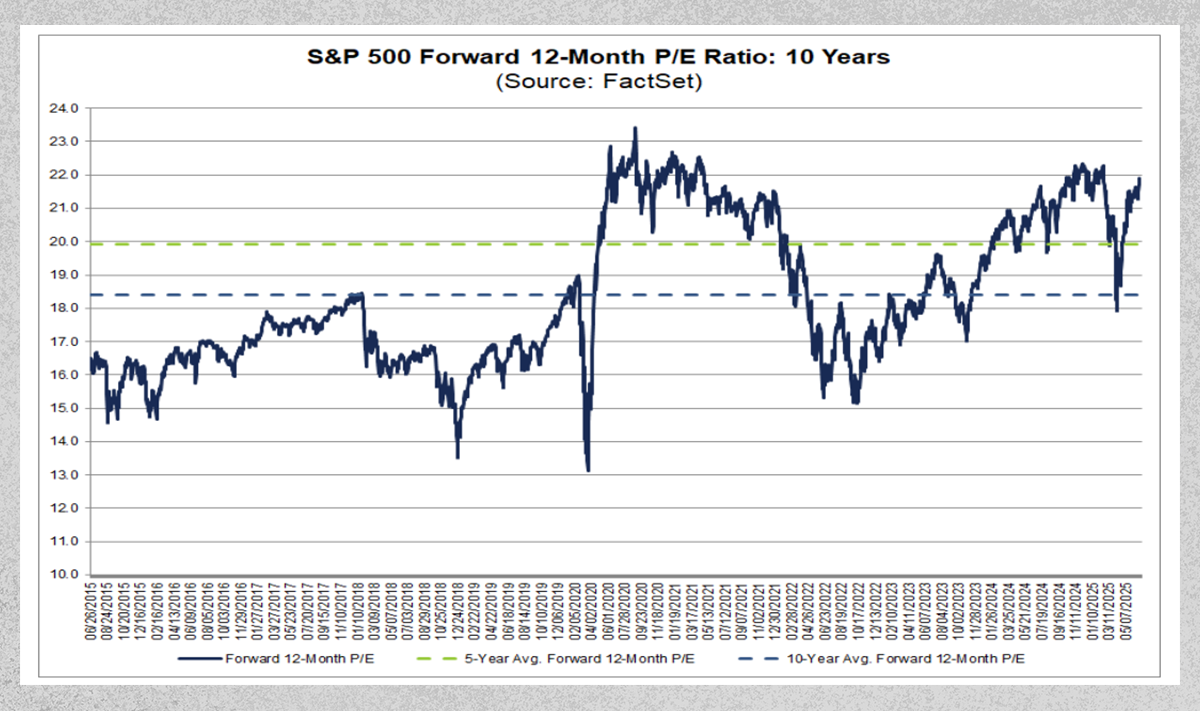

High Valuations, Selective Opportunities

One more risk we’d be remiss not to mention: stock valuations are looking stretched at these new highs. With the S&P 500 crossing 6,200, the index now trades around 22 times the next 12 months’ earnings – well above historical norms. For context, the 10-year average forward P/E is about ~18.5, and the very long-run average is closer to 16. By either measure, the market’s pricing is rich. In plain English, investors are paying a hefty premium for stocks right now, presumably for the prospect of strong growth and lower interest rates ahead.

Source: FactSet

Can such valuations be justified? In part, yes – because the S&P is top-heavy with high-quality, fast-growing tech behemoths that command premium multiples. Those Magnificent Seven stocks we discussed carry above-average P/Es, which pulls the whole index higher. If you believe their growth will continue (and many do, given their dominance in AI, cloud, etc.), paying 22x earnings for the S&P might not be crazy. Moreover, with bonds yielding ~4%, equities still look attractive on a relative basis to some investors, especially if the Fed cuts rates and bond yields fall.

However, we should also be aware of concentration risk and the possibility of mean reversion. A 22x multiple leaves little margin for error. Any disappointment – whether in earnings, economic data, or geopolitics – could spur a valuation correction. We got a taste of that in early April during the tariff scare when the S&P’s forward P/E briefly compressed back to ~18x amid the sell-off. That little dip was fleeting – you could’ve missed it if you weren’t watching closely – but it shows that the market can re-rate quickly when sentiment shifts.

For more reasonably priced opportunities, one need only look beyond the mega-caps. Mid-cap and small-cap stocks, for instance, haven’t rallied as hard and are generally trading at much more palatable earnings multiples (mid-teens in many cases). Similarly, international equities remain cheaper than U.S. large-caps by a notable margin. In Q2, while the S&P hit new highs, a diversified portfolio with exposure to non-U.S. stocks and smaller companies also performed well. In fact, in Q1 international stocks handily outperformed U.S. stocks, and although that trend paused in Q2 with the U.S. tech rebound, the valuation case for non-U.S. equity exposure is still compelling.

Our take: at this stage of the bull market, selectivity is key. The broad index at 22x is not cheap, so it’s important to ensure you’re not overpaying for pockets of froth. We’re actively looking for value in areas that might have lagged – whether that’s quality companies in sectors like healthcare and energy that didn’t participate as much in the rally, or solid businesses abroad trading at discounts. At the same time, we’re not shunning the winners; we simply prefer them in balanced proportions. The big secular growth names (the Mag 7) still have plenty of runway in our view, but their stocks will likely be more volatile given the lofty expectations baked in.

In short, discipline and diversification remain as crucial as ever. This market has proven it can overcome a lot (tariffs, wars, etc.), but high valuations suggest it won’t take much to spark some turbulence. By spreading out exposure and focusing on fundamental quality, we aim to participate in further upside while guarding against the downside.

THE BOTTOM LINE

There was a lot going on in markets and the economy in the second quarter of 2025. We didn’t even touch on some eye-popping storylines – like gold hitting a fresh all-time high above $3,400/oz amidst the uncertainty, the U.S. dollar plunging in its worst start to a year since the 1970s, President Trump pushing his “One Big, Beautiful Bill” through Congress, a mini bond market freakout in April when yields spiked briefly, or the mini-renaissance in IPOs as market confidence returned. It truly was a quarter that had a bit of everything: fear, relief, intrigue, and ultimately triumph.

Despite the drama and ever-shifting “animal spirits,” one theme prevailed: resilience. The stock market showed grit, climbing a “wall of worry” comprised of tariffs, war scares, and recession fears – and yet here we are heading into the second half at record highs. It’s a testament to the strength of diversified investors who tuned out the noise and stayed the course.

Looking ahead, we remain optimistic but vigilant. The back half of 2025 will no doubt bring its own surprises. As always, please reach out with any questions about how recent events impact your portfolio or plans.

In the meantime, enjoy the summer!

Related:

Want content like this each week, but you’re not on our mailing list? Let’s change that! Subscribe today.

Stokes Family Office is 100% Family Owned, and has been continually operating in the New Orleans Area for over 35 years. As a family office, we are focused on family wealth, financial planning, and tax planning. We are your local experts for Gulf South wealth management. Want to hear more from our team? Check out the Lagniappe Podcast.

*Stokes Family Office does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.