A Real Estate Boom, A Swiss Model, & a Bubble Checklist

October 24, 2025

Each week, the Stokes Family Office staff puts together a list of our favorite news and updates on all things wealth management. From financial planning, portfolio construction, tax and estate planning, retirement plan services to anything we found interesting. Enjoy this week’s curated list for your weekend reading!

A Real Estate Boom Is Coming — Are You Ready?

The Hill: Everything is a cycle. For the last few years, the real estate industry has been moving downward. But that will inevitably change. And when that change happens, this industry will see a boom unlike any boom it has seen before. When will this happen? No one knows. But soon, assuming the above factors continue on their trend.

Andrew Ross Sorkin, NYT: Speculation isn’t a bug in America’s economic code, but a crucial component part of the engine, writes Andrew Ross Sorkin.

Simon Grimm: There’s much to like about Switzerland for people of most political stripes. It is economically liberal, while also having high trust in government and a working welfare state. After my visit this summer, I’ve started pointing to Switzerland as a template for a European rebound far more often.

Related:

After a long posting hiatus, The Brooklyn Investor returns to check in on various topics, including gold, the Buffett transition, treasuries, and, most notably, the ongoing discussion of an impending bubble.

Ben Carlson: I personally don’t own any gold, but I understand why some investors have an allocation. Gold is one of the most unique assets there is. It truly marches to its own drummer. Let’s do a little history lesson on the returns of gold vs. the S&P 500 by decade, and then I’ll share why I don’t own any.

Barry Ritholtz: By definition, it is the crowd that creates bubbles through a combination of psychology, greed/FOMO, excess liquidity, and sheer recklessness. It is rare to see that same crowd be able to identify that bubble in real time. Way back in 2011, I tried to create a checklist of how to spot a bubble in real-time. It is 14 bullet quantitative points that should allow you to see if any market is exhibiting bubblicious tendencies.

Related:

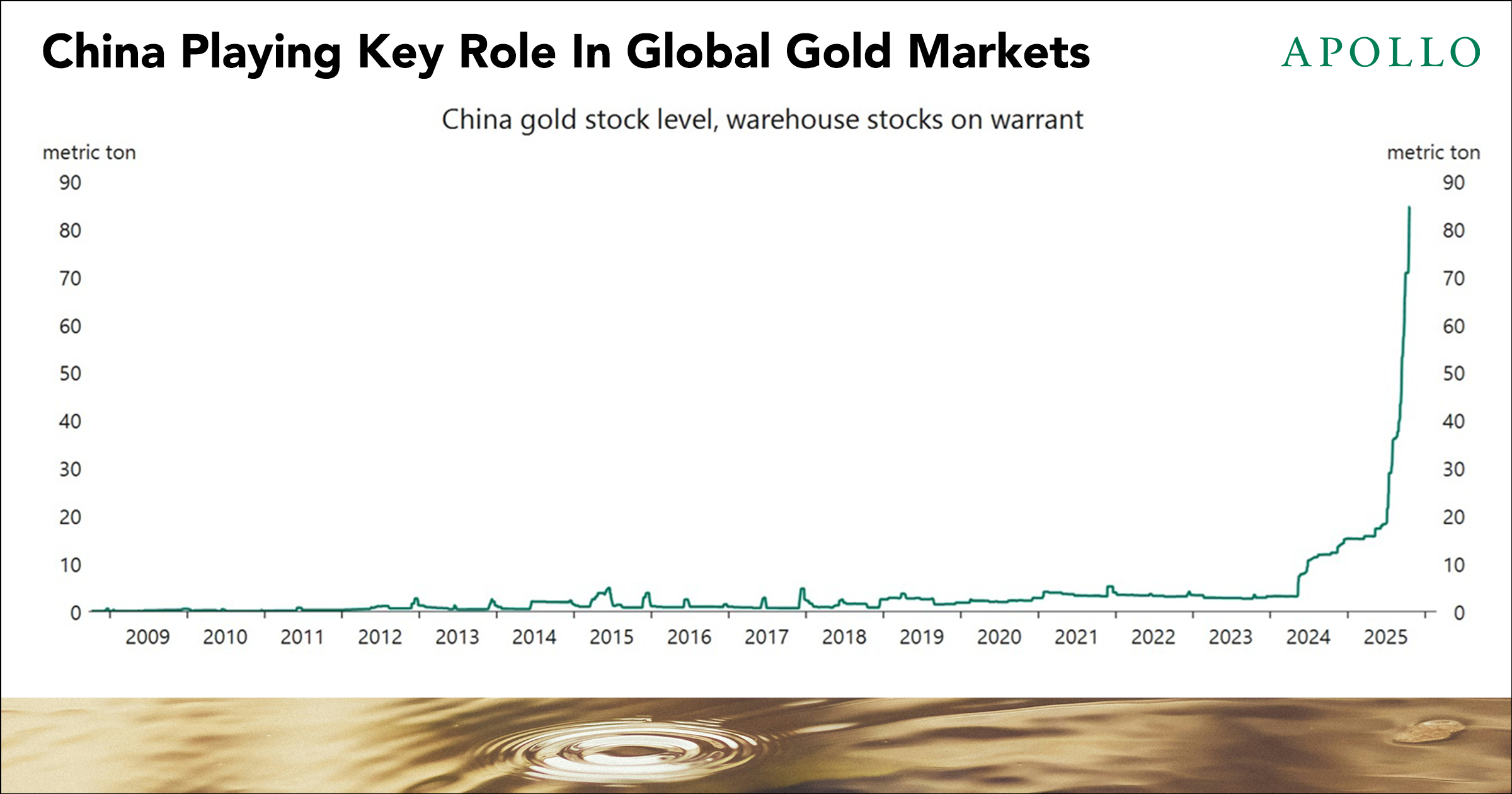

China is playing a key role in the ongoing rise in gold prices because of central bank buying, arbitrage trading, and increased speculative and safe-haven demand among Chinese households. (Via Torsten Sløk, Apollo)

Stokes Family Office is 100% Family Owned, and has been continually operating in the New Orleans Area for over 35 years. As a family office, we are focused on family wealth, financial planning, and tax planning. We are your local experts for Gulf South wealth management. Want to hear more from our team? Check out the Lagniappe Podcast.

*Stokes Family Office does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.