AI’s Effect On Human Thinking

September 25, 2025

Each week, the Stokes Family Office staff puts together a list of our favorite news and updates on all things wealth management. From financial planning, portfolio construction, tax and estate planning, retirement plan services to anything we found interesting. Enjoy this week’s curated list for your weekend reading!

Derek Thompson: The rise of AI’s “thinking” machines is not the problem. The decline of thinking people is.

What’s Happening to Wholesale Electricity Prices?

Construction Physics: The last several years in the US have seen a dramatic increase in electricity prices. For the five years prior to 2020, electricity prices were essentially flat; since 2020, average electricity prices in the US have increased by around 35%.

Significant Amounts of Tariff Revenue Collected at the Moment

Torsten Sløk: The US government currently collects about $350 billion in tariffs at an annualized rate, which corresponds to 18% of annual household income tax payments. The bottom line is that the amount of money collected in tariff revenue is very significant.

Related:

Joe Wiggins: Most investors would be better off doing less. Whether it is the folly of market timing or the irresistible lure of performance chasing in mutual funds, more activity is likely to be bad for us. In most aspects of life, doing less is the easiest thing, but in investing, it’s incredibly difficult – and getting harder.

Ben Carlson argues that while small caps face structural headwinds (less IPO flow, more capital staying private), their underperformance is more a function of outsized returns from large caps than catastrophic failure of small caps.

A Key Business Story to Watch in 2026

Sam Ro: Analysts and strategists are “baking in” expectations that corporate profit margins will widen in 2026. That margin expansion is viewed as a critical driver of earnings growth and stock market returns.

Related:

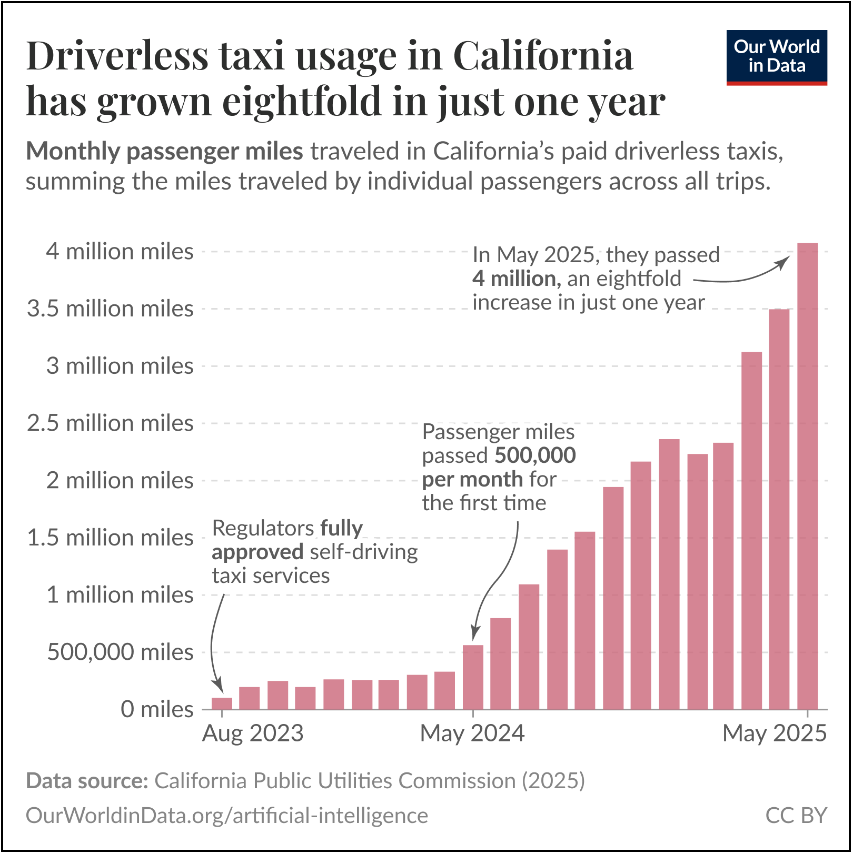

After only two years, California’s driverless taxis now transport passengers for more than four million miles per month via Our World in Data.

Stokes Family Office is 100% Family Owned, and has been continually operating in the New Orleans Area for over 35 years. As a family office, we are focused on family wealth, financial planning, and tax planning. We are your local experts for Gulf South wealth management. Want to hear more from our team? Check out the Lagniappe Podcast.

*Stokes Family Office does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.