4th Quarter 2024 Update

January 3, 2025

Happy New Year! Before we fully turn our attention to 2025, let’s wrap up the final quarter of 2024.

Stocks Mixed to End a Banner 2024 + Where Opportunities May Be Found in 2025.

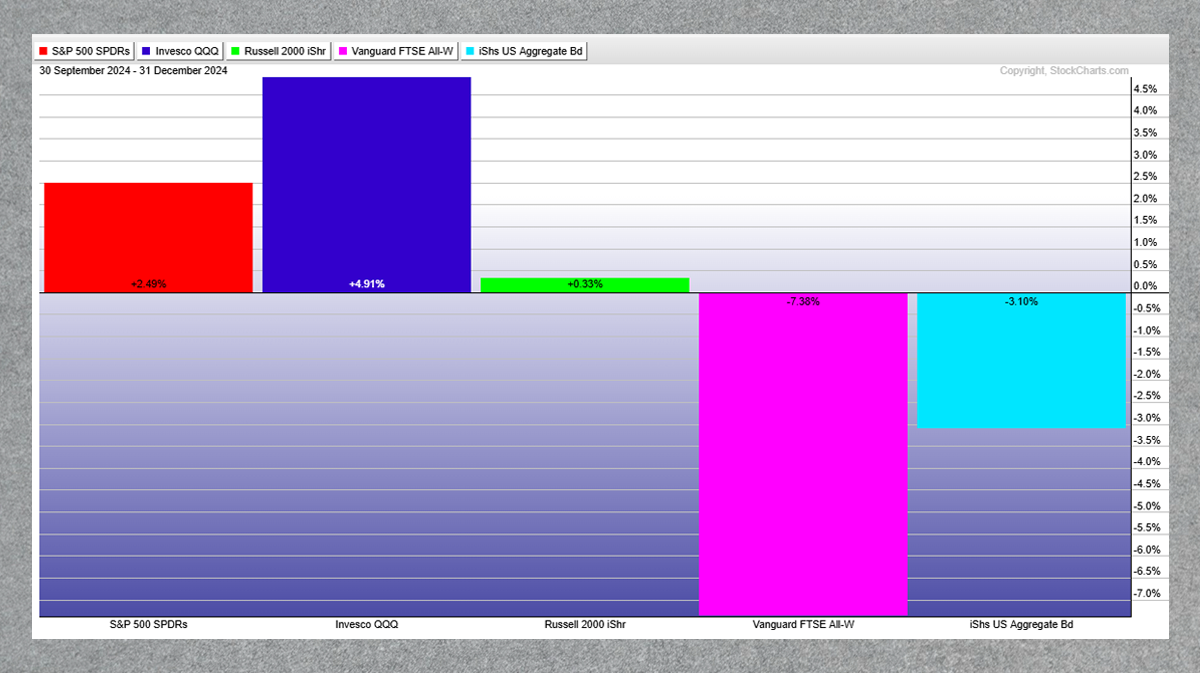

It was a shaky end to the year, but stocks posted modest gains in the fourth quarter. The S&P 500 rose 2.1% over the October through December period, with mega-cap tech once again powering the index. The Nasdaq Composite rose above the 20,000-mark for the first time, ultimately booking a 6.2% Q4 rally. Under the hood, it was a less sanguine story. The Russell 2000 small-cap index was flat in 2024’s final quarter and foreign stocks were decidedly in the red. Shares of value stocks were also negative in Q4.

Traders were left wondering where Santa was by the close of December. Historical data show that the Santa Claus Rally period – the final five days of the old year and the first two sessions of the new year – typically produces decent gains on low volatility. As of December 31, we had not seen the usual holiday cheer in terms of rising stock prices. In fact, the Cboe Volatility Index jumped to cap off 2024.

Source: StockCharts

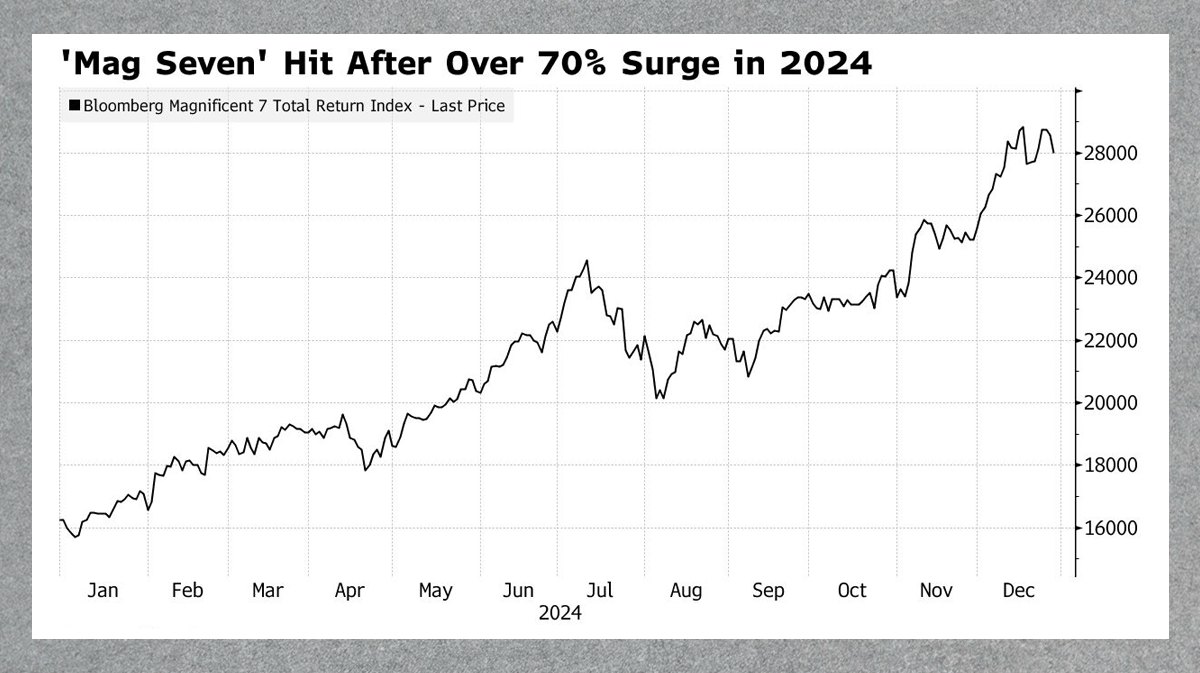

In all, the S&P 500 soared by 23% last year, led by the Magnificent Seven stocks which collectively notched about a 70% increase. US large caps posted their best back-to-back annual gains since the dot-com boom of the late 90s amid this cycle’s AI fervor and resilient US economic data.

Source: Bloomberg

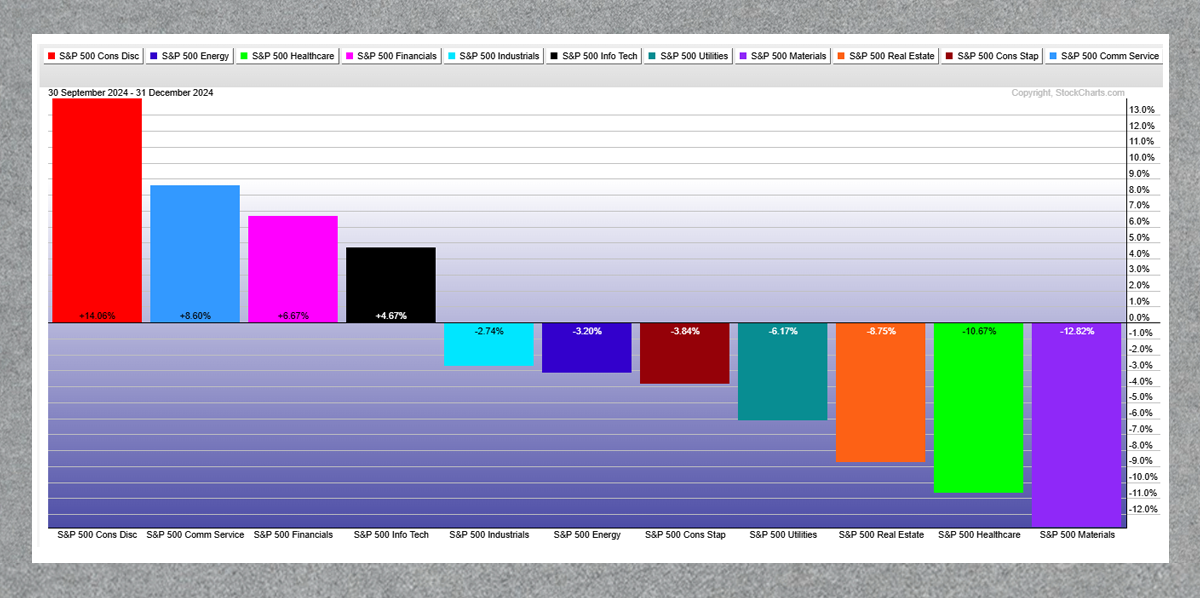

At the sector level, Consumer Discretionary climbed the most during 2024’s final quarter. Shares of its two biggest components, Amazon (AMZN) and Tesla (TSLA), enjoyed big returns before and after the election. TSLA was perhaps the biggest beneficiary of President-elect Trump’s win; CEO Elon Musk appears to be Trump’s right-hand man. Shares of retail companies also performed well over the holidays, but some of the group’s gains were surrendered in the last two weeks of the year.

Elsewhere, Communication Services and Information Technology enjoyed Q4 gains, along with the Financials sector. Despite the S&P 500’s fourth-quarter rally, seven of the 11 sectors finished down, an indication of how just a handful of stocks were responsible for Q4’s market advance.

Source: StockCharts

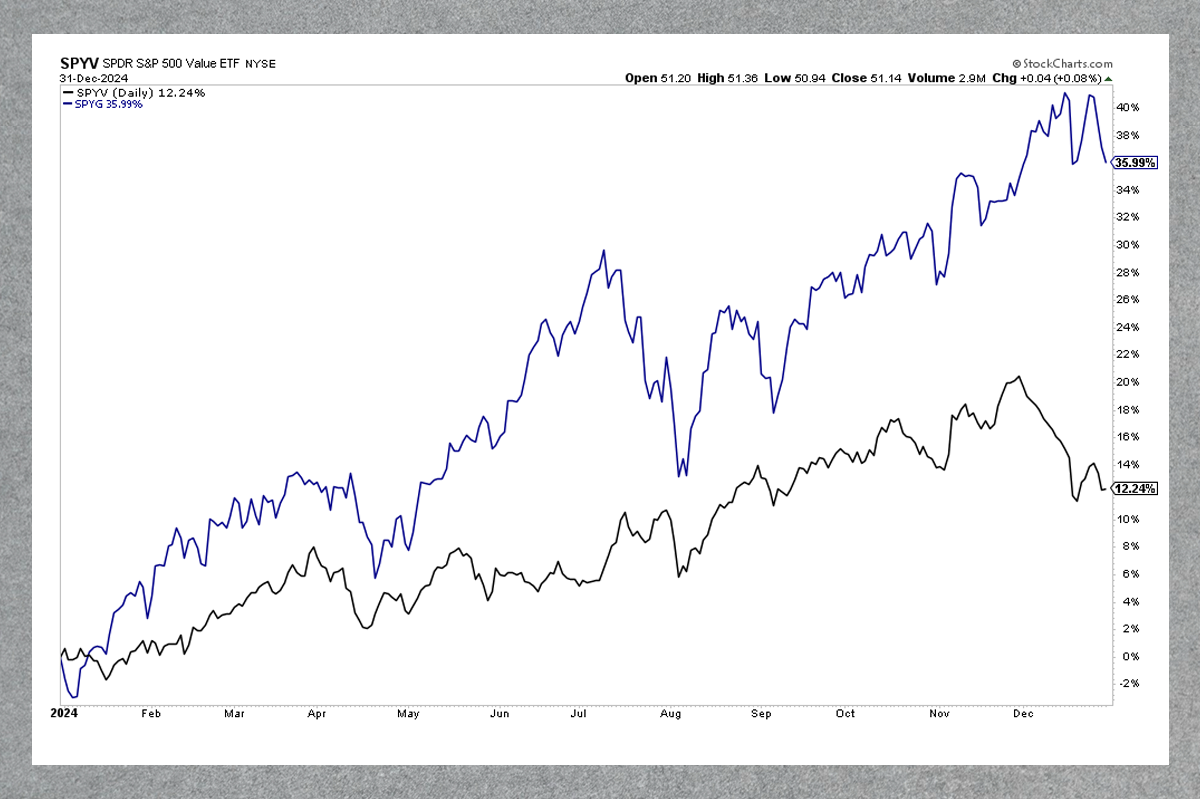

Indeed, both the MidCap 400 and SmallCap 600 indexes hugged the flat line while the lower-quality Russell 2000 was hardly changed over the year’s final three months. Rising interest rates and a broad preference for mega caps weighed on most niches away from the Mag 7. Shortly after the start of the second half, there was a flip in favor of value, cyclical, and smaller-cap stocks, but that relative rally lost steam in December.

Remarkably, the S&P 500 Value ETF (SPYV) traded lower for 14 consecutive sessions after Thanksgiving. All told, SPYV was up 12.2% (dividends included) last year while the S&P 500 Growth ETF (SPYG) returned 36%. That’s among the biggest ‘growth over value’ years in history.

Source: StockCharts

The same narrative played out among international stocks; the Vanguard FTSE All-World Ex-US ETF (VEU) barely outpaced Treasury bills in 2024. Up just 5.6% (total return) last year, it was a 20-percentage-point loser compared to the S&P 500 Total Return Index’s 25.0% gain. That performance gap had narrowed to about seven percentage points in September, but international equities fell out of bed in the 4th quarter. VEU’s Q4 return was -7%; nearly 10 percentage points of underperformance to US large caps.

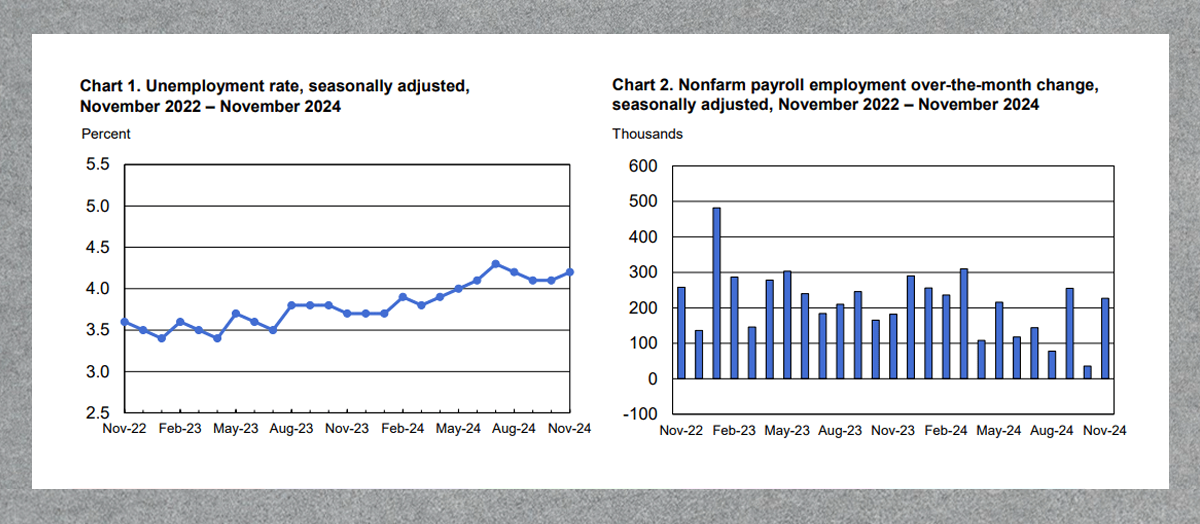

So, why the steep disconnect between the Mag 7 glamour stocks and the rest of the global market? There are both fundamental and technical factors. First, US economic data firmed up in the year’s final months. The domestic jobs situation appears ‘good, not great,’ while consumer spending trends are stout. Looking back on the fourth quarter, the October labor market report was weak in its headline employment gain, but Hurricanes Helene and Milton, along with worker strikes at Boeing, made that report less impactful.

Not surprisingly, the November payrolls update showed a bounce back in jobs added, but the unemployment rate did tick up to 4.25% – the summer high. While that’s something the Federal Reserve must keep its eye on, perhaps the primary barometer of the labor market is a solid level of workers’ pay gains. Humming along at 4%, inflation-adjusted wages are on the rise, fueling robust consumer spending.

Source: Bureau of Labor Statistics

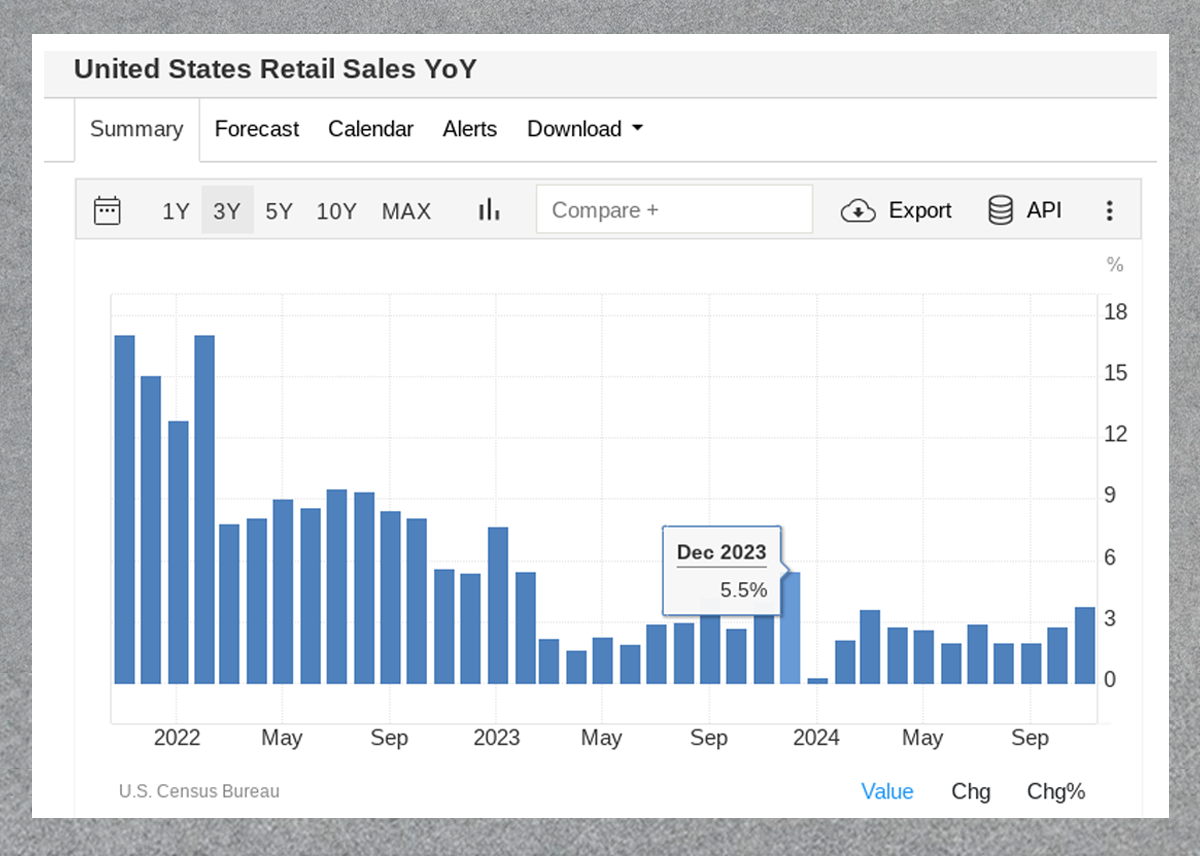

By most accounts, the holiday-shopping season was impressive. Despite one less weekend between Thanksgiving and Christmas, it appears that retail activity was stellar – we’ll find out for sure when the US Census Bureau reports December Retail Sales on January 16.

Source: Trade Economics

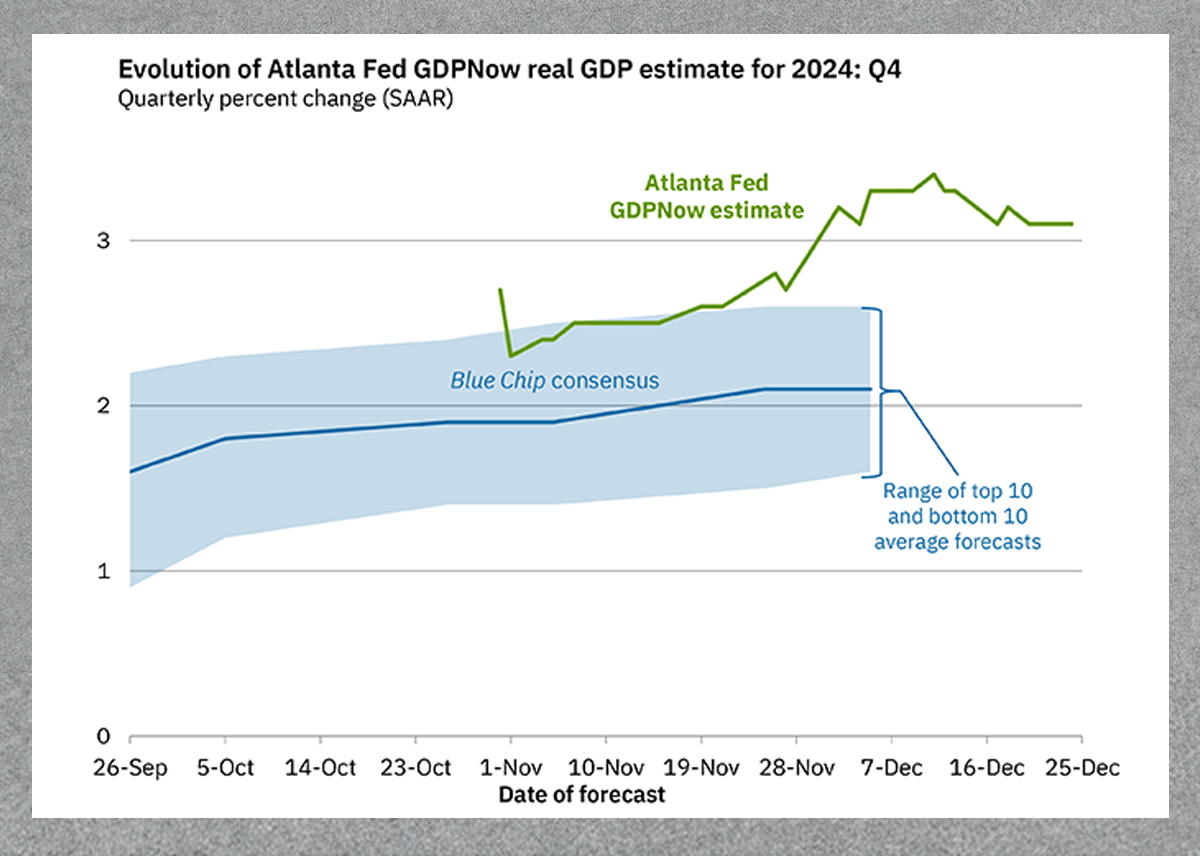

Putting it all together – job gains, rising wages, and big consumer spending trends – the US economy keeps chugging along. According to the Atlanta Federal Reserve’s GDPNow model, Q4 real GDP may come in at better than 3%, which is considered significantly above trend. At the same time, inflation jitters have resurfaced amid the firm growth backdrop. Throw in some anxiety around tariffs in the year ahead, and the bond market has reacted negatively.

Source: Atlanta Federal Reserve

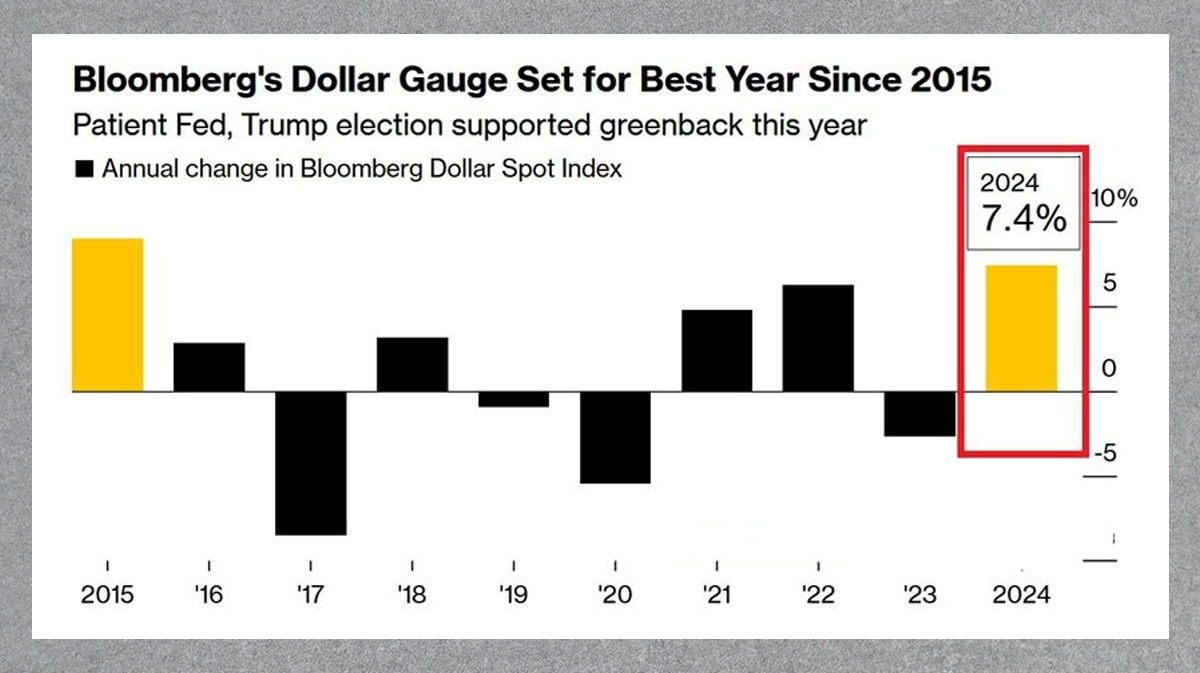

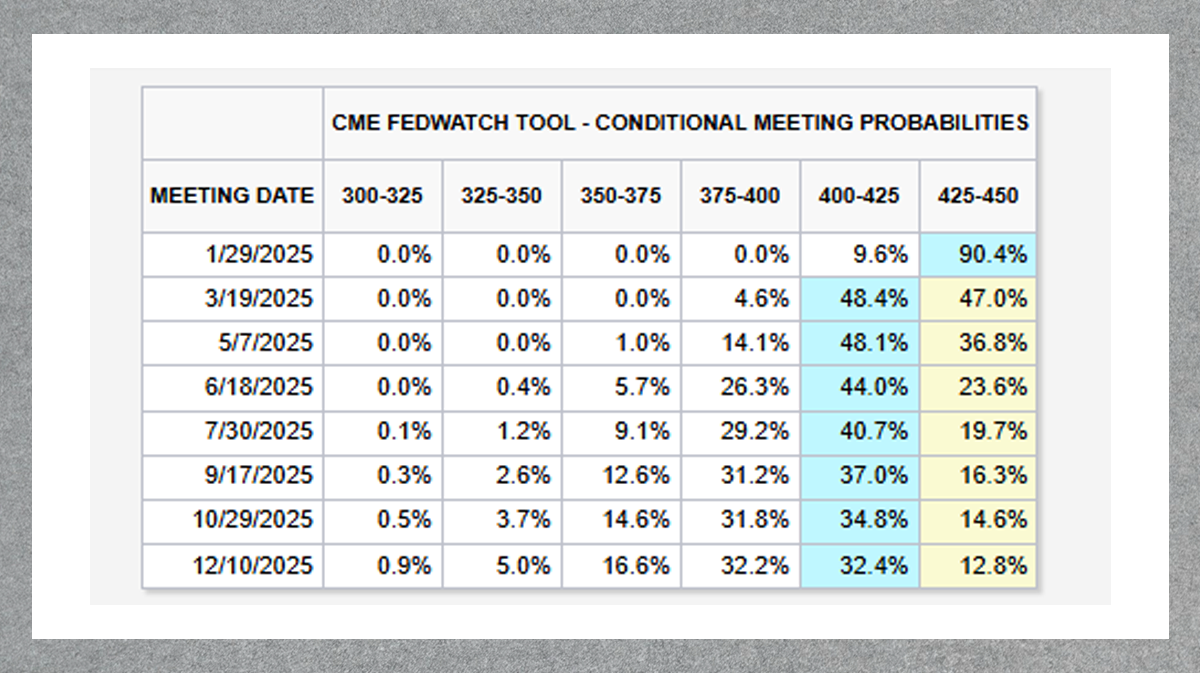

The rate on the benchmark 10-year Treasury note dipped to 3.6% around the time of the Fed’s half-point September rate cut announcement. Since then, though, yields have marched higher. By the day after Christmas, the 10-year yield eclipsed 4.6%. For Q4, the key rate rose almost 0.8 percentage points, and that negatively impacted areas like value stocks, small caps, and to a certain extent international shares. It also resulted in the US Dollar soaring to a 26-month high, and just one or two Fed rate cuts are now priced into 2025. All the while, the S&P 500’s price-to-earnings ratio rose to about 22x in December.

Source: Bloomberg – 2024 Data Through December 26

Source: CME FedWatch Tool

Amid a higher market valuation and frothy investor sentiment after the election, we have talked with clients about managing expectations. We are not bearish, but after two years of 20%-plus returns in the S&P 500, we take a more measured stance in 2025. What’s particularly interesting to us are the areas of value in the global stock market.

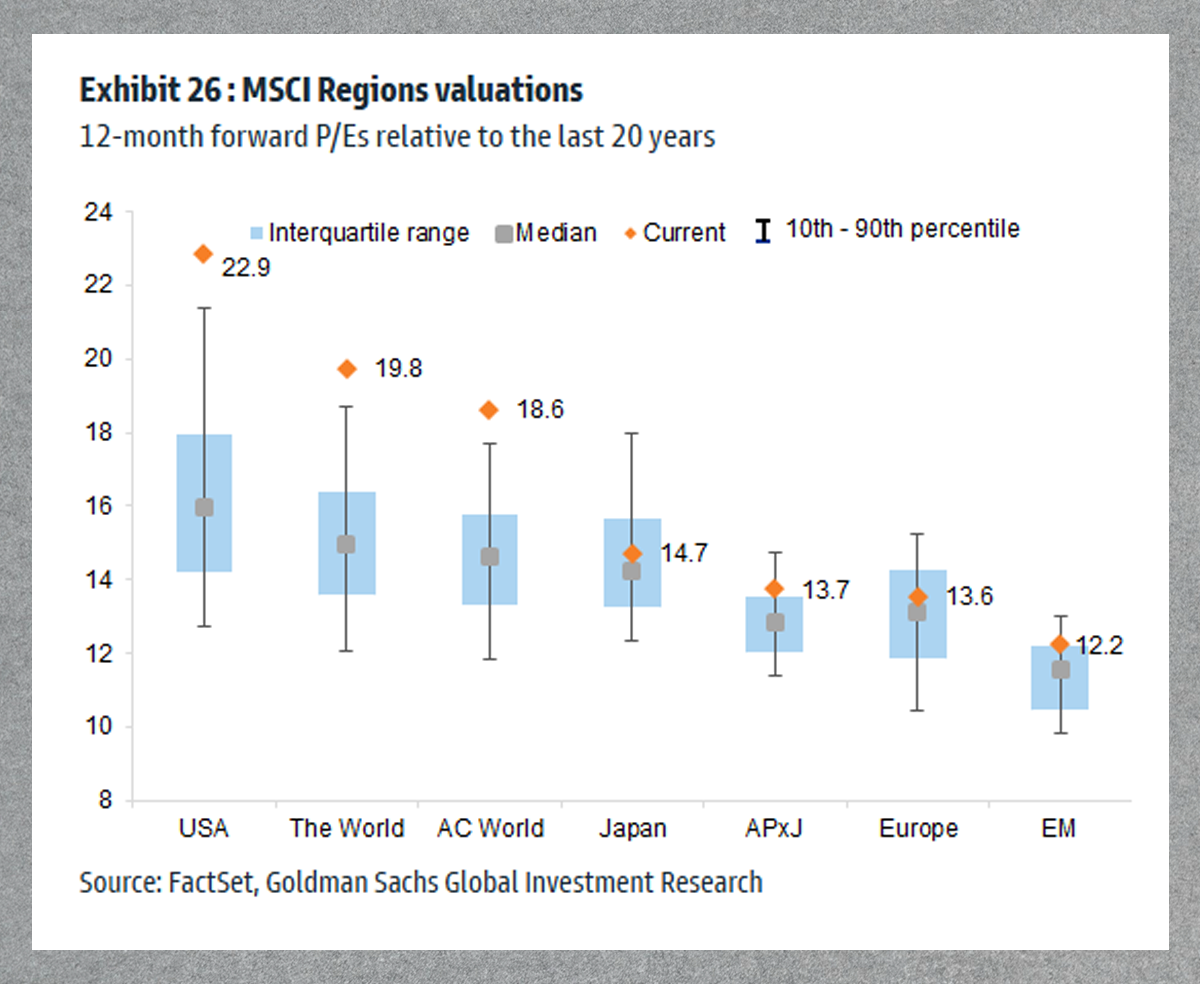

For instance, as mentioned earlier, the MidCap 400 and SmallCap 600 now trade under 16 times forward earnings estimates. Outside of the US, we see potentially more intriguing value opportunities. While the S&P 500 sells for close to 22 times earnings, ex-US developed markets have price-to-earnings ratios in the low teens. It’s true that foreign stocks should trade at a discount to US equities, but the valuation gap is near record levels: Japan has a 15x P/E; Europe at 14x. Are we pounding the table on going overweight ex-US? No, but there are clearly pockets of value globally and away from the Mag 7.

Source: Goldman Sachs

|

|

|

Related:

Stokes Family Office is 100% Family Owned, and has been continually operating in the New Orleans Area for over 35 years. As a family office, we are focused on family wealth, financial planning, and tax planning. We are your local experts for Gulf South wealth management. Want to hear more from our team? Check out the Lagniappe Podcast.

*Stokes Family Office does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.