4th Quarter 2025 Update

January 2, 2026

The bull market presses on. The S&P 500 dipped ever so slightly in December, but it was a year to remember for investors. U.S. large caps delivered an 18% return, dividends included, while international markets posted 30%-plus gains. Diversification finally had its time in the sun after two years of performance dominated by big-cap tech and the so-called “Magnificent Seven” stocks. In fact, just two of the Mag 7 beat the S&P 500—Alphabet (parent company of Google) and NVIDIA.

The year in stocks began with optimism, as hopes of deregulation, lower taxes, and steady profit growth would lift company earnings. Those aspirations were upended in March and April, culminating in President Trump’s “Liberation Day” tariff announcement from the White House Rose Garden on April 2.

Markets plunged on fears of a new world order of steep import duties, even potential embargoes with key economic partners. The administration proved flexible in its trade policy, however, and while the effective tariff rate remains high today, stocks recovered sharply from their early April lows.

Source: Bloomberg

From there, the year was filled with drama concerning the Federal Reserve, the big tax bill, inflation, slowing job growth, record corporate earnings, the “K-shaped economy,” and a boom in the mergers and acquisitions (M&A) space. All told, keeping your cool was the mantra. Investors who stayed the course—and even bought when fear reached its zenith in the spring—were rewarded. That was true not just for stocks.

The bond market turned in its best year since 2020, returning 7%. Our team specifically likes the risk-return prospects for tax-friendly municipal bonds in the current macro backdrop. State and local governments are generally well funded, while yields are decent compared to the average of the past 15 years. It’s not the most exciting financial corner, but that’s just fine for retirees seeking tax-exempt income.

Chart courtesy of Stockcharts.com

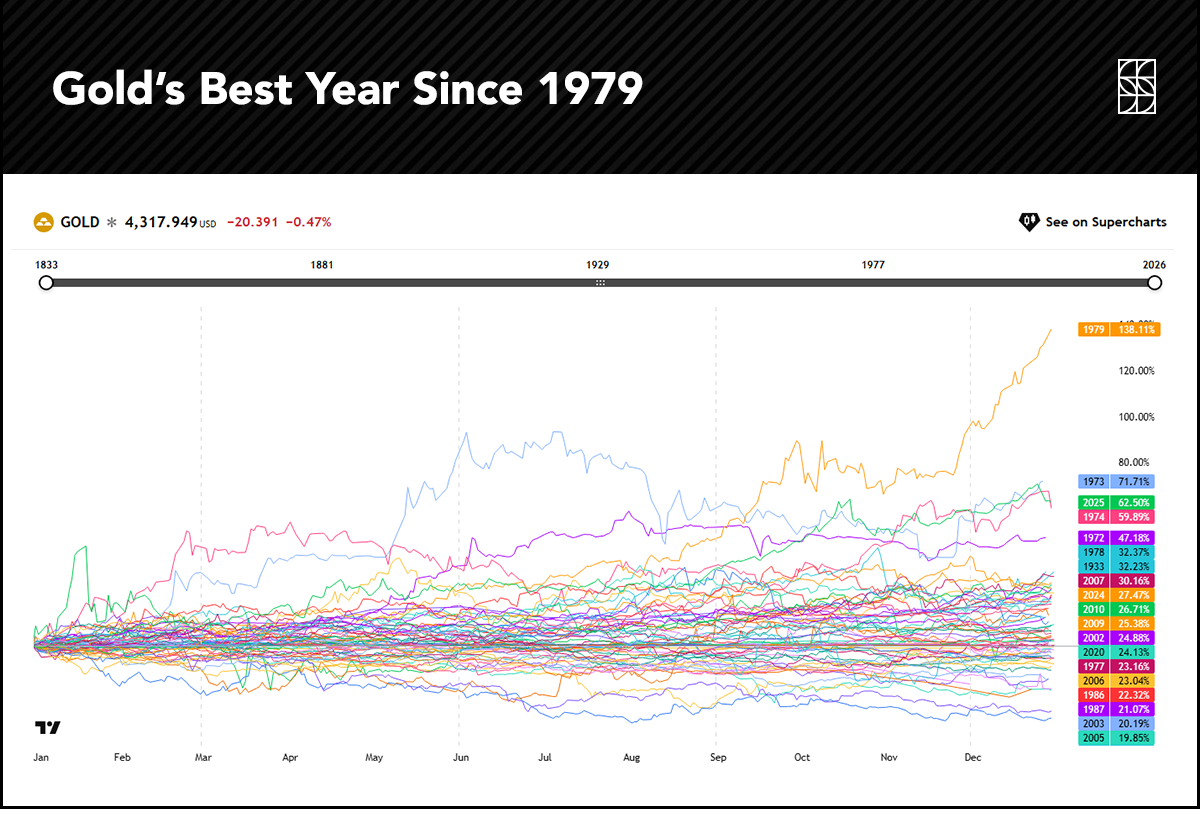

Elsewhere, 2025 ended with a meme-like frenzy in the precious metals arena. Gold and silver notched their most sterling years since 1979. Bitcoin performed well for much of the year, but then stumbled in the fourth quarter—it was the first time since 2014 that the S&P 500 was up while bitcoin was down.

Source: TradingView

Speaking of commodities, the energy sector struggled throughout much of 2025. A barrel of crude oil now goes for just $57. That’s cheaper than 20 years ago and a far cry from the $120-plus levels of mid-2022. Low oil usually means modest inflation, and though the Consumer Price Index (CPI) rate is closer to 3% than 2%, forward indicators point to easing inflation in the year ahead. We’ll have to wait and see.

That’s a high-level look at the action on the financial playing field. Now, let’s dig into specifics that shed light on the true state of the economy—those that impact households and business owners.

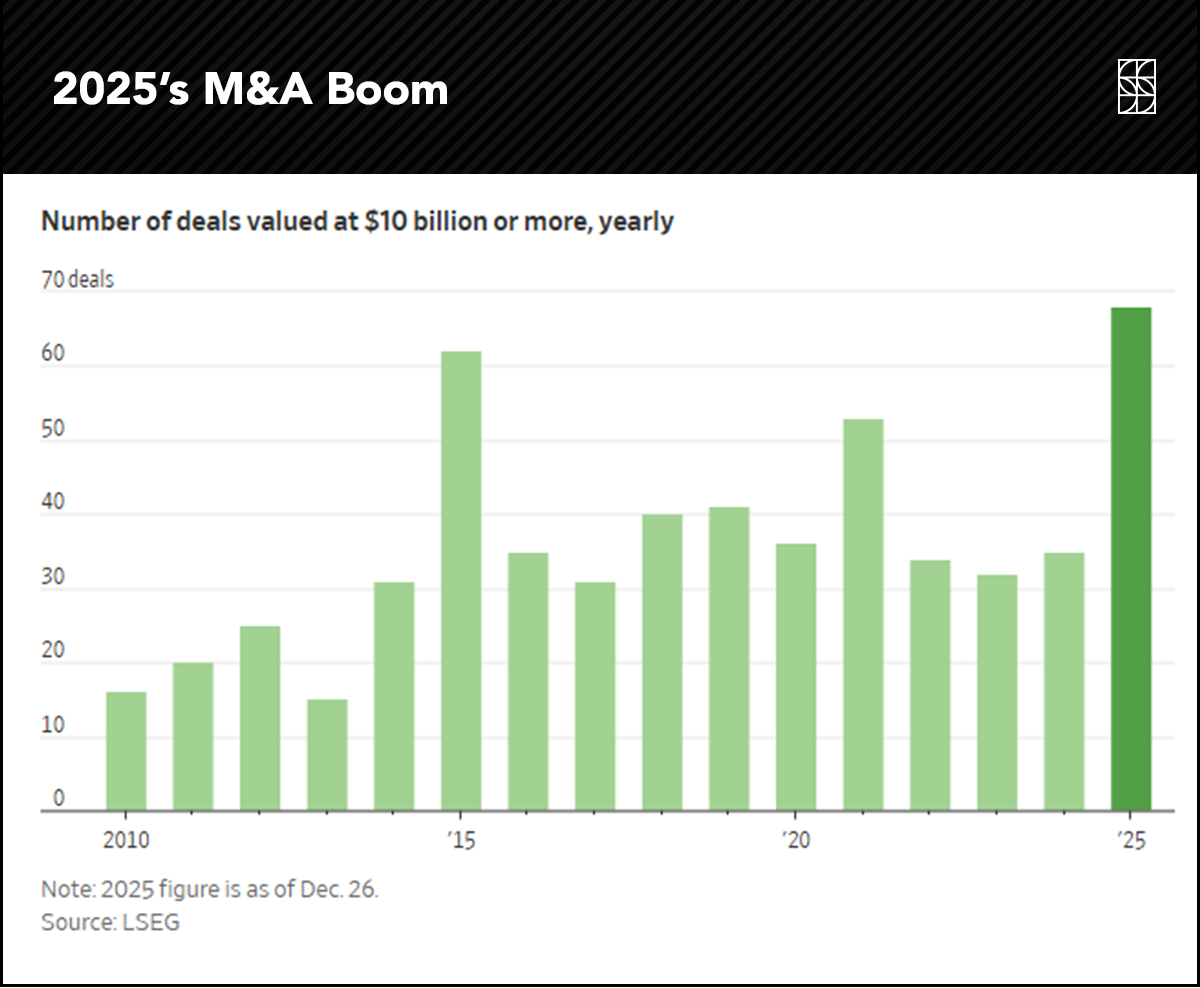

Among the more inspiring stories of 2025 was the outright boom in global M&A activity. The dollar value of mega-deals set a record, with capital markets activity gaining steam into the year’s finish. We expect the trend to continue.

It’s also possible that the bull market in large corporate deals trickles down to smaller firms. If that occurs, Wall Street’s “animal spirits” could shift toward Main Street. Improved business sentiment is needed, too. According to survey data from the Institute for Supply Management, manufacturing-sector sentiment has been negative for the better part of the last three years.

Initial public offerings (IPOs) weren’t quite as hot as M&A in 2025, but there were plenty of successful go-public stories—many of them AI-related. Companies like CoreWeave, Circle, and Chime soared in the first few weeks, bringing about late-1990s dot-com-era vibes. But the euphoria was short-lived as volatility ensued through the middle of the year and into the autumn for those new kids on the block.

On net, we are encouraged by the level of capital markets activity, and we expect it to continue into this year. Now may be the time for business owners to consider initiatives to boost their firms’ value. At a macro level, M&A and IPO trends are tailwinds. Historically, a healthier deal-making environment tends to coincide with confidence in forward earnings and economic durability. While not a guarantee of broad-based stock market upside, this reopening supports the case that risk appetite is improving.

Source: The Wall Street Journal

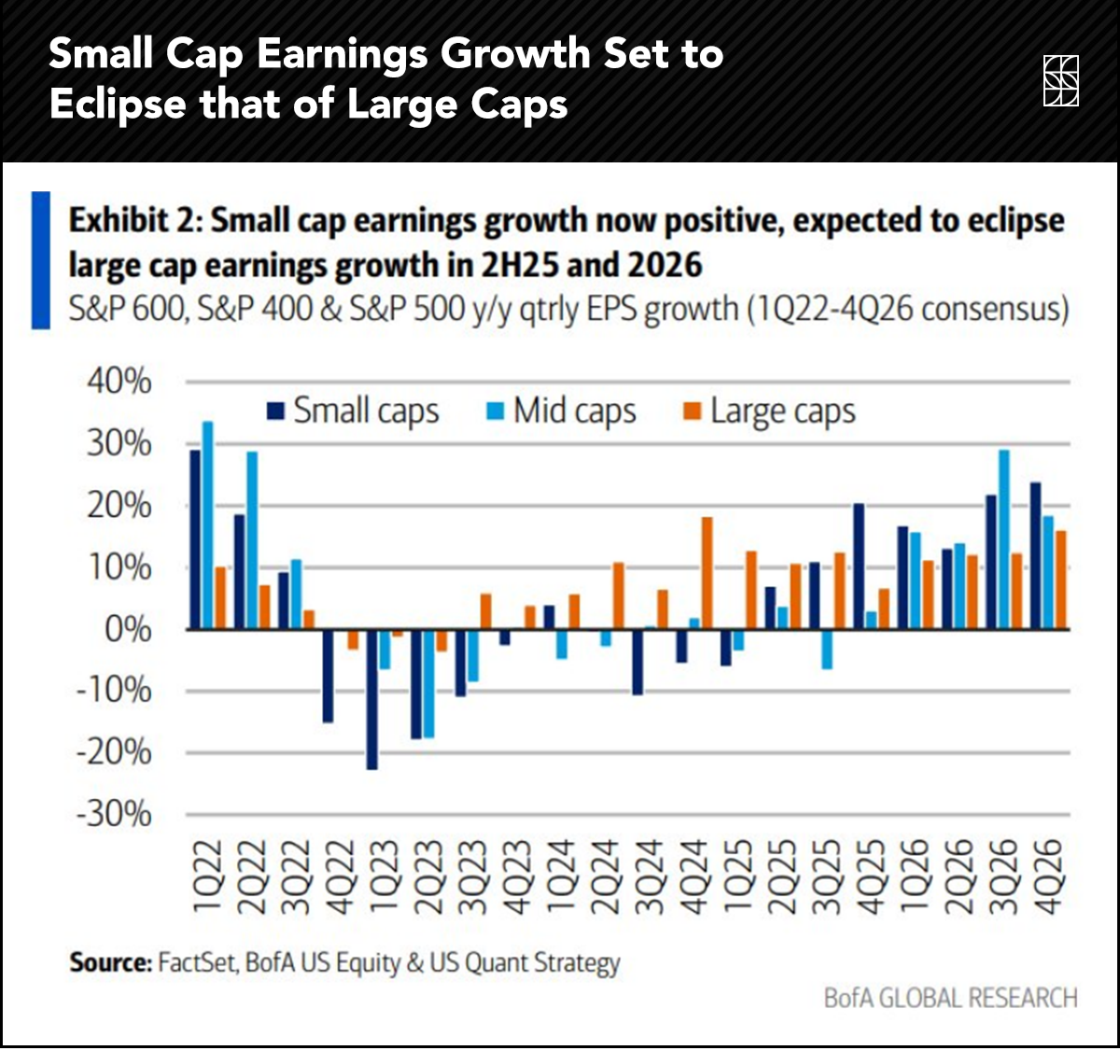

2026 could also be the year that the AI story shifts from the picks-and-shovels companies to actual end-user applications. Higher productivity, along with increased profit margins and valuation multiples, could be the result. Investors appear to have priced that in over the back half of 2025—U.S. small- and mid-cap stocks performed well, even outpacing the S&P 500 and Nasdaq 100.

The Russell 2000 Index of small stocks was up 14% in the second half of last year, potentially implying that a years-long period of stagnating earnings growth could be over. Looser financial conditions—brought about by lower short-term interest rates and somewhat modest corporate borrowing costs—have been beneficial, as have user-friendly AI tools hitting the market.

Indeed, AI is no longer confined to mega-cap tech firms. Increasingly, it is being integrated into logistics, customer service, inventory management, and back-office functions—areas where small and mid-sized businesses can realize outsized efficiency gains.

When paired with stable borrowing costs and more reasonable valuations, this productivity boost could translate into improving earnings leverage. While risks remain—particularly for companies with weaker balance sheets—the relative setup for select small- and mid-cap stocks looks more attractive than it has in several years. Still, it’s a “show-me” story in 2026.

Source: BofA Global Research

While we are generally upbeat on the “SMIDs,” U.S. big caps are battle-tested and resilient. Even companies outside the Mag 7 halo boast high profit margins and impressive return on equity (ROE) metrics. These firms benefit from scale, pricing power, global reach, and capital-light business models. The S&P 500’s aggregate profit margin and ROE could increase further this year, suggesting that capital is being deployed efficiently, even with uncertain GDP growth.

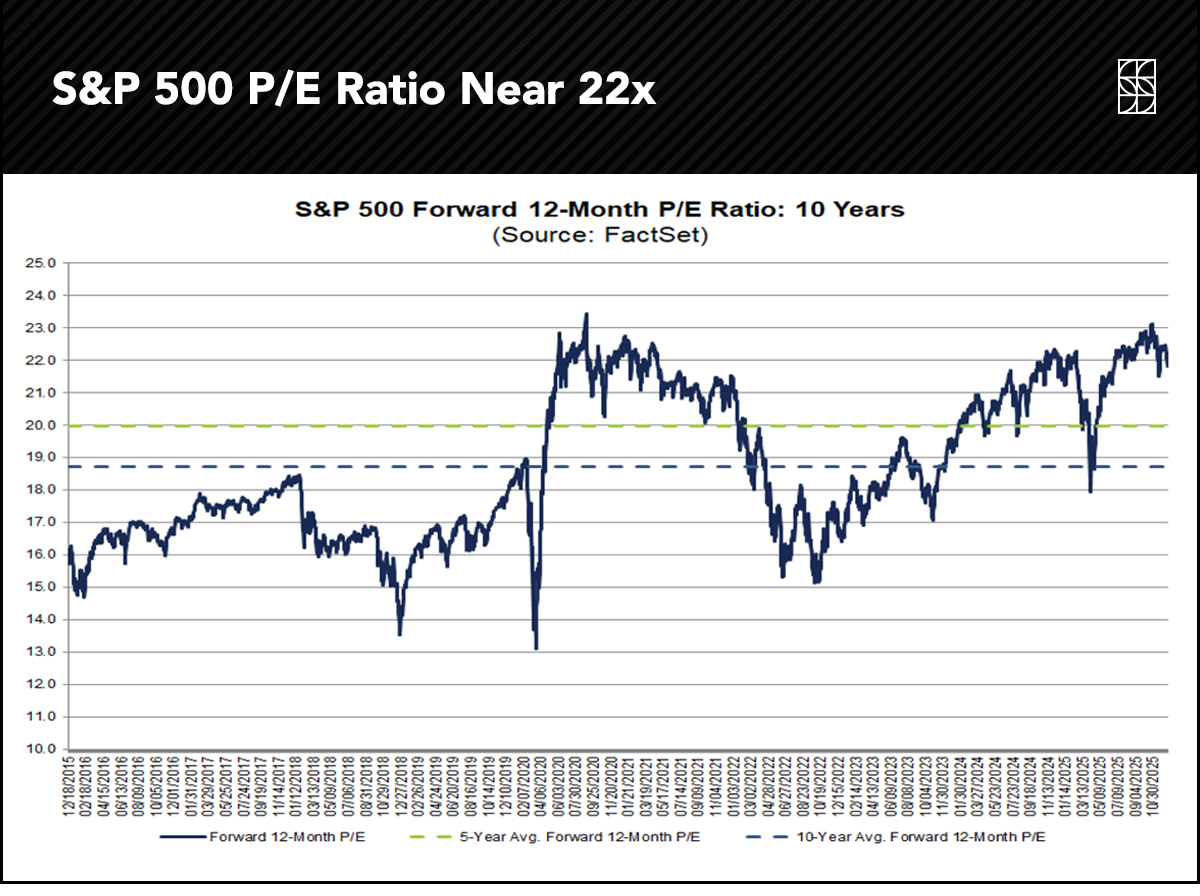

Many of the largest companies generate substantial free cash flow, fund innovation internally, and return capital to shareholders through dividends and buybacks. Perhaps for these justified reasons, the S&P 500 begins 2026 with a price-to-earnings ratio of 21.8x—historically high, but also near the average of the past 15 months (excluding March–May 2025).

Rick Rieder, once considered a serious contender to succeed Fed Chair Jerome Powell, often talks about this. While valuations are elevated, the quality premium embedded in these stalwart companies reflects durable competitive advantages rather than speculative excess. As long as profitability remains strong, large-cap stocks may continue to justify their outsized market weight, even if future returns moderate.

Source: FactSet

Investors have had only brief moments to buy the S&P 500 at even moderate earnings multiples. The P/E ratio fell to 18 at the depth of the April decline. In 2022, the valuation didn’t even get down to 15, once considered the long-term average.

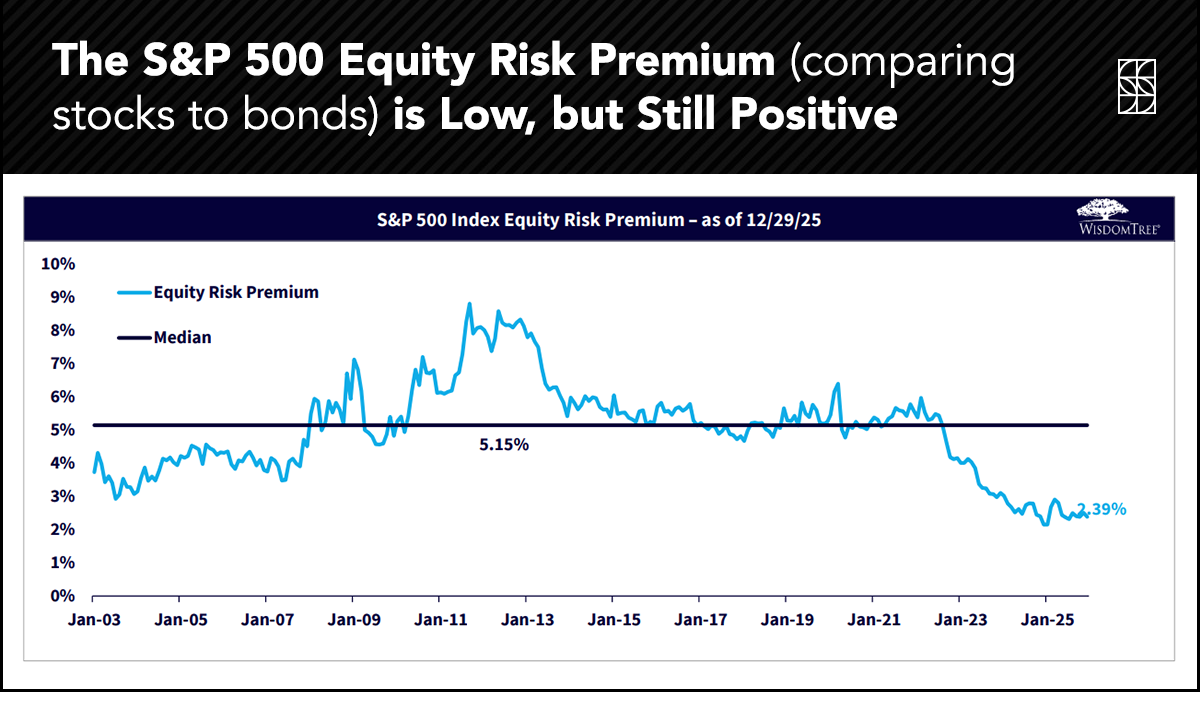

One way to think about the P/E ratio is to flip it upside down: the S&P 500 earnings yield is a historically paltry 4.6%. That’s only slightly more than the yield on the benchmark 10-year Treasury note. It’s not an apples-to-apples comparison, though, since stocks are generally solid inflation fighters over the long run (bonds are not).

The upshot: An elevated P/E does not imply an imminent correction or bear market, but it does suggest that future gains may be harder won. For investors, selectivity, diversification, and valuation discipline may matter more in 2026 than they did during the liquidity-fueled rallies of prior years.

Source: WisdomTree Funds

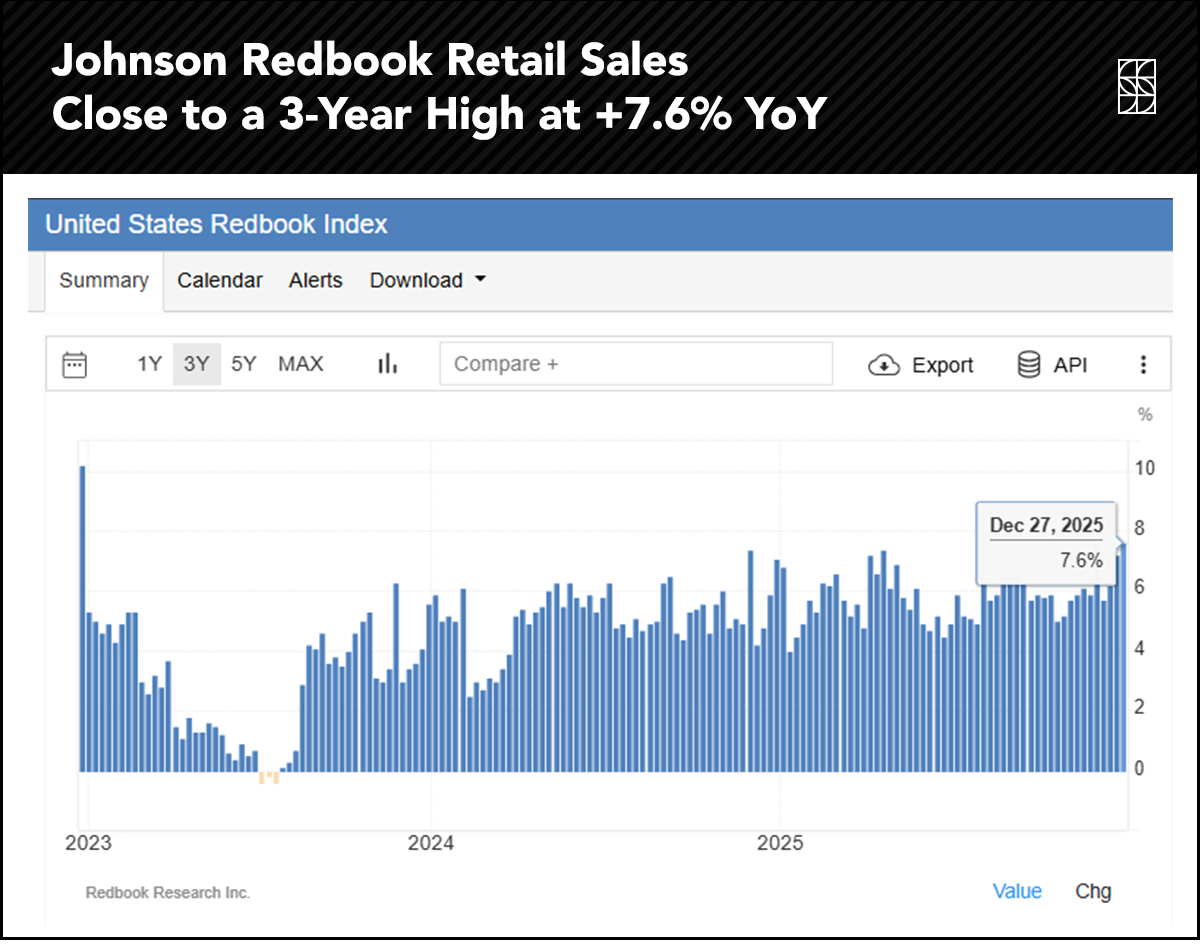

Turning to the consumer, household spending was something to behold throughout 2025. Despite downbeat sentiment, scary media headlines, and the reality of a stalled jobs market, folks were not shy about whipping out their wallets. The latest official Retail Sales report from the U.S. Census Bureau was for October and came in above forecasts. Recent weekly updates from other outlets confirm strong spending through the holiday season, up 7.6% year over year, according to Johnson Redbook.

And we may see more of the same. The One Big Beautiful Bill Act (OBBBA) largely extends President Trump’s 2017 Tax Cuts and Jobs Act (TCJA), keeping tax rates low for most Americans. What’s more, new provisions, including exemptions on certain forms of income like tips and overtime, should bolster take-home pay for some lower- and middle-income households. At a period when inflation has cooled but remains elevated relative to pre-pandemic norms, incremental income relief matters.

While these measures may not spark a consumption boom, they help stabilize spending at the margin. For markets, a stable consumer reduces downside risk to corporate earnings, especially in sectors tied to domestic demand. That said, fiscal support is unlikely to fully offset broader cyclical slowing if labor conditions continue to deteriorate.

Source: Trading Economics

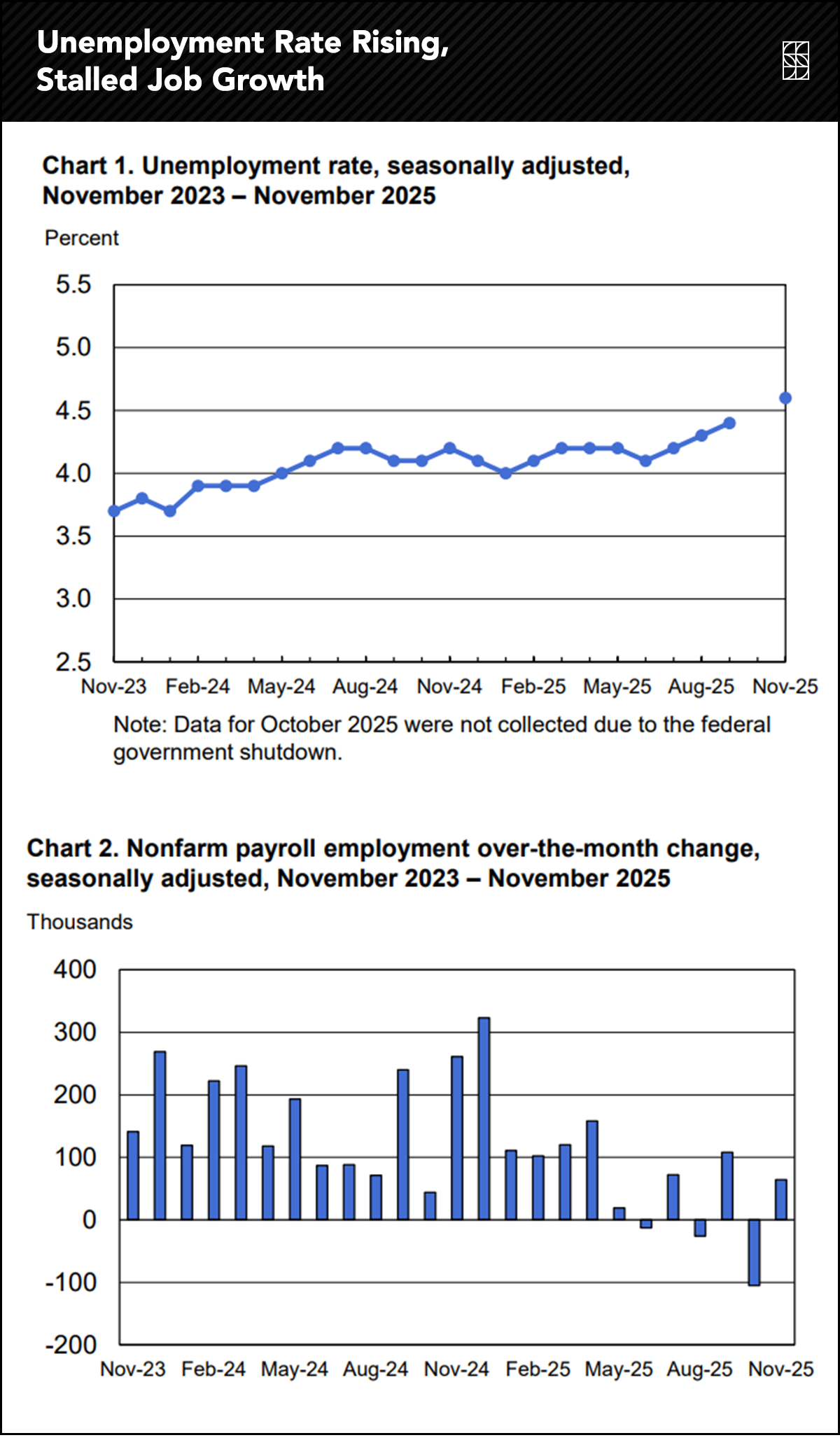

On the jobs front, the “slow hire, slow fire” environment is stubborn. The unemployment rate has stair-stepped higher, now at 4.564%—the highest since Q3 2021. Job openings are down, wage growth has fallen, and layoff announcements are much higher compared to just a year ago. We’ll get fresh reads in the weeks ahead, as official data flows normalize following the October–November government shutdown.

The Fed is no doubt concerned about the direction of travel in the labor market, even if it is not falling off a cliff. In response, the Committee cut its policy rate at each of the final three meetings of last year. A new set of 12 FOMC voting members takes their seats January 27–28, while Powell’s term is up in mid-May.

Source: BLS

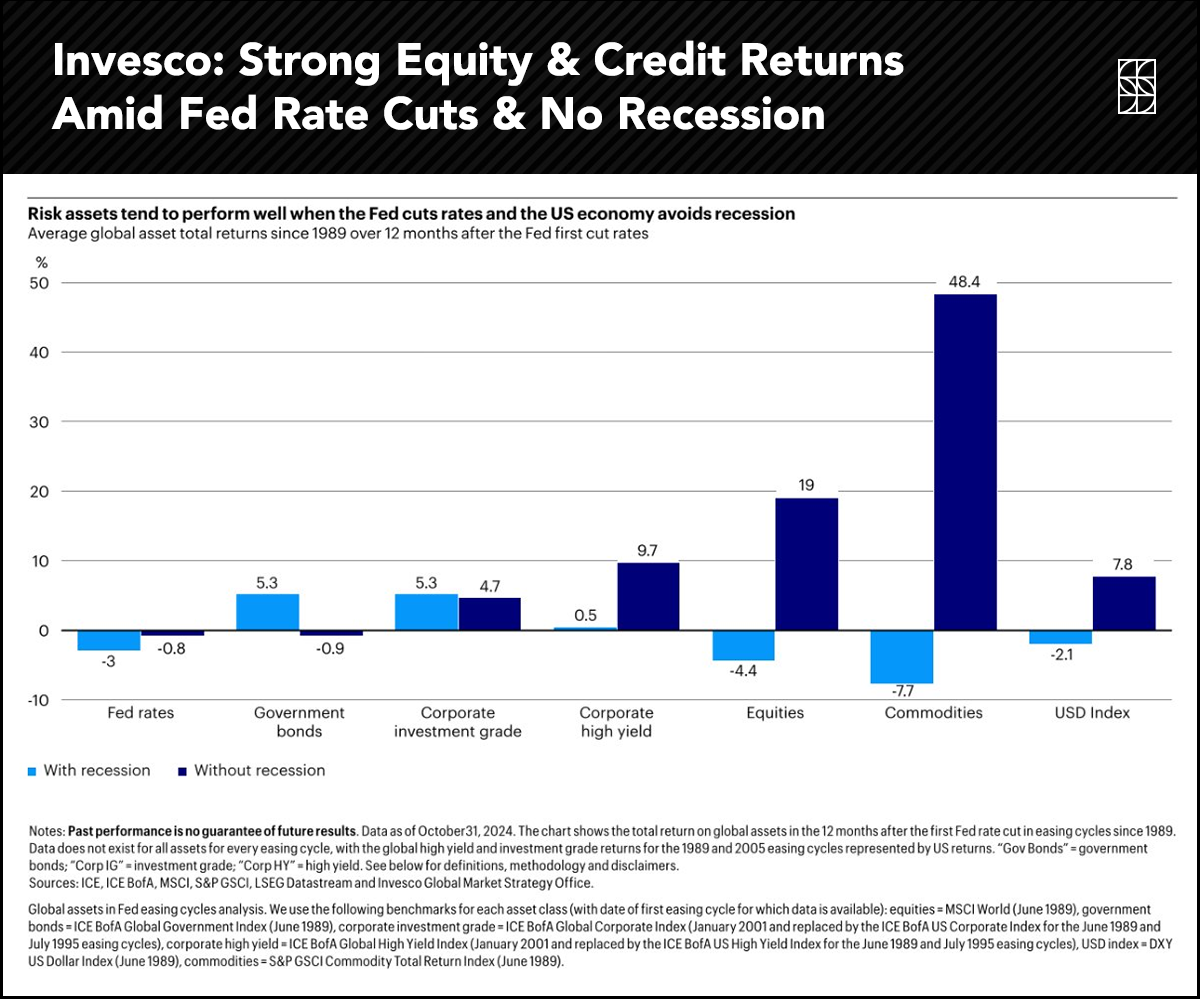

Putting the spotlight on the Fed and what it means for investors, Goldilocks rate cuts—those that come about absent a recession—are often rocket fuel for risk assets like stocks.

In previous cycles, equities have returned close to 20% in the 12 months after the Fed begins (or resumes) easing without a recession. Commodities have done even better, according to data compiled by Invesco. The data is clear: Lower rates reduce discount rates, ease financial conditions, and encourage capital investment, benefiting stocks, corporate bonds, and even the value of the U.S. dollar.

So, everybody should climb aboard the bullish boat, right? Not so fast.

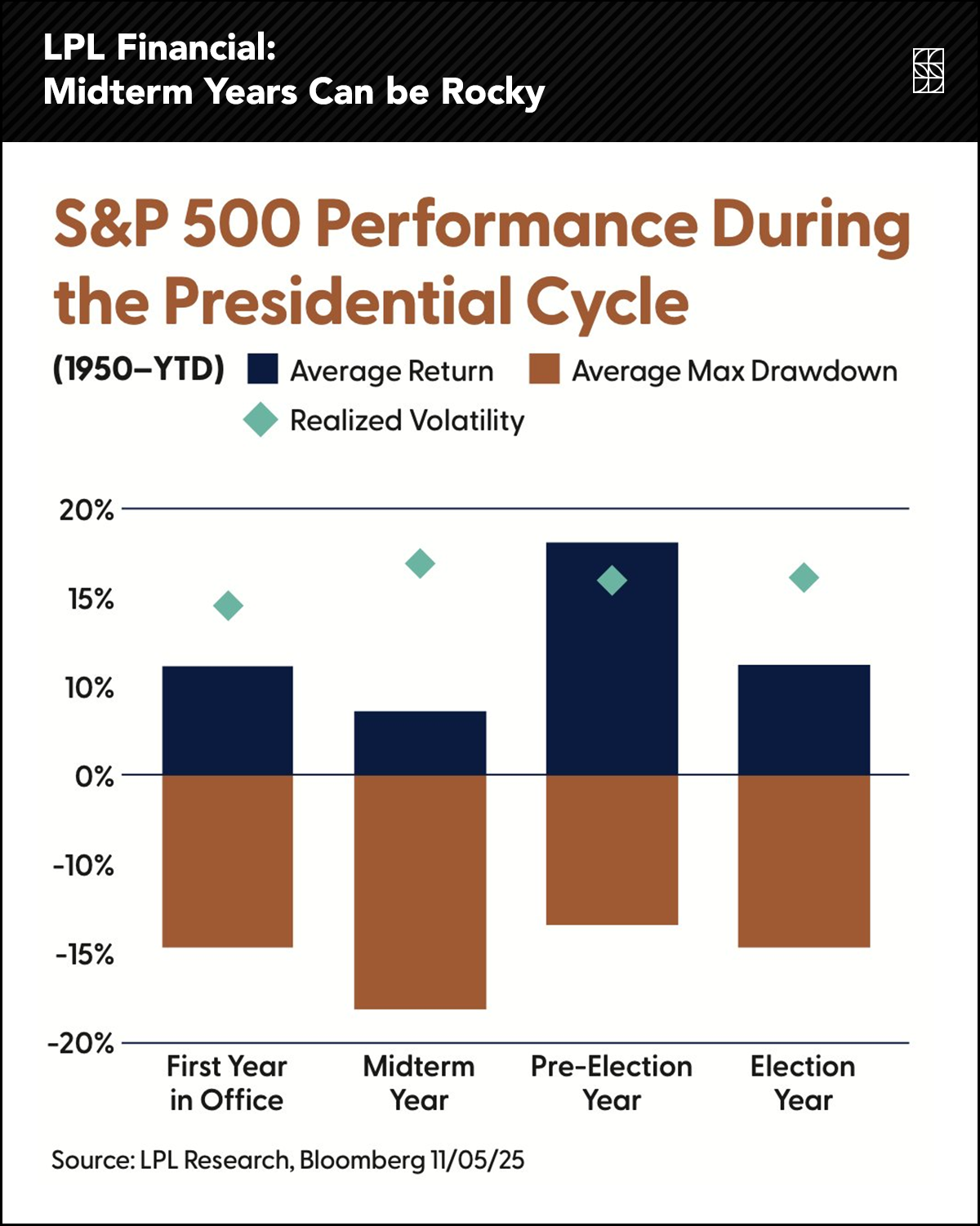

It’s a midterm election year, and that has historically been troubling news—not always bad news—for stocks. LPL Financial notes that since 1950, midterm years have been the weakest link in the presidential cycle. The S&P 500 typically sees higher volatility, averaging just a 4.6% gain alongside a steep 17.5% average drawdown. Policy uncertainty, shifting fiscal priorities, and political rhetoric can all influence investor sentiment, even if underlying fundamentals remain intact.

The good news? Stocks often stage big November–December rallies to close out midterm years. Are we reading tea leaves? Maybe, but historical trends can help suss out signal from noise.

It wasn’t a December to remember for investors, but 2025 as a whole was a classic example of why it pays to have a plan—and to hold fast to it. April brought about some of the most intense macro fear since 2008, yet global stocks turned in their best annual return going back to 2019. Bonds were also resilient. This year brings new risks and opportunities, but the overall backdrop remains constructive.

*Stokes Family Office does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.