Social Security, Dollar Value, & The Stealthy Wealthy

June 6, 2025

Each week, the Stokes Family Office staff puts together a list of our favorite news and updates on all things wealth management. From financial planning, portfolio construction, tax and estate planning, retirement plan services to anything we found interesting. Enjoy this week’s curated list for your weekend reading!

Not Now, Not In 10 Years, Social Security Isn’t Going Insolvent

Real Clear Markets: The surest sign insolvency in no way looms in Social Security’s present or future can be found in the certainty that there’s no “lock box” and there never was one.

The paradoxical truth is that the lack of funds stashed away for future retirees is the surest sign that their Social Security payments are secure now and forever.

Is the Dollar Losing Its Edge?

Underpinned by the economic and institutional strength of the United States, the dollar has been the world’s dominant currency since the Second World War.

Econofact analysis considers whether there are signs of changes to the way in which the dollar is regarded — and what this could mean for the dollar’s dominant role.

Inflation Pressures Were Tamed a Few Years Ago

Scott Grannis: The big-picture takeaway here is that the surge in inflation, which occurred in the wake of the Covid crisis, ended in mid-2022. It’s all over but the shouting.

Related:

There’s a Limit to What the Investor Class Will Tolerate

Sam Ro on TACO trades, stock market vigilantes, and Trump puts.

7 Attributes of The Millionaire Next Door

The 1996 book “The Millionaire Next Door” profiles the stealthy wealthy. Ben Carlson examines whether or not the data holds true today.

Michael Batnick writes about why he is a big fan and consumer of index funds

“Individual stock investing isn’t for the faint-hearted. Most stocks underperform, lose massive value, and don’t always recover. Even winning stocks endure brutal drawdowns.”

Related:

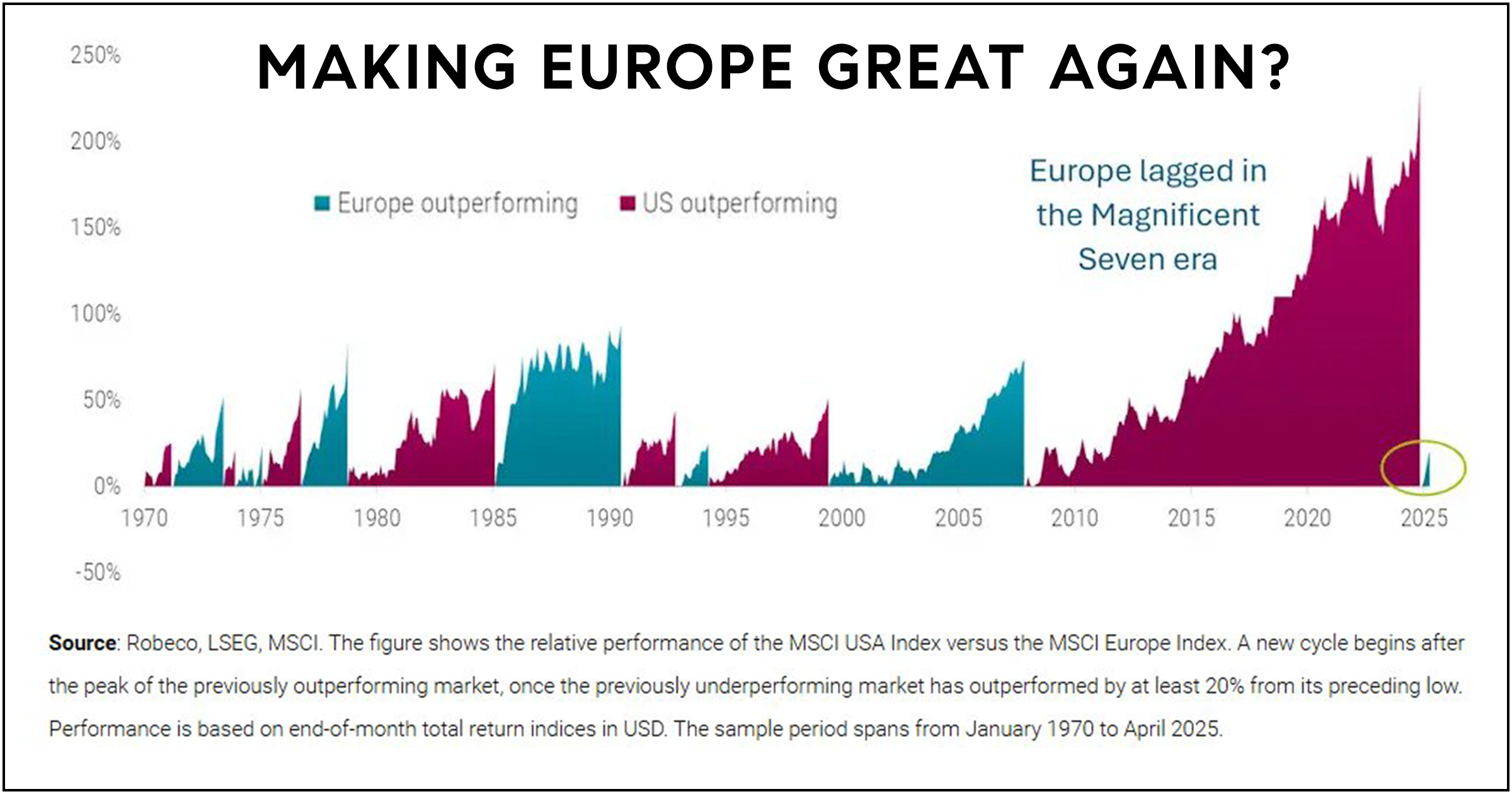

Has the extended market leadership for US equities come to an end for now? Via Mike Zaccardi

Stokes Family Office is 100% Family Owned, and has been continually operating in the New Orleans Area for over 35 years. As a family office, we are focused on family wealth, financial planning, and tax planning. We are your local experts for Gulf South wealth management. Want to hear more from our team? Check out the Lagniappe Podcast.

*Stokes Family Office does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.