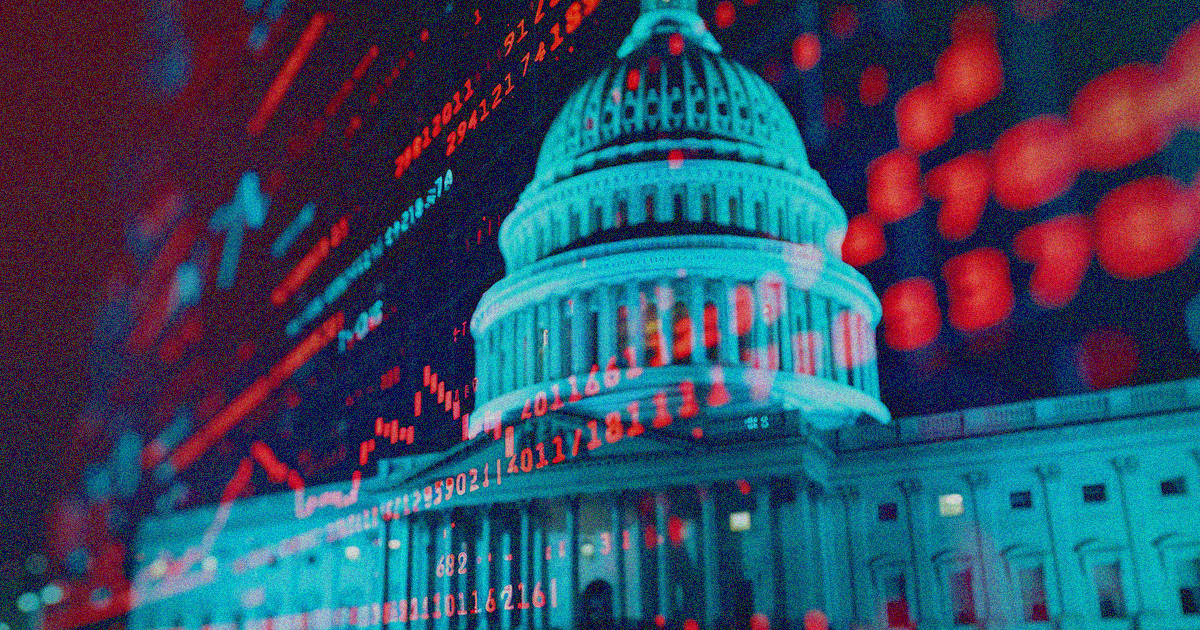

With the voting results in hand, we’re reading election reaction, as well as articles on nuclear power, gold, and more!

Each week, the Stokes Family Office staff puts together a list of our favorite news and updates on all things wealth management. From financial planning, portfolio construction, tax and estate planning, retirement plan services to anything we found interesting. Enjoy this week’s curated list for your weekend reading!

ECONOMY NEWS

- Three Things – Election Autopsy Edition

- Cullen Roche breaks down why Trump won, what it means for the economy, markets, inflation and interest rates, and potential pros and cons.

- Is Nuclear Power’s High Cost Justified for Clean Energy?

- David Kemp writes, “Nuclear will require substantial cost reductions before it is worth investing in, whether its clean energy benefit is considered or not.

- He also says our current web of subsidies and regulations makes it difficult to evaluate the benefits and costs of various energy sources.

- Economically-Weighted ISM Average Indicates Expanding Economy But likely in Latter Cycle Stage

- Bonddad Blog: While goods production is in contraction, services provision is expanding strongly.

- As expansions age, goods production tends to wane while services continue to grow suggesting even if no recession is close at hand, the expansion is likely in its latter half.

MARKETS NEWS

- What’s Driving Gold? Central Banks And Hedging Are Key Factors

- The Capital Spectator: Prior to the last several years, modeling the gold market was relatively straight forward. But a lot has changed in recent history, and so has the mix of factors that are front and center in gold’s price trend.

- Presidential Terms, Recessions & Bear Markets

- Prior to the election, Ben Carlson was asked which candidate was more likely to cause a recession/bear market.

- He goes into why his answer would be the same regardless of outcome and cites the U.S. economy being in a sweet spot.

- On Presidents, the Stock Market, and the Big Picture for Investors

- Sam Ro writes, “history suggests that a U.S. president’s political slant may not be as important for stock market performance as you might assume.”

Related:

Stokes Family Office is 100% Family Owned, and has been continually operating in the New Orleans Area for over 35 years. As a family office, we are focused on family wealth, financial planning, and tax planning. We are your local experts for Gulf South wealth management. Want to hear more from our team? Check out the Lagniappe Podcast.