What is a Target Date Fund?

November 9, 2022

While working with 401k participants, a common introductory question is, “How is your 401k plan invested?” A very popular response is, “Well…I don’t know.” When a participant does not know how their 401k funds are invested, the answer to that question almost always ends up being a Target Date Fund.

So, what is a Target Date fund?

Almost every 401k plan in America has them. The intention is to match participants with Target Date Funds that approximate the year that they will retire or hit age 65. They’ve become immensely popular in recent years with over 60% of new 401k assets invested into TDFs.*

Why are they so popular?

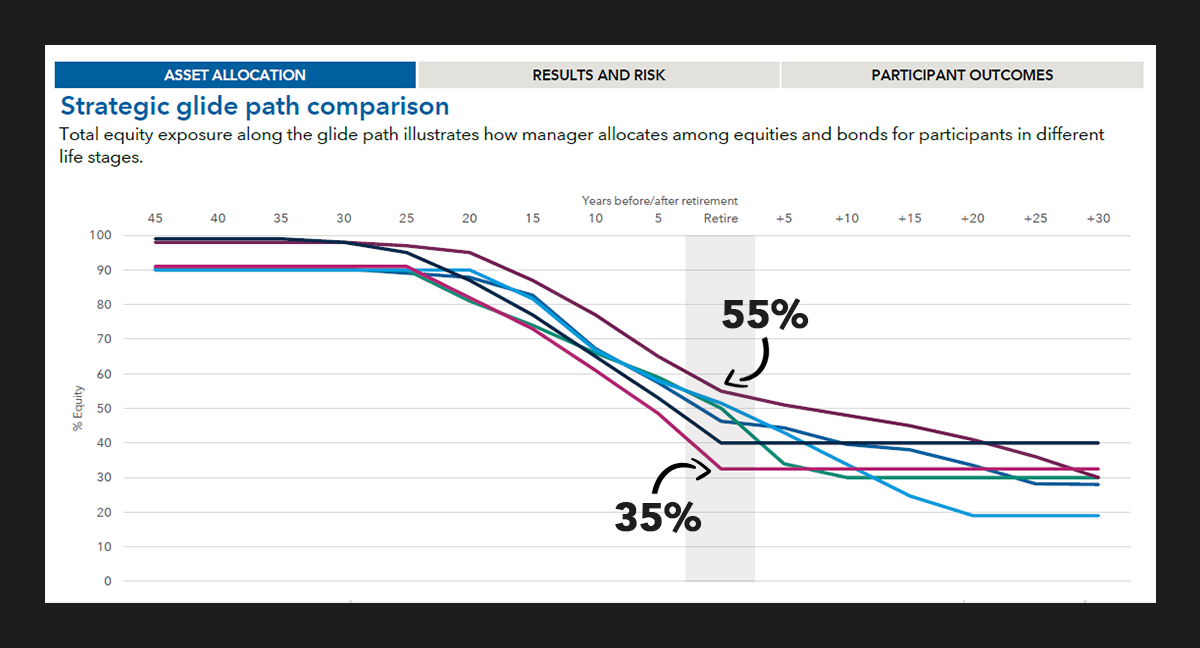

The mechanism by which fund companies reallocate a participant’s account to become more conservative as they age is called a “Glidepath”, and every Target Date Fund operates on one. However, not every Glidepath and Target Date Fund is created equally.

The below chart is a study from American Funds representing the six largest target date fund families in the industry and the differences in their Glidepaths. The y-axis on the chart represents the % of equities owned within the fund and the x-axis represents “years away from retirement”. As you can see within the graph, each of these funds has a different allocation at retirement. The most aggressive fund family allocates 55% to equities at age 65. Conversely, the most conservative fund family allocates 35% to equities. This is a large difference in allocation, which will lead to varied volatility and rates of return.

Being that Target Date Funds of the same retirement year can have such different allocations, it’s important for participants to gain a better understanding of what they’re invested in. And to go further, plan sponsors should also understand how aggressive or conservative their target date fund glidepath is, and should document the fact that the funds’ glidepath fits the specific demographics of their employee base.

In many cases, a 401k is a participant’s largest financial asset should be managed and adjusted in a more tailored way than Target Date Funds can offer, especially as retirement approaches. To make this happen, participant education and one-one-one consultations are something that Stokes Family Office is proud to offer each client to ensure employees are using their 401ks effectively.

*Source: Pension Resource Council

*Stokes Family Office does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.