When Discipline Really Mattered

March 12, 2021

This week marks the one-year anniversary of coronavirus bringing the country to a standstill. At a time of so much uncertainty and fear – with life completely shut down and the markets in freefall – it would have been nearly impossible to predict that one year later there would be many vaccine options available and “a light at the end of the tunnel” for the pandemic.

While it may seem like a distant memory, you may recall the S&P 500 fell 34% in a matter of weeks. To everyone’s surprise, the markets then proceeded to finish the year in positive territory.

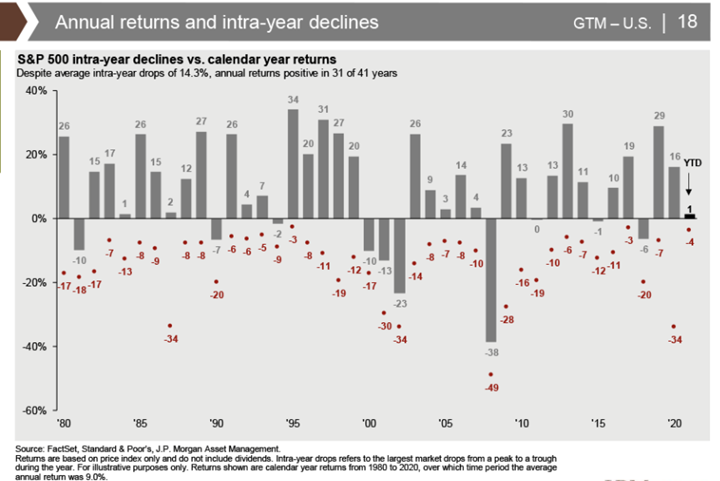

Just like we saw last year, intra-year declines are quite common, even when annual returns are positive. As shown in the JP Morgan Chart below, the “red dot” indicates the lowest intra-year decline in the markets any given year. The “grey bar” indicates the calendar year return.

Over the last 41 years, the average intra-year decline in the S&P 500 has been 14.3%, and the average annual return has been 9%. In other words, to earn this sizable, average annual return, you’ve had to maintain discipline through a lot of difficult periods – like March 2020.

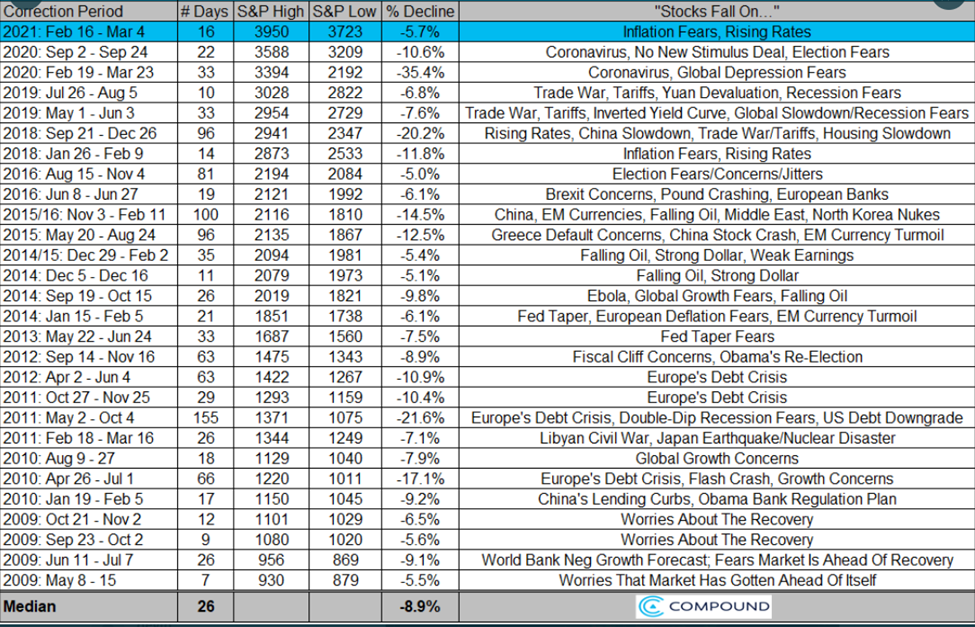

While last March was certainly a difficult time, markets have experienced corrections for much more benign reasons… at least in hindsight.

See below for a specific itemization of all corrections in the S&P 500 since the Global Financial Crisis of 2009.

More recently, the S&P 500 saw a 5.7% correction from February 16 to March 4 due to concerns over inflation and rising interest rates. This begs the question – “is this the start of another big correction/bear market, or is it just normal, healthy volatility?” While no one truly knows the answer to this question, those who have stuck to long-term plans have been rewarded throughout market history.

We believe maintaining a long-term perspective is important. In the depths of last March, it would be difficult to see a light at the end of the tunnel, yet here we are. The S&P 500 closed on Thursday at an all-time high. It certainly would have been hard to imagine writing that one year ago. Next time you hear a prognosticator make dire market predictions, try and remember how many people forecasted a return to all-time highs one year post-Covid.

We hope everyone has a happy and safe weekend. Please give us a call if you have any questions.

Sources:

https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

*Stokes Family Office does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.