What’s On Tap For 2026

January 9, 2026

Each week, the Stokes Family Office staff puts together a list of our favorite news and updates on all things wealth management. From financial planning, portfolio construction, tax and estate planning, and retirement plan services to anything we found interesting. Enjoy this week’s curated list for your weekend reading!

G3 Fiscal Policy Very Expansionary in 2026

Torsten Slok: The IMF estimates that fiscal policy will boost growth by 1% in Germany and 0.5% in Japan in 2026. The CBO estimates that the One Big Beautiful Bill will boost US growth by 0.9%. The bottom line is that fiscal policy in the G3 will be very expansionary over the coming quarters.

Joel Kotkin: Soaring housing costs are driving young people towards socialism—only dispersed development and expanded property ownership can preserve liberal democracy.

Preston Caldwell: Resilient demand will keep oil prices afloat through mid-century.

Related:

Ryan Detrick: Recent gains are rooted in fundamental earnings growth and broad participation across many stocks rather than unsustainable price increases driven only by a few names.

Matt Cerminaro: It’s not about “narrow leadership” anymore.

Rick Rieder: 2026 is a market for investors, not gamblers.

Related:

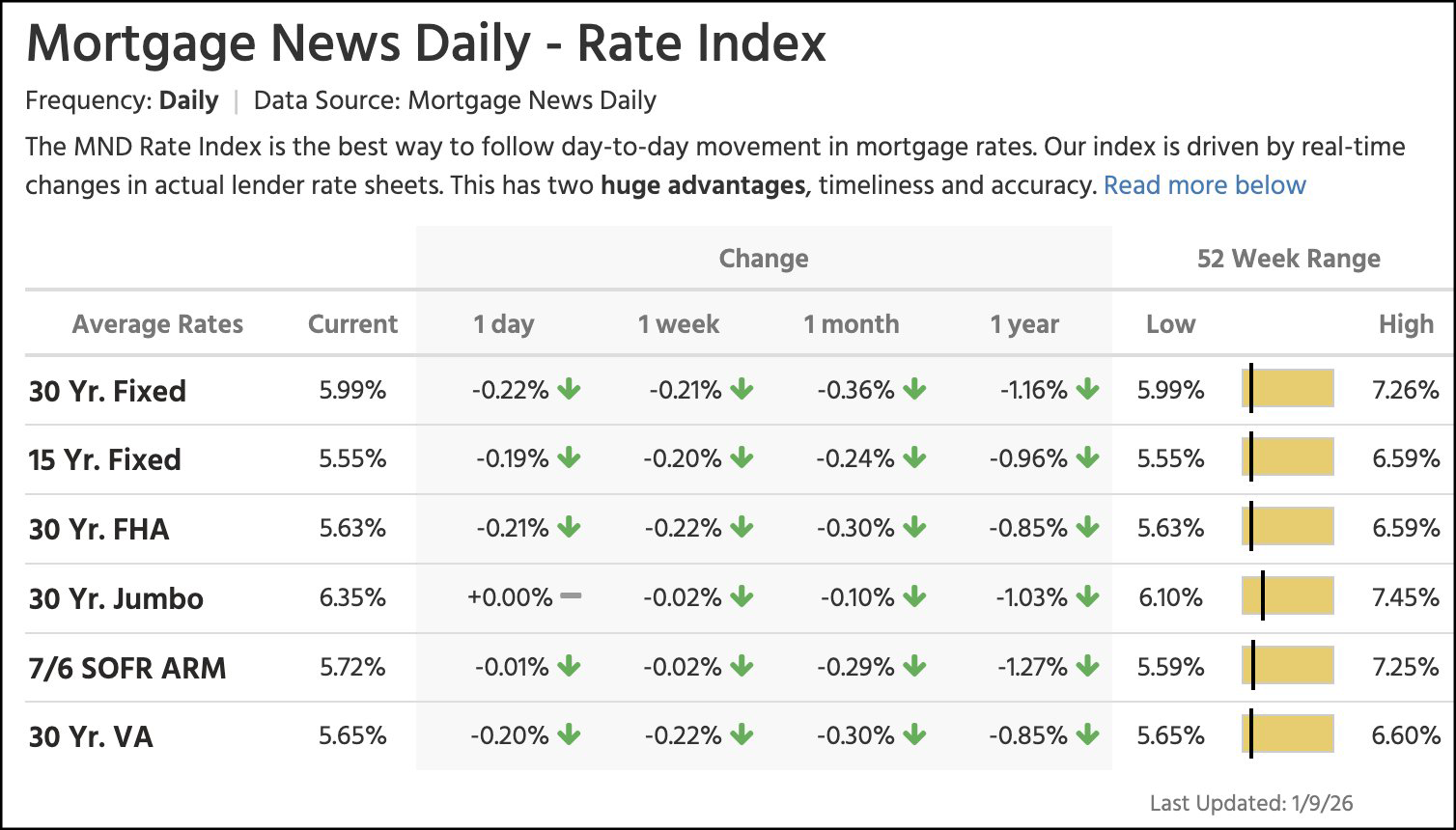

Via Lance Lambert, there was a big one-day mortgage rate drop. The average 30-year fixed mortgage rate today: 5.99%. The same day last year: 7.15% https://lnkd.in/gKpS-Ahp

10-year Treasury yield today: 4.17%, Spread today: 182 bps.

Stokes Family Office is 100% Family Owned, and has been continually operating in the New Orleans Area for over 35 years. As a family office, we are focused on family wealth, financial planning, and tax planning. We are your local experts for Gulf South wealth management. Want to hear more from our team? Check out the Lagniappe Podcast.

*Stokes Family Office does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.