The Stock Market: Is This Time Different?

May 3, 2022

The further you zoom out, the more attractive stock market investing looks. Since 1926, the S&P 500 has compounded at an annualized rate of return of 10.31% thru March 31, 2022.

$1,000 invested would have grown to $12.6 million, assuming all dividends reinvested. Not bad. It’s also been a fantastic hedge against inflation as the S&P 500 has returned 7.16% per year after inflation (“real return”) over the same timeframe.

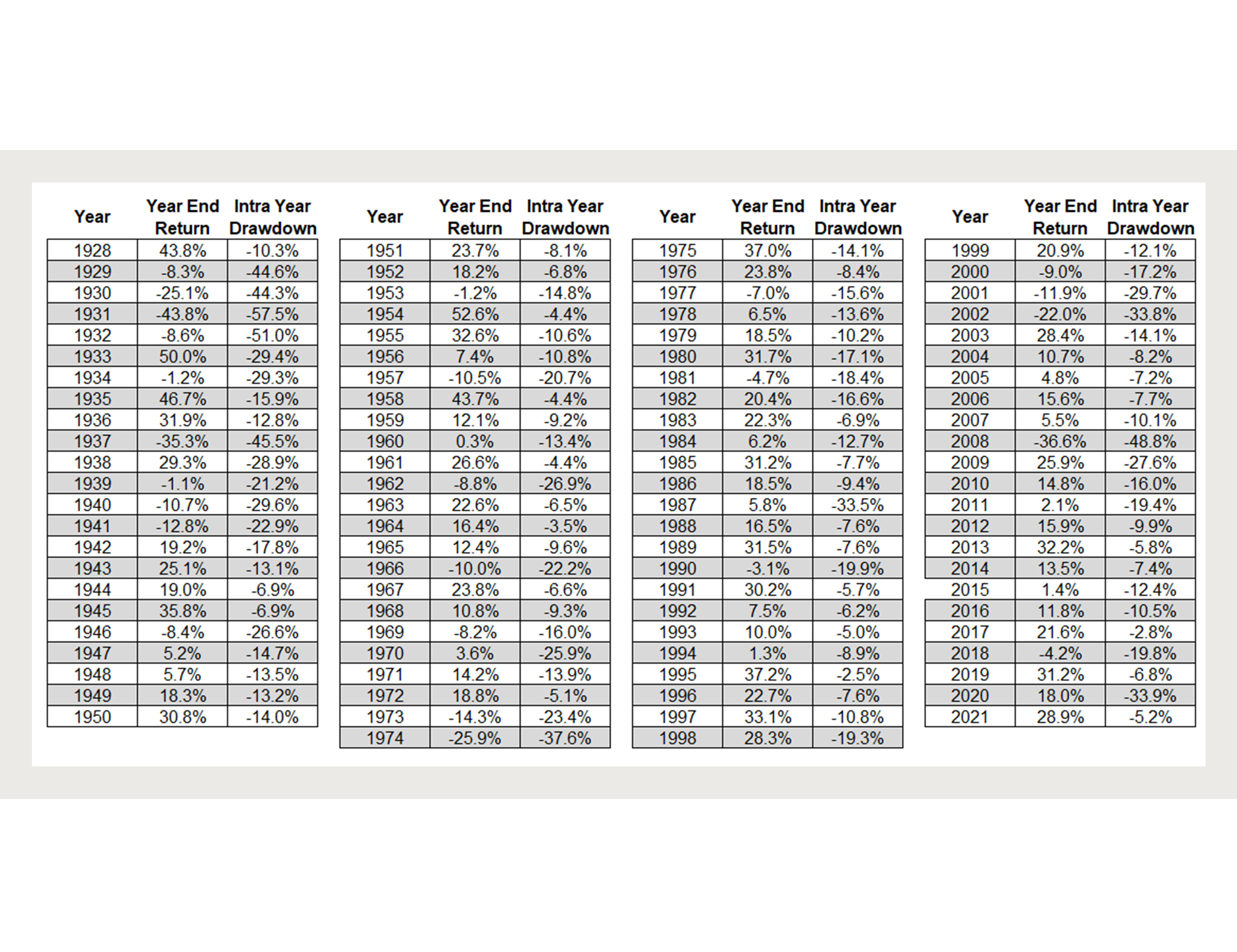

Although returns have been in excess of 10% per year, the path has been anything but linear. Below is a summary of each market correction over that time period.

According to Ben Carlson, author of A Wealth of Common Sense, there have been 59 periods over that span in which the market was in correction or bear market territory. In those 59 years:

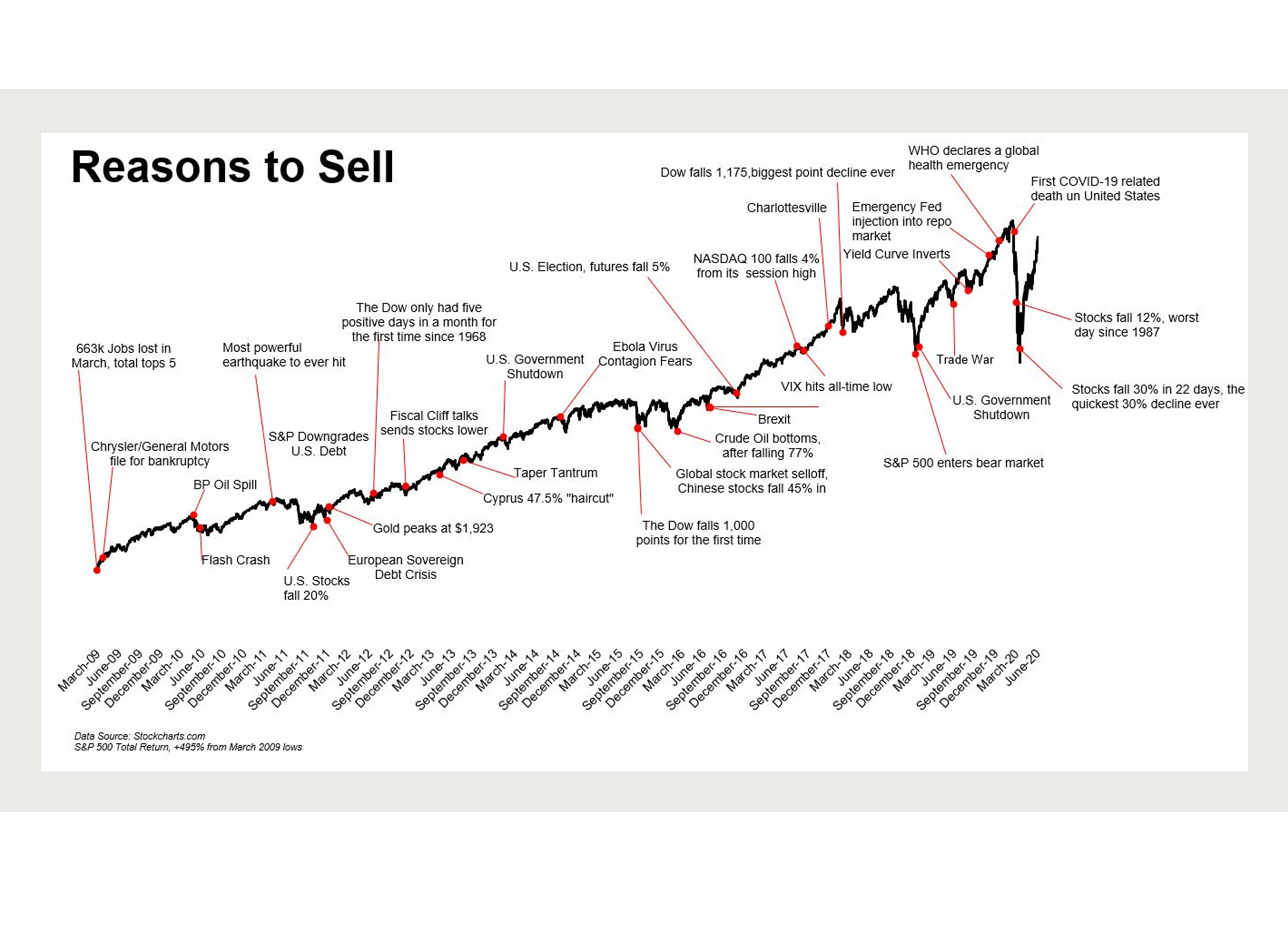

Each one of these drops carried with it a gut-wrenching narrative designed to instill fear in investors.

Today, all you need to do is turn on the news or scroll through your social media feed. We have inflation and rising interest rates, a war in Europe, a Fed-tightening cycle, and Chinese lockdowns, just to name a few events happening around the world simultaneously.

Of course, there were seemingly world-ending narratives in the 20s and 30s with the Great Depression, the 40s with World War II, the 60s and 70s with Vietnam and Stagflation, the 80s with Black Monday, the 90s with the Asian Financial Crisis and the Russian Ruble Crisis, and the 2000s with the tech bubble bursting, 9/11, and the Great Financial Crisis. Recently, of course, we had our own generational event with COVID.

Despite the narrative, markets finished positive for the year in 6 out of 10 years where there was a intra-year drawdown of greater than 10%. In those years, the markets finished positive after a double-digit decline, and the average year-end return was 20.1%. Conversely, of the 4 out of 10 times the market finished negative in a correction or bear market year, the average year-end return was -13.31%. The current max drawdown for 2022 is ~13%.

Volatility has been painful, but the American economic engine that turned $1,000 into $12.6 million has kept moving forward. So is this time different? We doubt it. There will always be a reason to sell. A well-designed portfolio and a disciplined financial plan should help curb the urge to act when things get uncomfortable.

Sources:

*Stokes Family Office does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.