The Stock Market & The Economy Are Diverging

September 19, 2025

Each week, the Stokes Family Office staff puts together a list of our favorite news and updates on all things wealth management. From financial planning, portfolio construction, tax and estate planning, retirement plan services to anything we found interesting. Enjoy this week’s curated list for your weekend reading!

AI Will Change Jobs Before the Data Shows It

17 Charts to Consider as Stocks Rally and the Economy Cools

What’s the Real Reason Behind a Softening Job Market?

Related:

How Old Is This Bull Market? Younger Than You Think

Worth Its Weight? Assessing Gold’s Portfolio Utility

The 60/40 Portfolio: A 150-Year Markets Stress Test

Related:

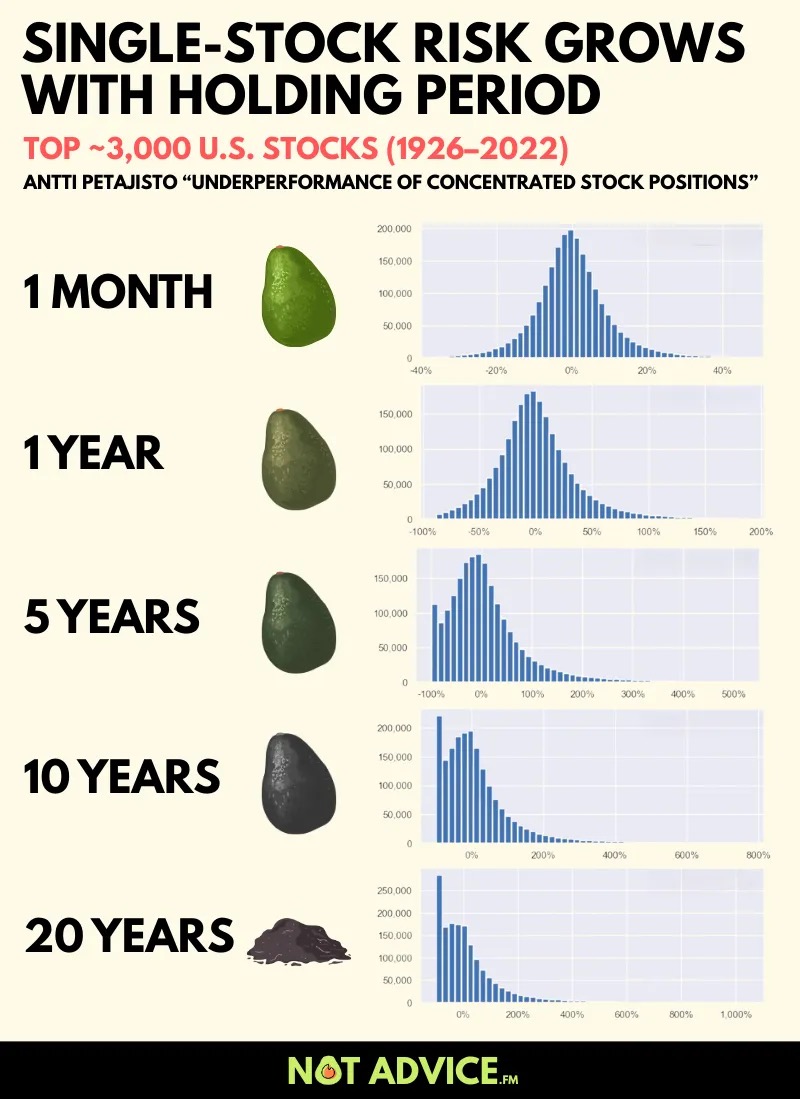

Brent Sullivan of Tax Alpha Insider has a produce analogy about holding a single stock too long as he dives into the underperformance of concentrated stock positions. See more.

Stokes Family Office is 100% Family Owned, and has been continually operating in the New Orleans Area for over 35 years. As a family office, we are focused on family wealth, financial planning, and tax planning. We are your local experts for Gulf South wealth management. Want to hear more from our team? Check out the Lagniappe Podcast.

*Stokes Family Office does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.