Rare Earths, AI CapEx, & Market Valuations

October 31, 2025

Each week, the Stokes Family Office staff puts together a list of our favorite news and updates on all things wealth management. From financial planning, portfolio construction, tax and estate planning, retirement plan services to anything we found interesting. Enjoy this week’s curated list for your weekend reading!

Alex Tabarrok: The issue isn’t the rarity, or the dirtiness of extraction, but how China has much better technology for rare earth extraction.

Kai Wu, Sparkline Capital: The AI revolution has reached a key inflection point, with the largest U.S. tech firms embarking on a massive AI infrastructure buildout. While the market has rewarded this spending so far, we find that historical capital expenditure booms have typically resulted in overinvestment, excess competition, and poor stock returns – both at the macro and individual firm level.

Renters Have the Upper Hand. And They Are Probably Keeping It.

Rebecca Picciotto, WSJ: Apartment rents nationally are advancing at their slowest pace in years because the glut of new units is taking longer to absorb than expected

Related:

Why the AI Spending Spree Could Spell Trouble for Investors

Larry Swedroe: As Big Tech pours trillions into AI infrastructure, history warns of overinvestment, shrinking returns, and rising risks.

Nick Maggiulli: For those who have been living under a rock, let’s hope it was gold, because the shiny metal is up over 50% year-to-date (YTD) compared with 18% for the S&P 500 (with dividends). With this recent outperformance by gold, some are starting to question whether investing in stocks still makes sense.

Is The Stock Market Overvalued?

Adam M. Grossman: Stock market investors are enjoying yet another strong year. The S&P 500 has gained about 14% so far, shrugging off, for the most part, uncertainty over tariffs, interest rates, and the latest government shutdown. Should this worry us?

Related:

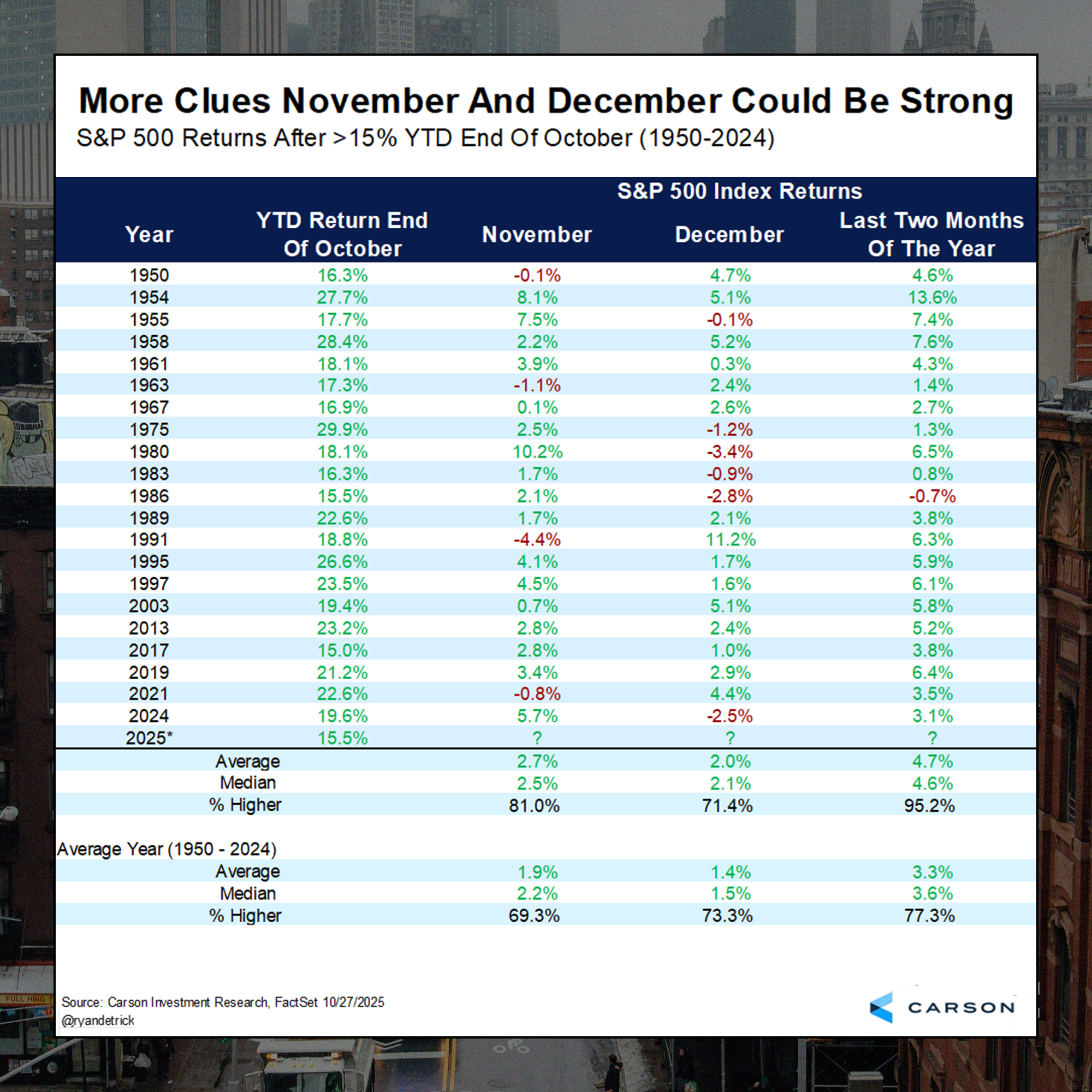

Ryan Detrick, of the Carson Group, says a good first 10 months = a better final two months. Since 1950, when S&P 500 >15% YTD going into November, the final two months have been lower only once out of 21 times.

Stokes Family Office is 100% Family Owned, and has been continually operating in the New Orleans Area for over 35 years. As a family office, we are focused on family wealth, financial planning, and tax planning. We are your local experts for Gulf South wealth management. Want to hear more from our team? Check out the Lagniappe Podcast.

*Stokes Family Office does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.