Inflation Surprises and Calls For Rate Cuts

June 20, 2025

Each week, the Stokes Family Office staff puts together a list of our favorite news and updates on all things wealth management. From financial planning, portfolio construction, tax and estate planning, retirement plan services to anything we found interesting. Enjoy this week’s curated list for your weekend reading!

What are Inflation Surprises Telling Us About Tariffs?

Claudia Sahm: current inflation surprises—especially in apparel—are challenging the narrative that tariffs are fueling persistent inflation.

She opines that less tariff-driven inflation could pave the way for Fed easing in 2025.

Memo to Fed: Lower Interest Rates Are Overdue

Scott Grannis writes that inflation has beaten official expectations for the past two years—yet the Fed remains cautious.

He says lower interest rates are not only justified but long overdue.

Adam M. Grossman: Economics is not a perfect science. It describes relationships which are sometimes true, but can also change, sometimes permanently.

He looks at models on market valuation, market efficiency, inflation, and taxes, saying they are useful to understand—but should never be taken as gospel.

Related:

The Overvalued Dollar: What a Reversal Could Mean for Global Equities

Larry Swedroe: For the past three decades, the US dollar and American stock market performance have been closely linked, with periods of dollar strength typically coinciding with US equity outperformance.

However, 2025 has marked a significant shift: the dollar’s rally has reversed, and international equities are beginning to benefit from this new dynamic.

Fortune: Harvard, Yale & others are selling private equity stakes at increasingly steep discounts to net asset value, a trend labeled “NAV squeezing.”

Buyers are capitalizing on reduced pricing—so-called “juice”—enhancing potential returns.

Why You Can’t Invest by Looking in the Rear-View Mirror

Dr. Jim Dahle: Selecting investments solely by looking at past performance is the equivalent of driving while looking in the rear-view mirror. Sure, it can be done, but it probably isn’t going to lead to optimal results—and it might even lead to a spectacular crash.

Related:

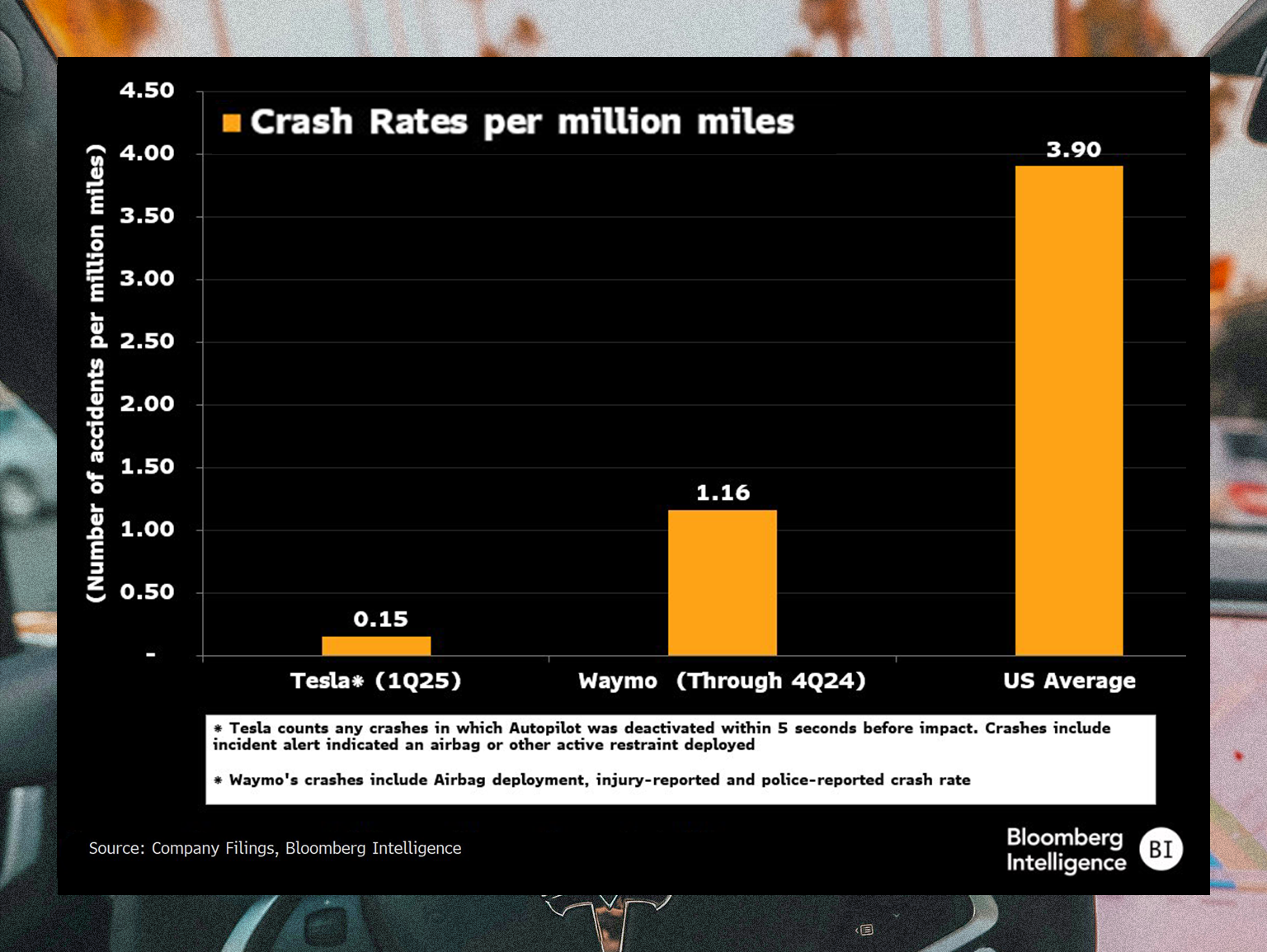

A report from Bloomberg Intelligence shows the number of car accidents per million miles. Click here to read more on why BI thinks Tesla may have the self-driving advantage.

Stokes Family Office is 100% Family Owned, and has been continually operating in the New Orleans Area for over 35 years. As a family office, we are focused on family wealth, financial planning, and tax planning. We are your local experts for Gulf South wealth management. Want to hear more from our team? Check out the Lagniappe Podcast.

*Stokes Family Office does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.