Housing, AI Capex, & US Exceptionalism

July 25, 2025

Each week, the Stokes Family Office staff puts together a list of our favorite news and updates on all things wealth management. From financial planning, portfolio construction, tax and estate planning, retirement plan services to anything we found interesting. Enjoy this week’s curated list for your weekend reading!

Goldman’s Mid-Year Housing Outlook

Honey, AI Capex is Eating the Economy

The State of the American Consumer, As Told by Their Bankers

Related:

Headline Fatigue: Does the Stock Market Care About Tariffs Anymore?

No Sign of Investors Fleeing “US Exceptionalism”

Is the Exceptional Performance of US Stocks Sustainable? Key Takeaways for Investors

Related:

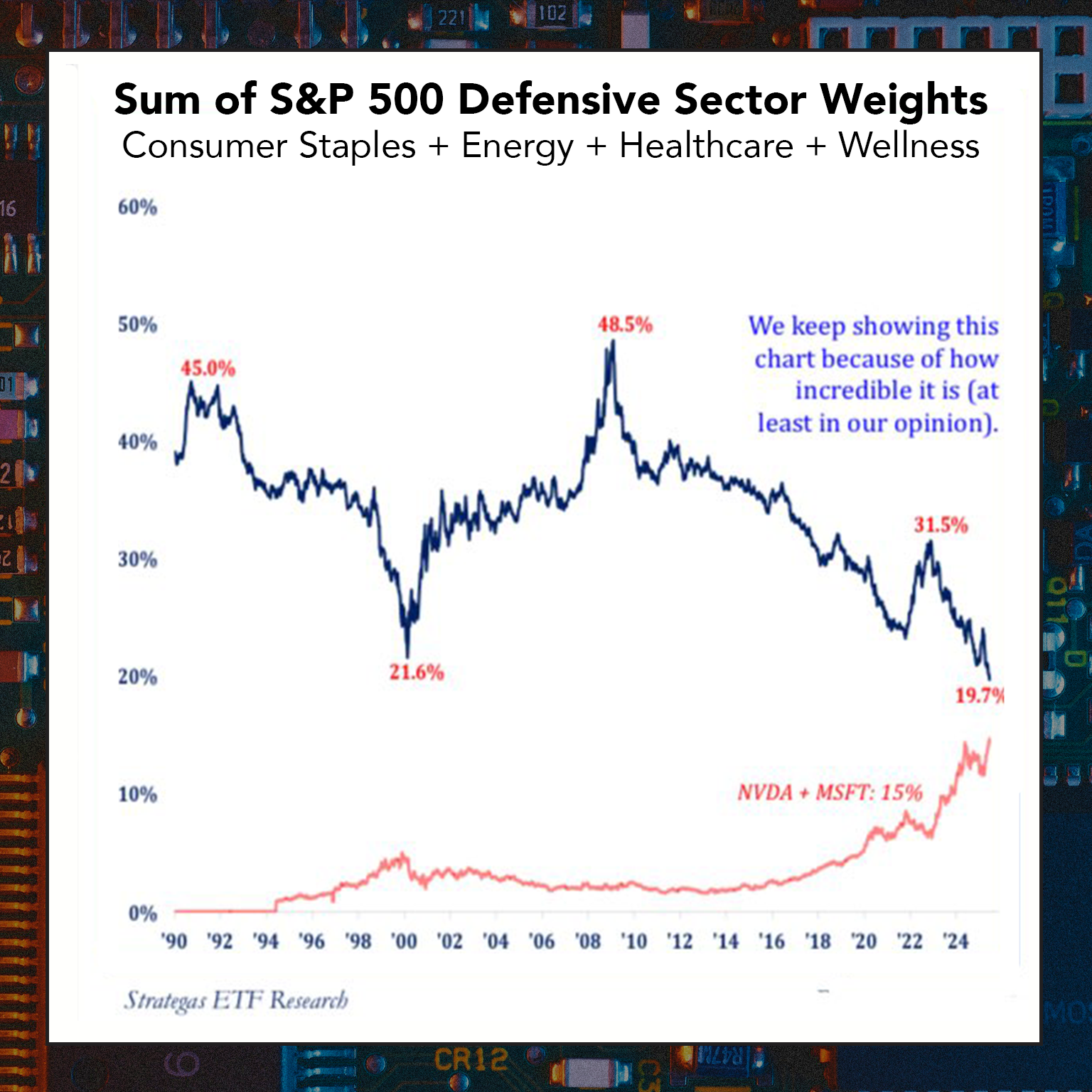

Looking at the the combined weight of the S&P 500’s defensive sectors—Consumer Staples, Energy, Healthcare, and Utilities—to the combined weight of NVIDIA (NVDA) and Microsoft (MSFT), we note that these two companies now account for 15% of the entire S&P 500.

Stokes Family Office is 100% Family Owned, and has been continually operating in the New Orleans Area for over 35 years. As a family office, we are focused on family wealth, financial planning, and tax planning. We are your local experts for Gulf South wealth management. Want to hear more from our team? Check out the Lagniappe Podcast.

*Stokes Family Office does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.