Greenland, Oil, & The Middle Clas

January 23, 2026

Each week, the Stokes Family Office staff puts together a list of our favorite news and updates on all things wealth management. From financial planning, portfolio construction, tax and estate planning, and retirement plan services to anything we found interesting. Enjoy this week’s curated list for your weekend reading!

Josh Wolfe: The most dangerous mistake about “Greenland is believing it is about Greenland.

The Middle Class Is Shrinking Because of a Booming Upper-Middle Class

Stephen J. Rose & Scott Winship: The upper-middle class boomed from 10 percent of families in 1979 to 31 percent in 2024, and its share of income doubled. The share of families whose income left them short of the core middle class fell from 54 percent to 35 percent. Claims of a hollowed-out middle class wrongly reinterpret widespread (if unequal) gains across the income distribution as rising insecurity and declining living standards.

Oil Remains the Epicenter of Commerce, Geopolitics, and Energy

Mark Mills: The focus cannot be on chimerical energy solutions that “change everything,” but on ensuring markets can meet the enduring challenge of simultaneously guaranteeing availability, reliability, and affordability.

Related:

Is a Stock Market Rotation Underway? These Sectors Are Outpacing Tech in 2026

Rachel Schlueter: While it’s only a few weeks into 2026, the latest data shows that the tables are turning in the stock market.

Ryan Detrick: Rule one, politics usually don’t move markets, and I hate talking about politics. Rule number two, never forget rule number one.

Why You Can’t Time the Market (Even When You Know the Future)

Nick Maggiulli: Wouldn’t it be great if you knew the future before it happened? Imagine all the money you could make in the stock market. It seems like a dream scenario, right? But, what if I told you that it wasn’t true? What if “knowing the future” wasn’t as profitable as you think?

Related:

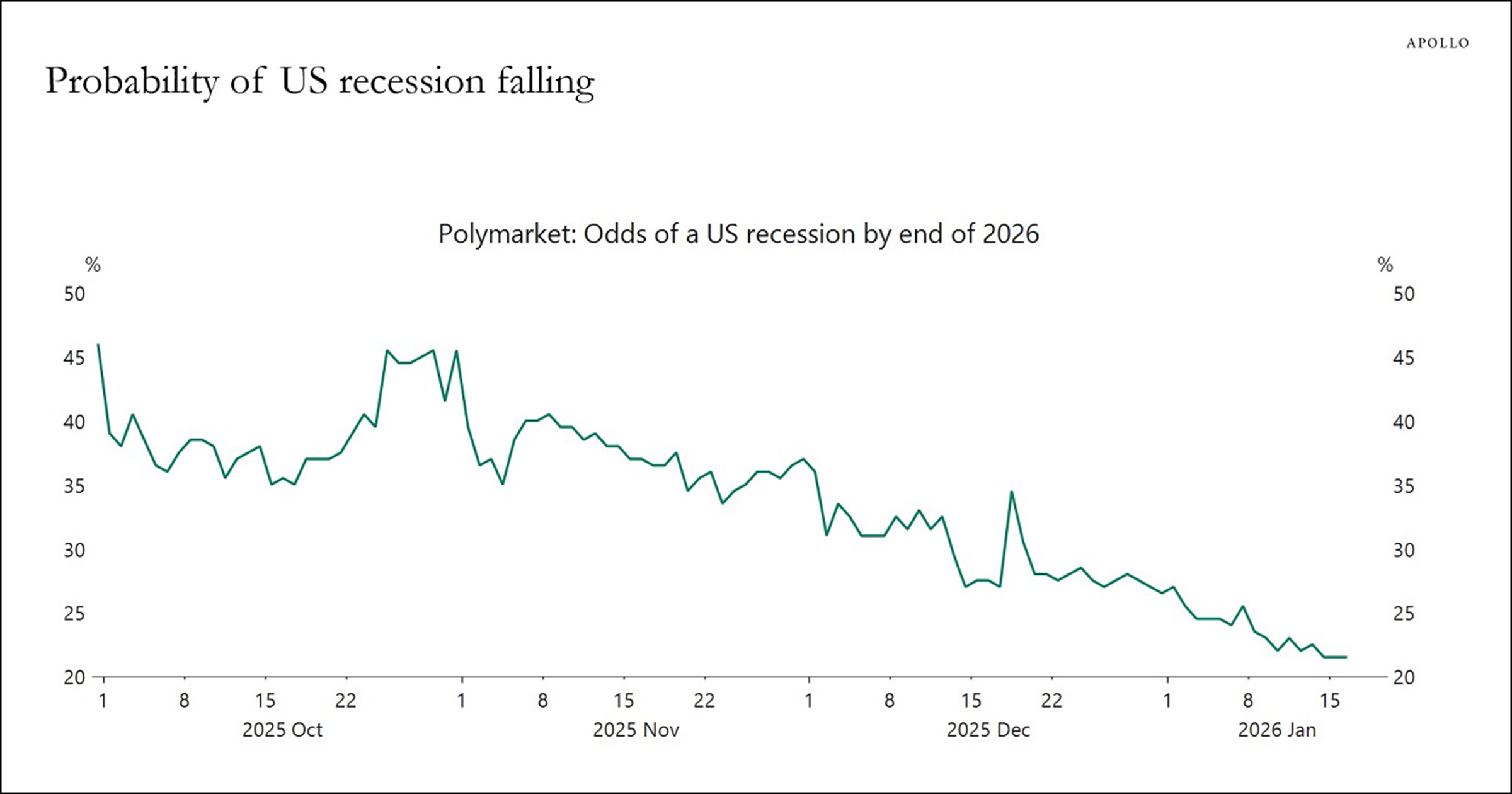

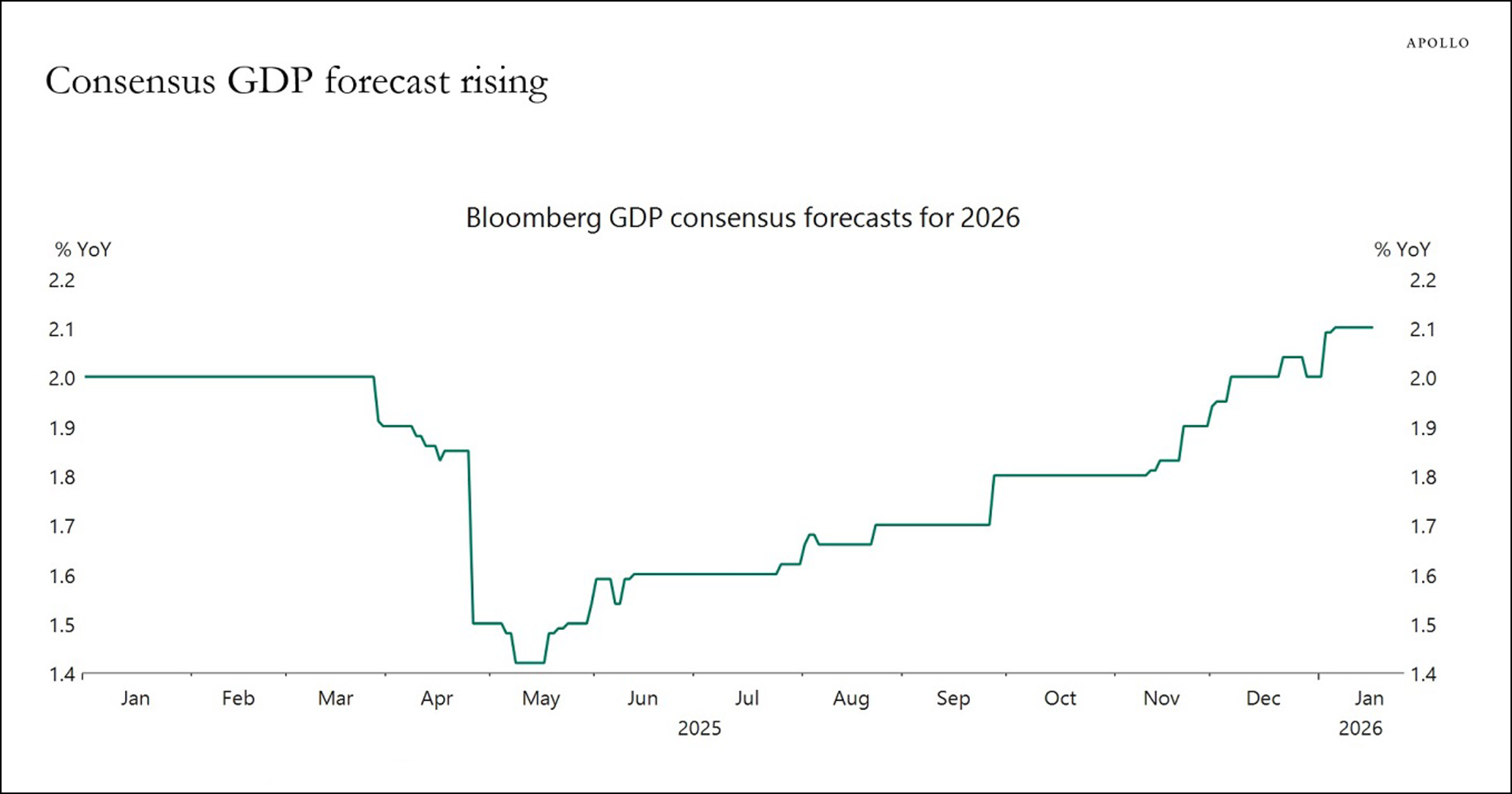

The probability of a recession in 2026 continues to decline (chart 1), and the consensus continues to revise up the growth forecast for the year (chart 2) via Torsten Slok, Apollo Global Management

Stokes Family Office is 100% Family Owned, and has been continually operating in the New Orleans Area for over 35 years. As a family office, we are focused on family wealth, financial planning, and tax planning. We are your local experts for Gulf South wealth management. Want to hear more from our team? Check out the Lagniappe Podcast.

*Stokes Family Office does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.