Energy Stocks, Housing, & the Overstretched Consumer

February 20, 2026

Each week, the Stokes Family Office staff puts together a list of our favorite news and updates on all things wealth management. From financial planning, portfolio construction, tax and estate planning, and retirement plan services to anything we found interesting. Enjoy this week’s curated list for your weekend reading!

US Private Sector Balance Sheets in Excellent Shape

Torsten Slok: The private sector in the US is in really good shape. Households have been deleveraging since the 2008 financial crisis, and the corporate sector has been deleveraging since COVID. Unfortunately, the government’s balance sheet is not in good shape. Government debt to GDP has increased steadily from 40% of GDP in 2007 to more than 100% today.

Does the U.S. Actually Have a Housing Shortage?

Nick Maggiulli: Many people are debating why the U.S. housing market is broken. Some blame interest rates. Some blame prices. Some blame zoning laws. While the truth is a mix of all of these factors, there’s one thing that no one seems to agree on—supply. Does the U.S. actually have a housing shortage, or is something else going on?

Short- and Medium-Term Inflation, Interest Rates, and The Overstretched Consumer

The Bonddad Blog: The overall picture is that of an overstretched US consumer, unable to absorb price increases, and driving recessionary-type price concessions from sellers, with little prospect of longer-term relief as interest rates are unforgiving.

Related:

Agentic AI Isn’t Eating Software – It’s Feeding Market Volatility

David Parsons: The sharp sell‑off across software names in recent weeks has prompted questions from investors, many centred on whether the rapid rise of agentic artificial intelligence marks the beginning of a deeper structural shift in enterprise technology.

Energy Leads This Year as Tech and Financials Fall Behind

The Capital Spectator: Energy, basic materials, and defensive consumer stocks are in. Tech and financials are out. That, at least, is Mr. Market’s view so far in 2026, based on a set of US equity sector ETFs

If This Breaks Out, Good Luck Being Bearish

J.C. Parets: Let’s talk about small-cap financials. This chart carries the most bullish implications in the entire market. And if it resolves higher, it could make it difficult for this bull market to roll over in any meaningful way.

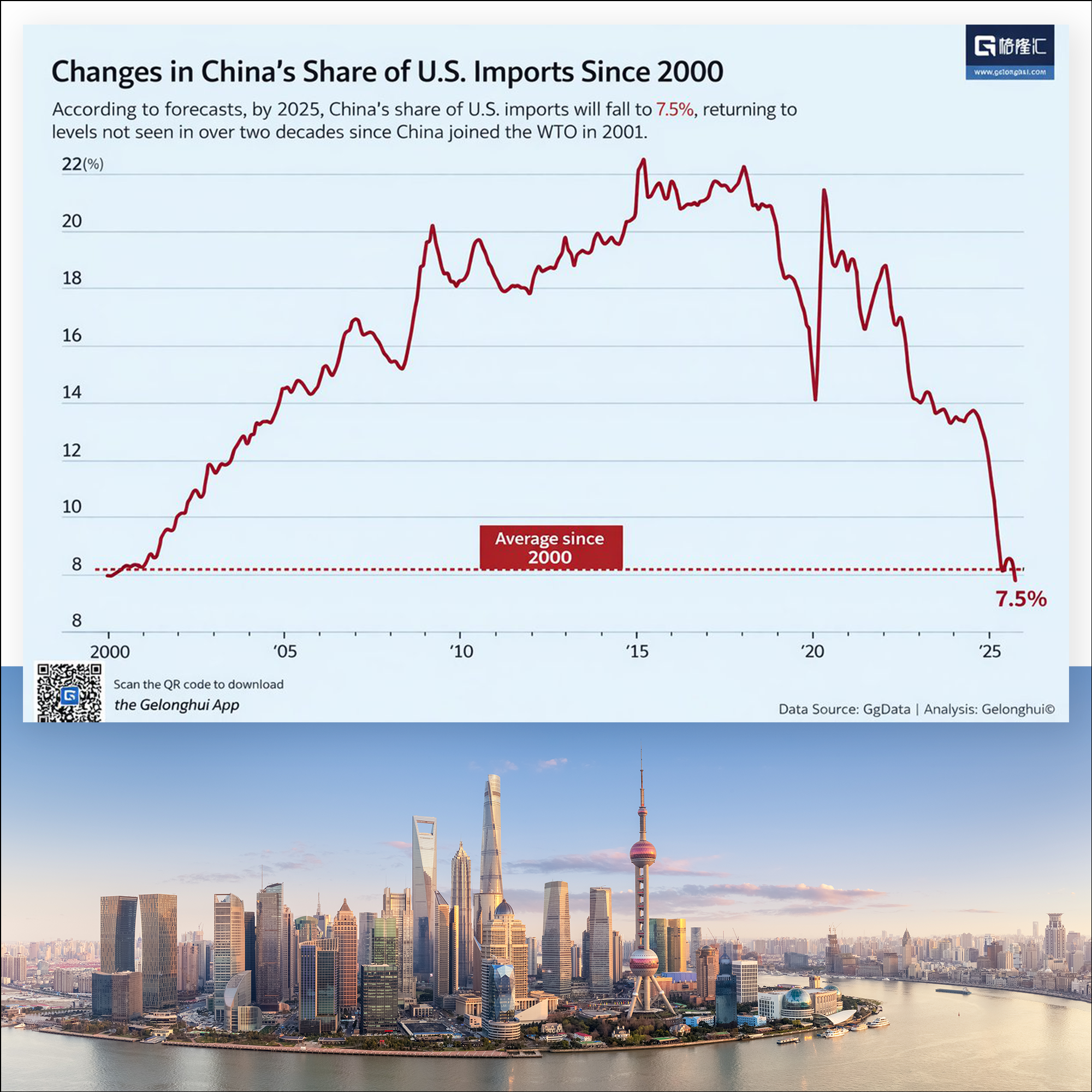

Via Ken Cao, de-China-ization is no longer a theory. It’s happening.

Stokes Family Office is 100% Family Owned, and has been continually operating in the New Orleans Area for over 35 years. As a family office, we are focused on family wealth, financial planning, and tax planning. We are your local experts for Gulf South wealth management. Want to hear more from our team? Check out the Lagniappe Podcast.

*Stokes Family Office does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.