Energy, Housing, & Expected Returns

June 27, 2025

Each week, the Stokes Family Office staff puts together a list of our favorite news and updates on all things wealth management. From financial planning, portfolio construction, tax and estate planning, retirement plan services to anything we found interesting. Enjoy this week’s curated list for your weekend reading!

Apollo gives charts on demand, supply, and the Strait of Hormuz

Housing Market Well On Its Way To Rebalancing

The Bonddad Blog writes that repeat home sales through April confirm a housing market rebalancing.

And that we can expect further good news in the very large shelter component of the CPI in the months ahead; with the sole – significant – exception of the effects of tariffs.

Jerome Powell & The ‘Nothing Happens’ Narrative

Cullen Roche gives 3 charts on target interest rates, the US Dollar Index, and the CAPE vs 10 Year Sharpe Ratio

Related:

What’s Better Than U.S. Bonds for Downside Protection?

Nick Maggiulli answers the questions:

Are U.S. bonds still the best form of downside protection?

Or should we consider other assets within our portfolios to hedge against future market corrections?

Callie Cox examines the investing implications of a humanitarian crisis.

Expected Returns in the Stock Market

Ben Carlson looks at the John Bogle Expected Return Formula which focuses on dividend yield, earnings growth, and the speculative return or change in valuations.

He runs the formula with data through 5/31/25, noting one can forecast fundamental drivers, but market sentiment is the unpredictably powerful variable.

Related:

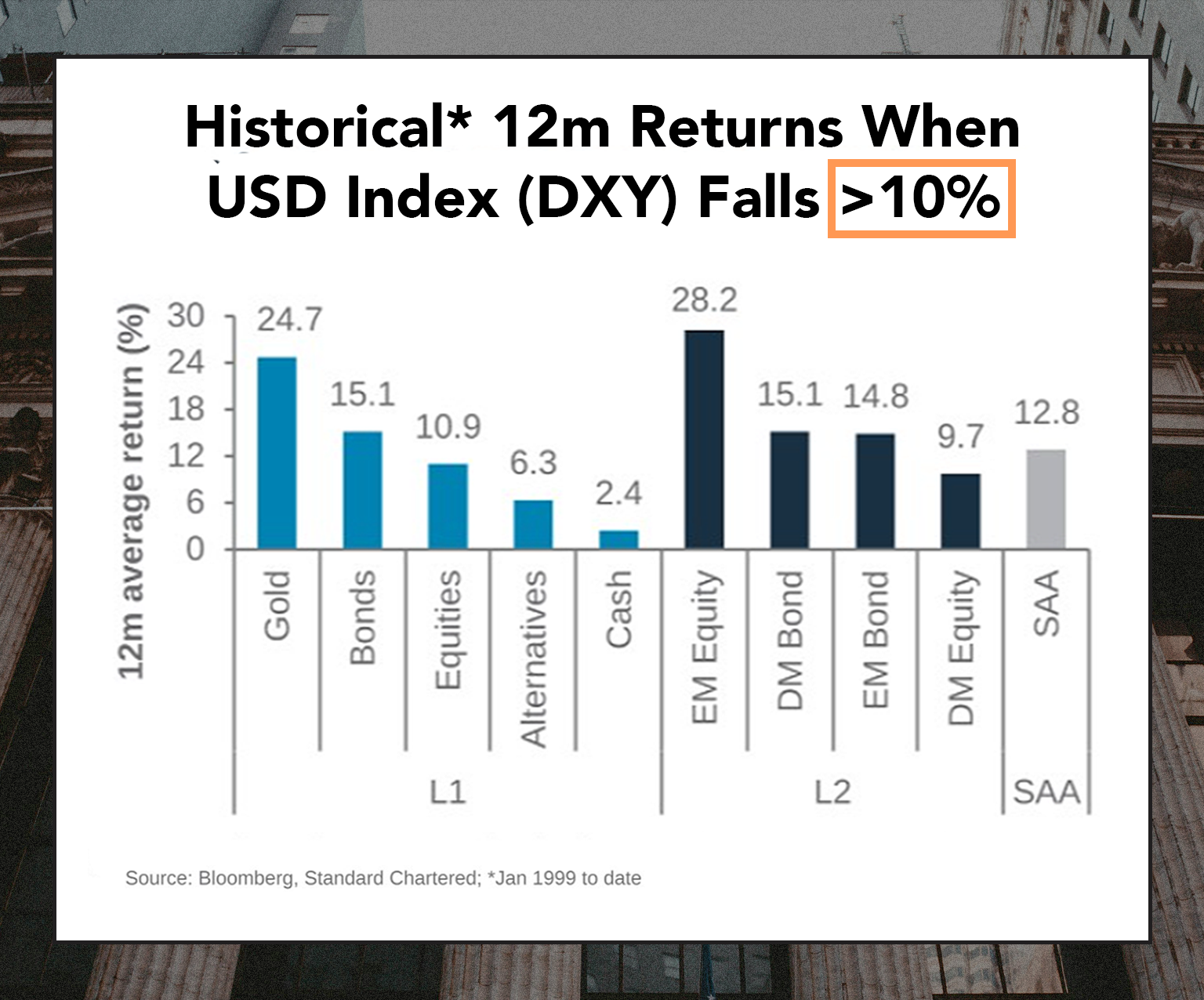

Weak USD is usually a good thing for risk assets. Here are the historical 12-month returns when $DXY drops 10% (via Mike Zaccardi // Bloomberg)

Stokes Family Office is 100% Family Owned, and has been continually operating in the New Orleans Area for over 35 years. As a family office, we are focused on family wealth, financial planning, and tax planning. We are your local experts for Gulf South wealth management. Want to hear more from our team? Check out the Lagniappe Podcast.

*Stokes Family Office does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.