Debt, Data Centers, & Gold

September 5, 2025

Each week, the Stokes Family Office staff puts together a list of our favorite news and updates on all things wealth management. From financial planning, portfolio construction, tax and estate planning, retirement plan services to anything we found interesting. Enjoy this week’s curated list for your weekend reading!

Ray Dalio is Wrong – A Debt Heart Attack isn’t Coming

Cullen Roche: We know following Covid that the government can cause big inflation if it tries hard enough. But this isn’t Covid any more. In fact, when you adjust aggregate government policy for how restrictive the Fed still is, we have only a modest net inflationary impact from the deficit at present. And then when you layer on these huge macro headwinds in tech growth and demographics I think the argument for high inflation and a debt induced heart attack become far less convincing.

Data Centers Make the Beige Book, Plus Power Problems

Paul Kedrosky: The latest Beige Book of regional economic activity is a kind of econo-ode to data centers.

How Ben Franklin’s French Diplomacy Raised Money—and Saved the American Revolution

WSJ: Franklin led the effort to secure the financing the fledgling country needed to survive and win the war. It’s hard to imagine anybody else could have succeeded.

Related:

Is The Stock Market Overbought?

The Capital Spectator: The short answer: Yes, it appears to be. The somewhat longer answer: Yes, but (you knew this was coming) a number of indicators have been advising no less over the summer, and yet the market has continued to climb. Short-term timing decisions, in other words, remain as fraught as ever.

Why I’m Bearish on U.S. Stocks (for the Second Time Since 2017)

Nick Maggiulli is signaling that this is not the time to get complacent. The repeating pattern of extreme valuations, speculative behaviors, and SPAC enthusiasm serves as a red flag—especially when these factors are aligned across the market.

Can the Gold Rush Continue? Warning Signs for Investors

Amy C. Arnott: The yellow metal has been on a tear, but caution may be warranted.

Related:

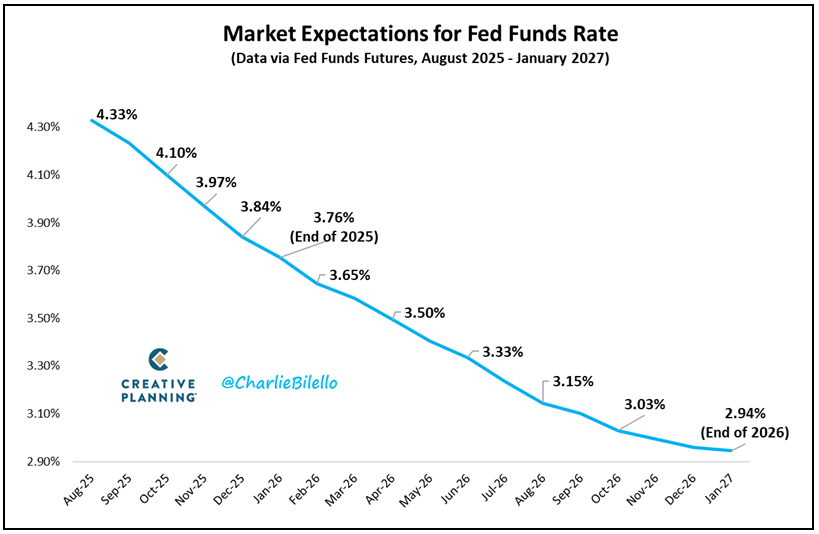

Via Charlie Bilello: The bond market is now fully pricing in 2 rate cuts by year-end and 3-4 more cuts in 2026. That would bring the Fed Funds Rate below 3.00%. See more.

Stokes Family Office is 100% Family Owned, and has been continually operating in the New Orleans Area for over 35 years. As a family office, we are focused on family wealth, financial planning, and tax planning. We are your local experts for Gulf South wealth management. Want to hear more from our team? Check out the Lagniappe Podcast.

*Stokes Family Office does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.