Bull Markets, Skimpflation, & The Dollar

February 6, 2026

Each week, the Stokes Family Office staff puts together a list of our favorite news and updates on all things wealth management. From financial planning, portfolio construction, tax and estate planning, and retirement plan services to anything we found interesting. Enjoy this week’s curated list for your weekend reading!

Is Inflation Higher Than We Think?

Nick Maggiulli: The experienced inflation rate may be higher than official statistics suggest because standard inflation measures don’t fully capture declines in product and service quality, a phenomenon called “skimpflation”.

What Comes After The Bubble Could Be Electrifying

Sam Ro: How today’s AI investment boom compares to past technological revolutions, such as electrification in the early 20th century and the internet boom of the late 1990s. And why current markets might be seeing a “bubble” *yet still set the stage for long-term economic transformation

Why I’m Not Worried About a Weaker Dollar

Ben Carlson: The concern is that all of our government spending, high deficits, and trade war policies are causing a retreat from the dollar. This is the debasement trade everyone has been talking about. Anything is possible, but I’m not all that concerned about the dollar for the time being. Here’s why.

Related:

12 Ways Politics Has Confounded and Confused Investors

Sonu Varghese: Politics and investing don’t mix well, and markets do not reliably move in predictable ways simply because of which political party or policies are in power.

Gold and Silver’s Most Volatile Day

Nitesh Shah: The sharp drawdown may have cleared speculative excess, potentially creating a more attractive entry point for long-term strategic investors seeking gold and silver exposure amid structural tailwinds such as geopolitical fragmentation, fiscal dominance concerns, and a broadening global buyer base.

JC Parets: The pessimism around the stock market is back. All it took was software stocks sliding back toward last year’s lows and bitcoin getting cut in half, and suddenly, the same crowd is declaring the bull market dead. Again. This is not what market tops look like. This is not how bull markets end. In my experience, when real bear markets begin, you don’t see broad participation quietly expanding beneath the surface.

Related:

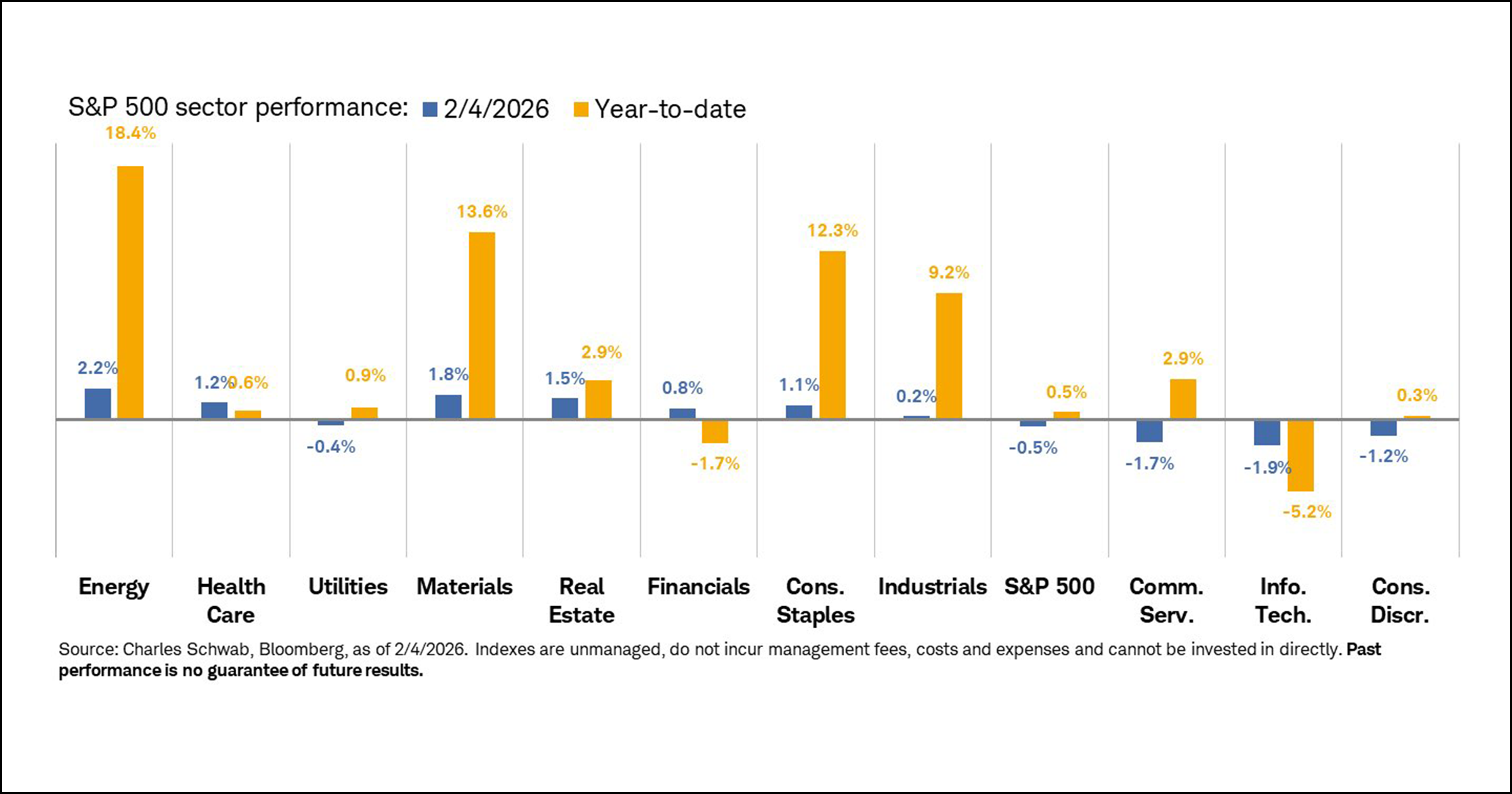

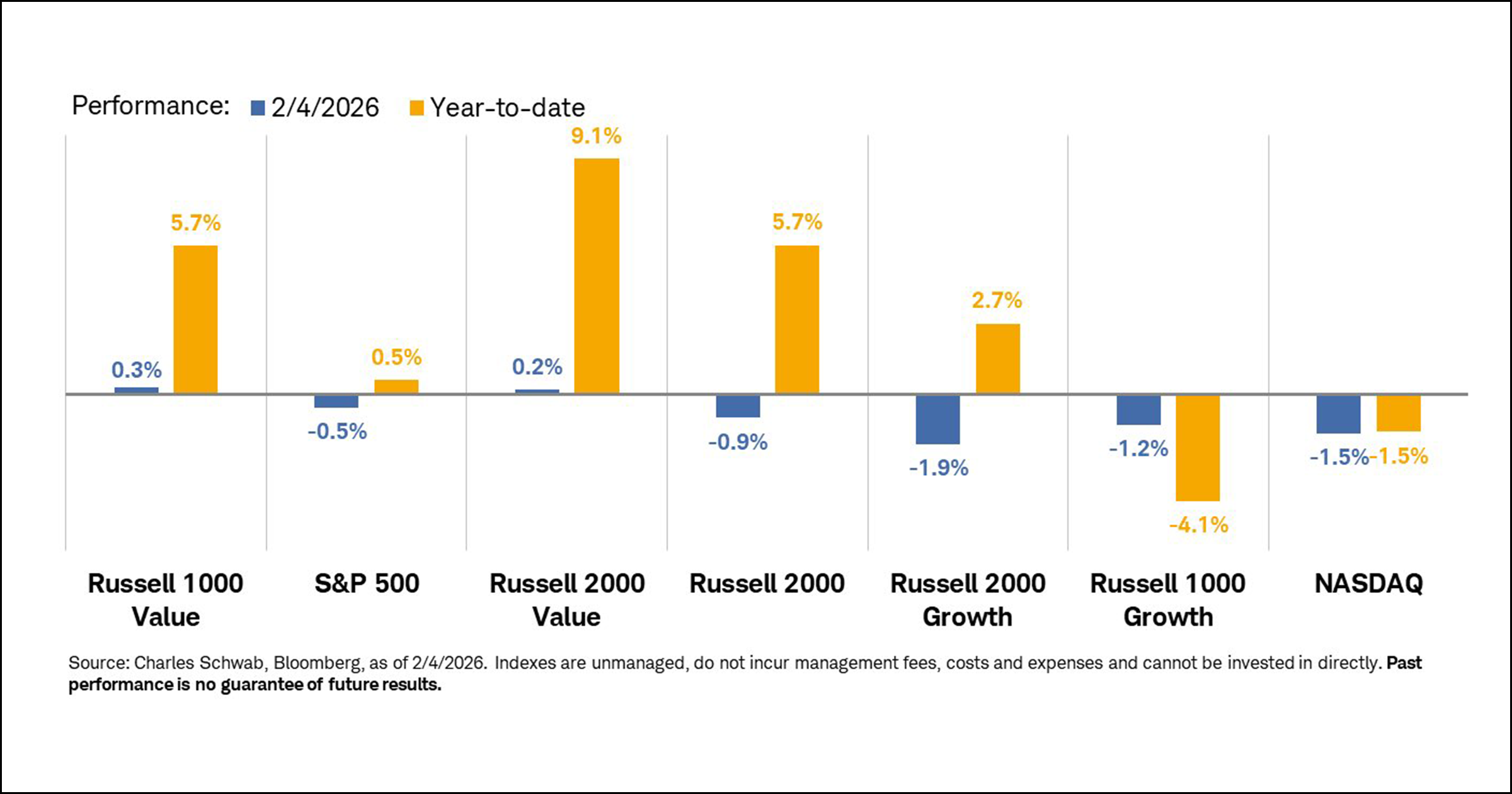

2026 already looks a lot different than 2025.

Performance: sectors/indexes on 2/4/26 and YTD via Liz Ann Sonders

Stokes Family Office is 100% Family Owned, and has been continually operating in the New Orleans Area for over 35 years. As a family office, we are focused on family wealth, financial planning, and tax planning. We are your local experts for Gulf South wealth management. Want to hear more from our team? Check out the Lagniappe Podcast.

*Stokes Family Office does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.