3rd Quarter 2025 Update

October 3, 2025

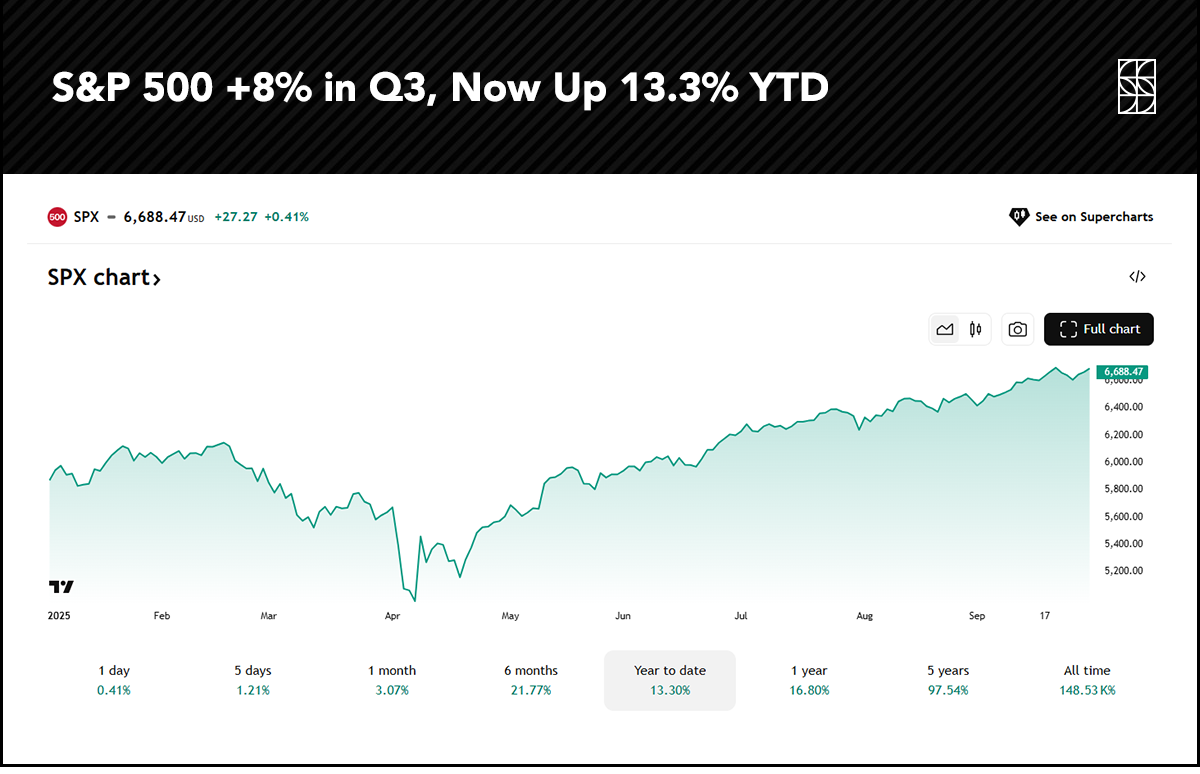

Stocks Hover Near Record Highs as the Bull Market Nears 3 Years Old

The rally rolls on. The S&P 500 (SPX) rose 7.8% in the third quarter, adding to gains that began in mid-April. It was the market’s best Q3 since 2020. Leading the charge were tech stocks, as the Nasdaq 100 (NDX) tacked on 8.8% over the July through September stretch. The Magnificent Seven mega-caps, with NVIDIA (NVDA) the largest (now a record $4.5 trillion in market value), carried the torch. Unlike previous periods, however, the run-up to new all-time highs was broad-based.

Source: TradingView

We’ll dig into the “why” behind the price action, but U.S. small caps beat their large-cap peers by almost five percentage points. Mid-caps were less impressive, while non-U.S. markets tallied a 7% Q3 total return. Over in the bond market, there was more green. Lower interest rates helped deliver a 2.1% performance in the aggregate bond index, dividends included.

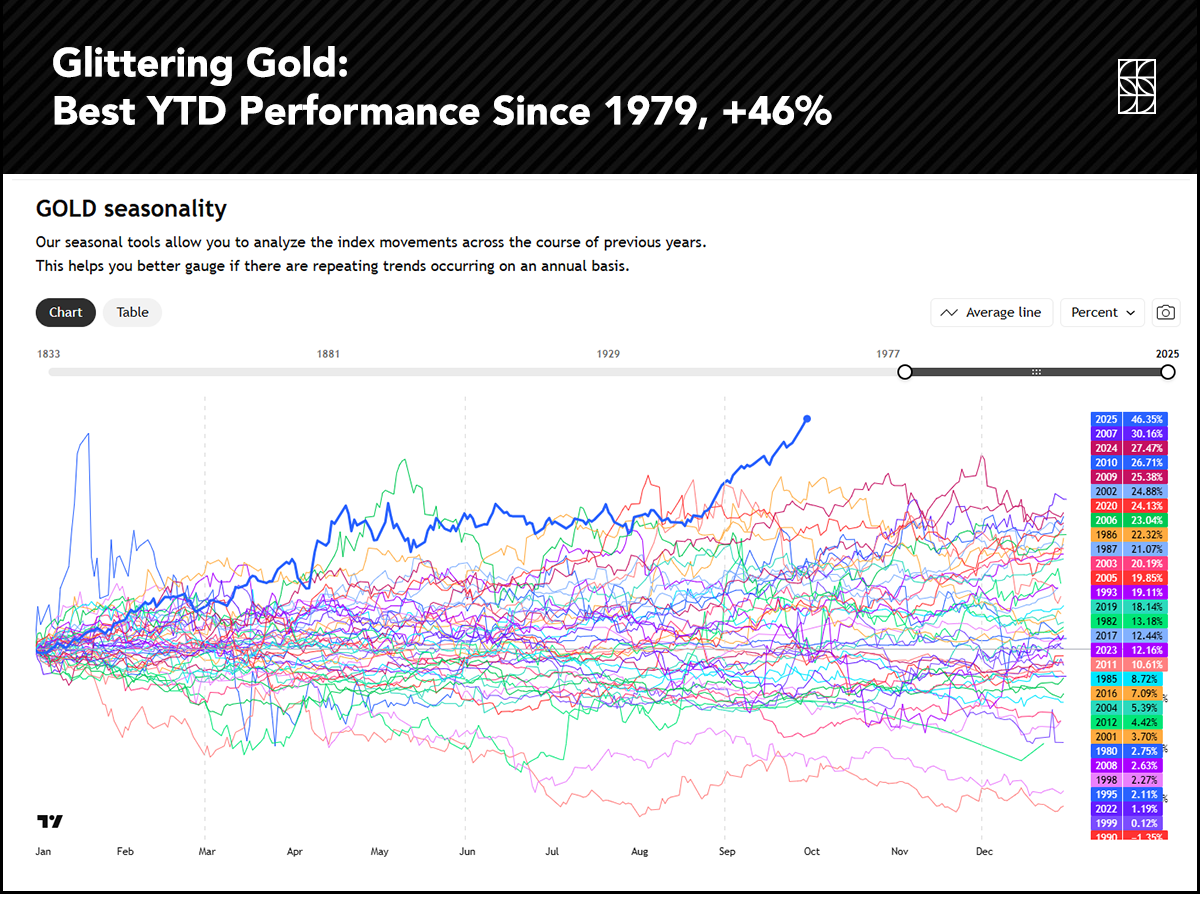

The star of the show may have been a shiny metal. Gold’s 2025 ascent went into overdrive with a 16.5% Q3 advance. Some Wall Street strategists now expect gold to reach $4,000 or higher over the coming months. Meanwhile, silver encroaches on a new record of its own. The precious metals space has been working despite the U.S. Dollar Index (DXY) holding steady since mid-year. The greenback fell hard from January through June, but its downside momentum abated just as some domestic economic data turned south. More on that to come.

Source: TradingView

The upshot: diversified investors generally fared well in Q3. The environment feels much different from the panic stretch of late March and early April, a time when stocks cratered and macro uncertainty reached a zenith. Cooler heads may have prevailed in Washington, D.C., and investors now look forward to what might be in store as year-end nears. As the bull market turns three years old, we identified five key themes that matter to the economy and stock prices.

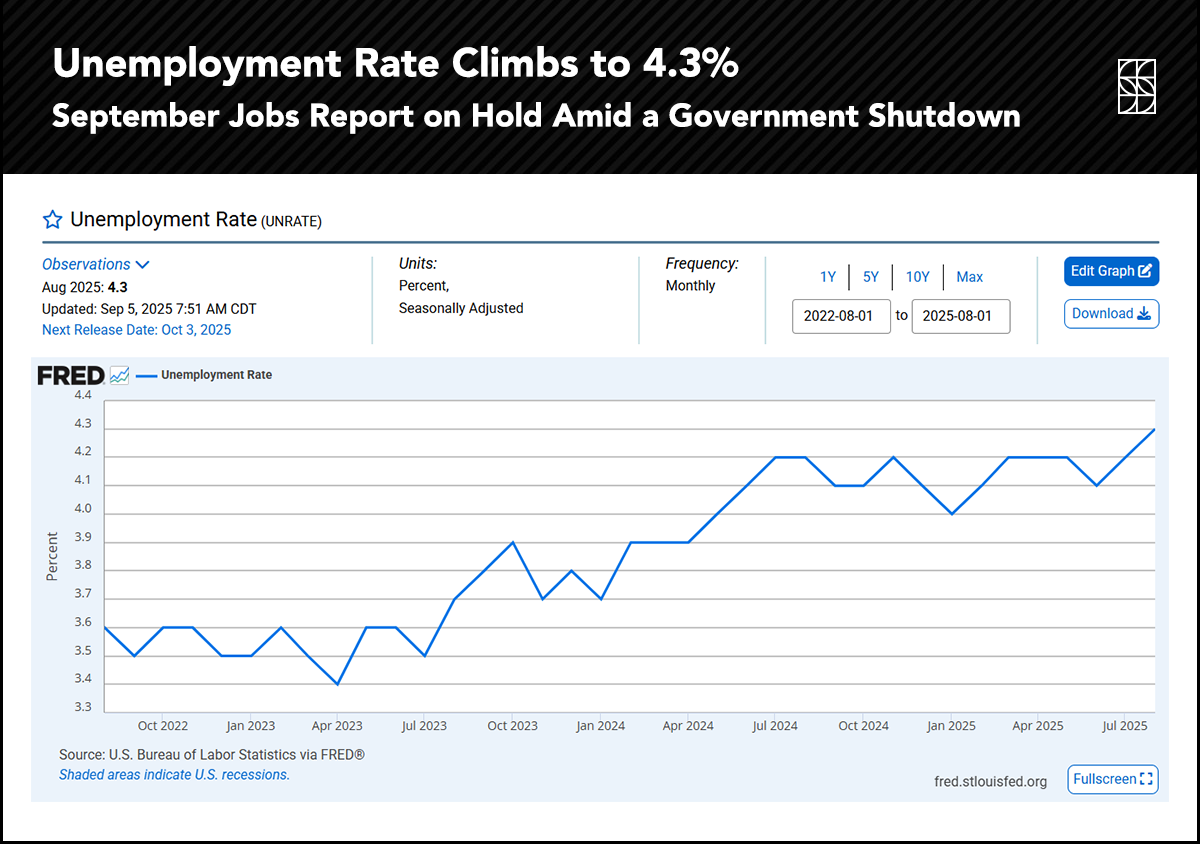

The Federal Reserve resumed its rate-cutting cycle in September. The Federal Open Market Committee (FOMC) voted to reduce its policy rate by a quarter point for the first time since last December. As markets do, stocks and bonds climbed ahead of the news. From the scenic backdrop of the Grand Tetons in Jackson Hole, Wyoming, Fed Chair Powell signaled to investors that the macro balance of risks had shifted. Indeed, prevailing economic data highlighted that the jobs market was increasingly at risk.

For background, the Fed has a dual mandate to promote maximum employment and price stability. Is inflation still a worry? Yes—it currently runs just shy of 3%, well above its 2% target. But the risk needle moved toward employment when the July jobs report was released in early August. The headline employment gain of 73,000 was well below economists’ forecasts, and the unemployment rate rose to 4.25%, the highest since October 2021.

Source: U.S. BLS via FRED

That news prompted Powell and the other 11 voting FOMC members to rethink their interest rate policy. Powell’s dovish Jackson Hole pivot was then confirmed by another weak payrolls survey published on September 5. Four days later, the Bureau of Labor Statistics put out its annual revisions to labor market data, and the updated numbers were far weaker than first reported. So, not only did the Fed cut by a quarter point last month, but we may get two more eases by December 31.

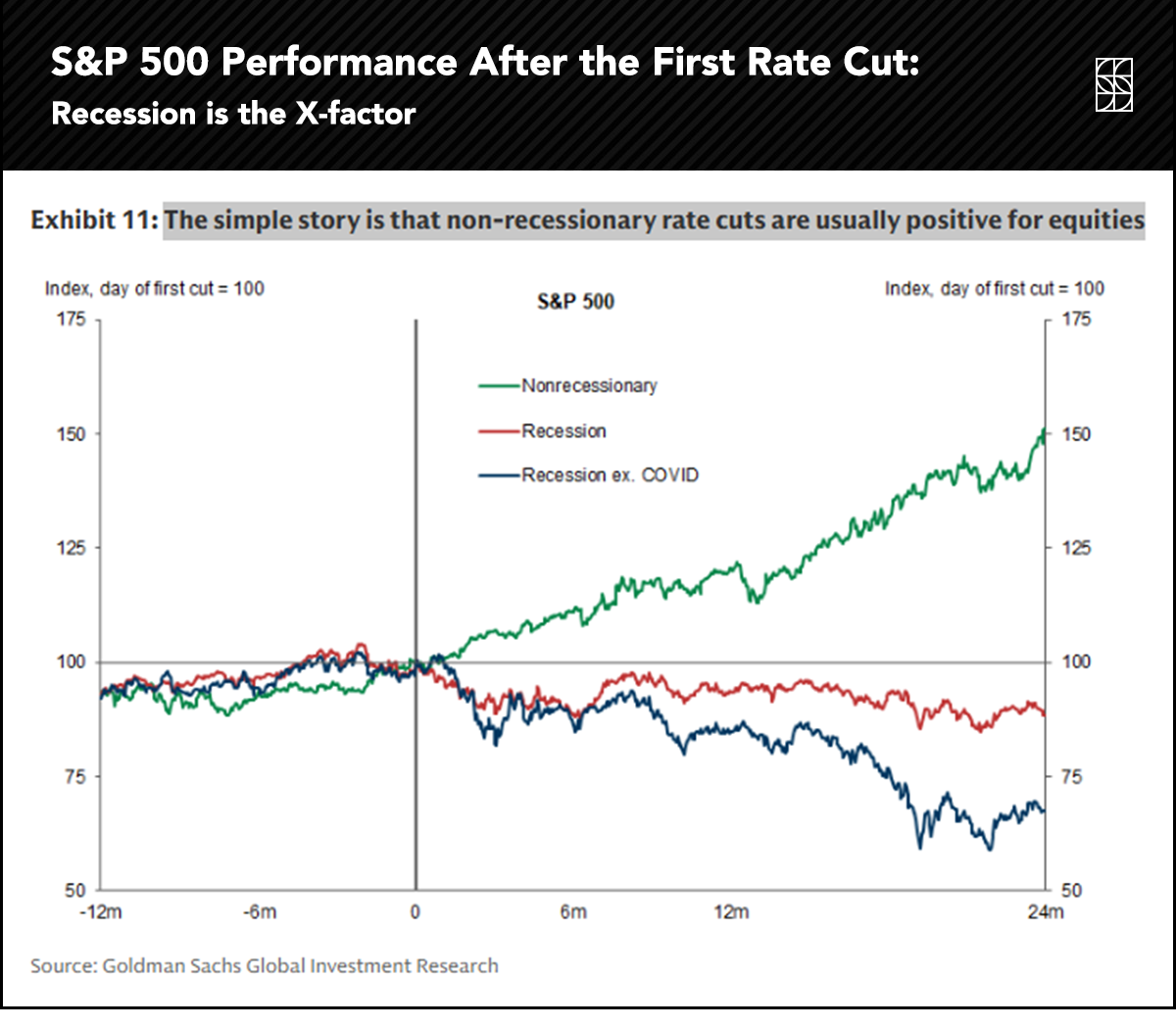

What does that mean for markets? Well, the answer hinges on whether a recession occurs. According to data from Goldman Sachs (graphed below), the S&P 500 has performed well when the Fed begins cutting rates, assuming there is no recession. So-called “recession” rate cuts have tended to coincide with choppier and more volatile markets.

For now, the labor market hangs in there, and U.S. corporate earnings are at new records. So far, so good. As for bonds, a multi-year low in the Treasury volatility index suggests less drama compared to the first half of the year.

Source: Goldman Sachs

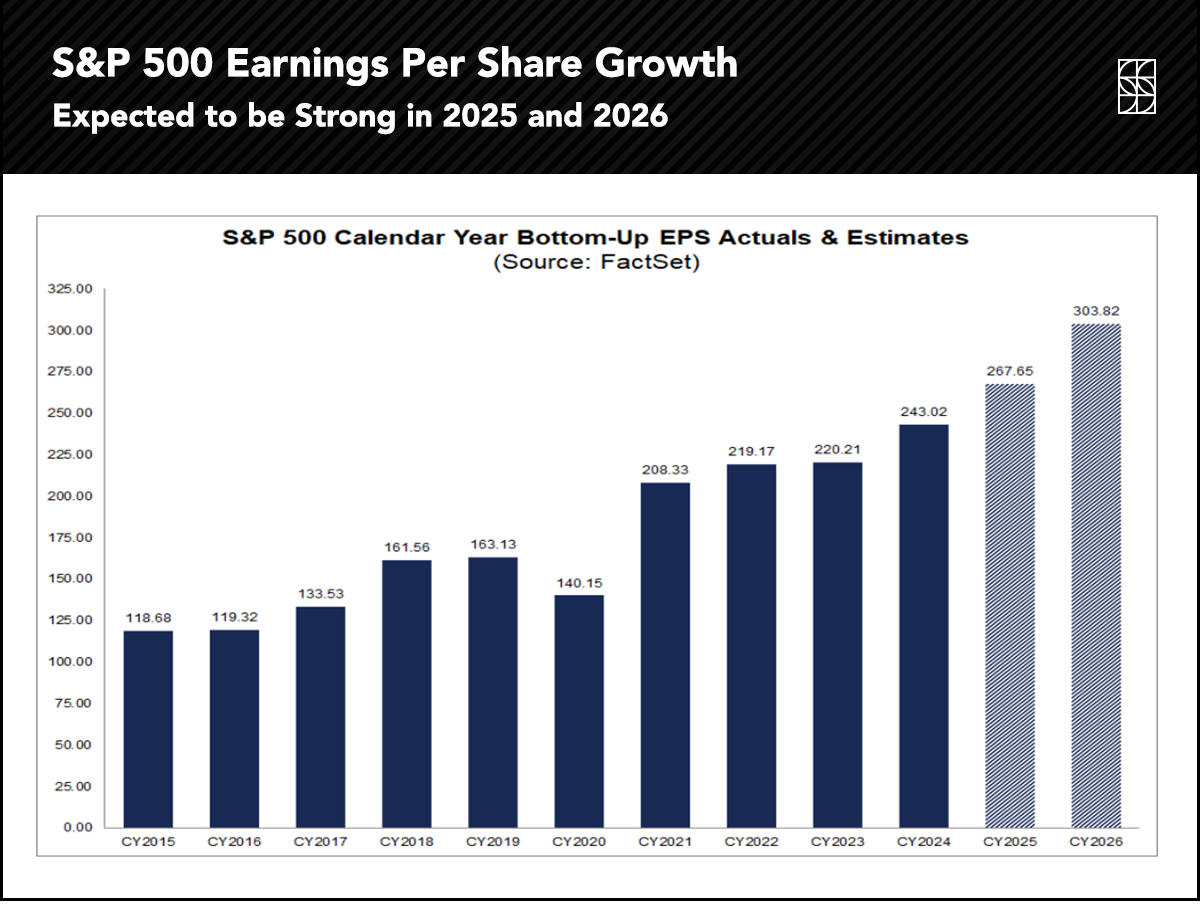

Does the Fed matter? Absolutely. Is it the end-all, be-all for stocks? No. ChatGPT launched in November 2022, and now, almost three years into the AI-powered tech supercycle, S&P 500 earnings growth has been nothing short of incredible. Per-share earnings could hit $300 later this quarter.

For context, that figure was only $220 as recently as 2023. That’s reassuring news for investors since it proves that fundamentals, not just animal spirits, underpin a large part of the rally. We can thank AI for that.

Source: FactSet

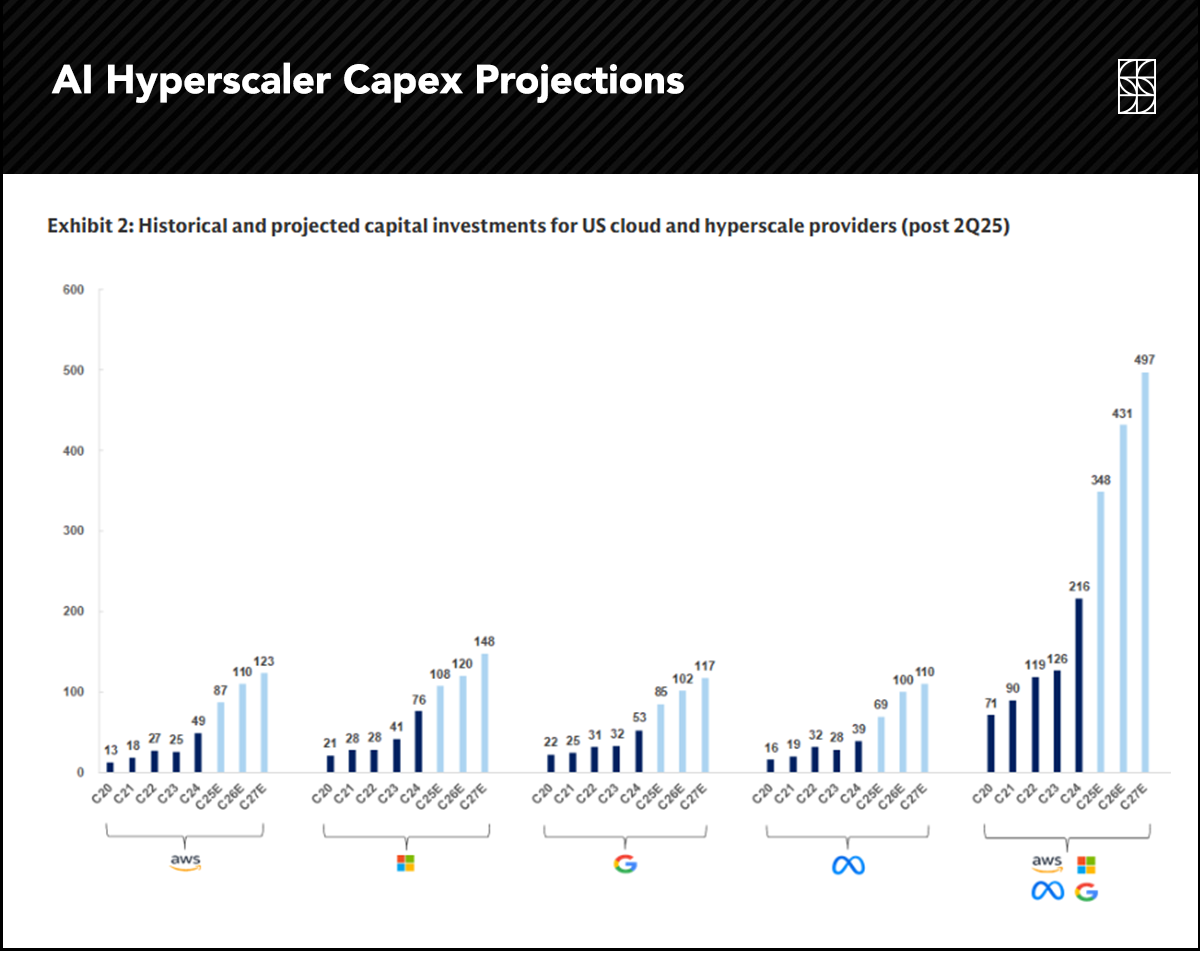

A tech investment boom is underway. Capital expenditures from the biggest tech firms are already massive, and they are set to continue. The “AI hyperscalers” could pour half a trillion dollars into AI projects by 2027, per Goldman Sachs. The number is hard to fathom—and it grows seemingly each week. Agreements announced in September among chipmakers, cloud-storage providers, data center builders, and power-generating companies proved that, for now, nothing is stopping the AI capex train.

Source: Goldman Sachs

But a new risk emerges. The cost to power AI grows each passing month. Electricity inflation now paces far ahead of the prevailing Consumer Price Index (CPI) rate. Efforts to make AI more powerful and a cornerstone of everyday life may hit those on the lower wealth rungs the hardest—and that may become a political football as the midterm elections approach.

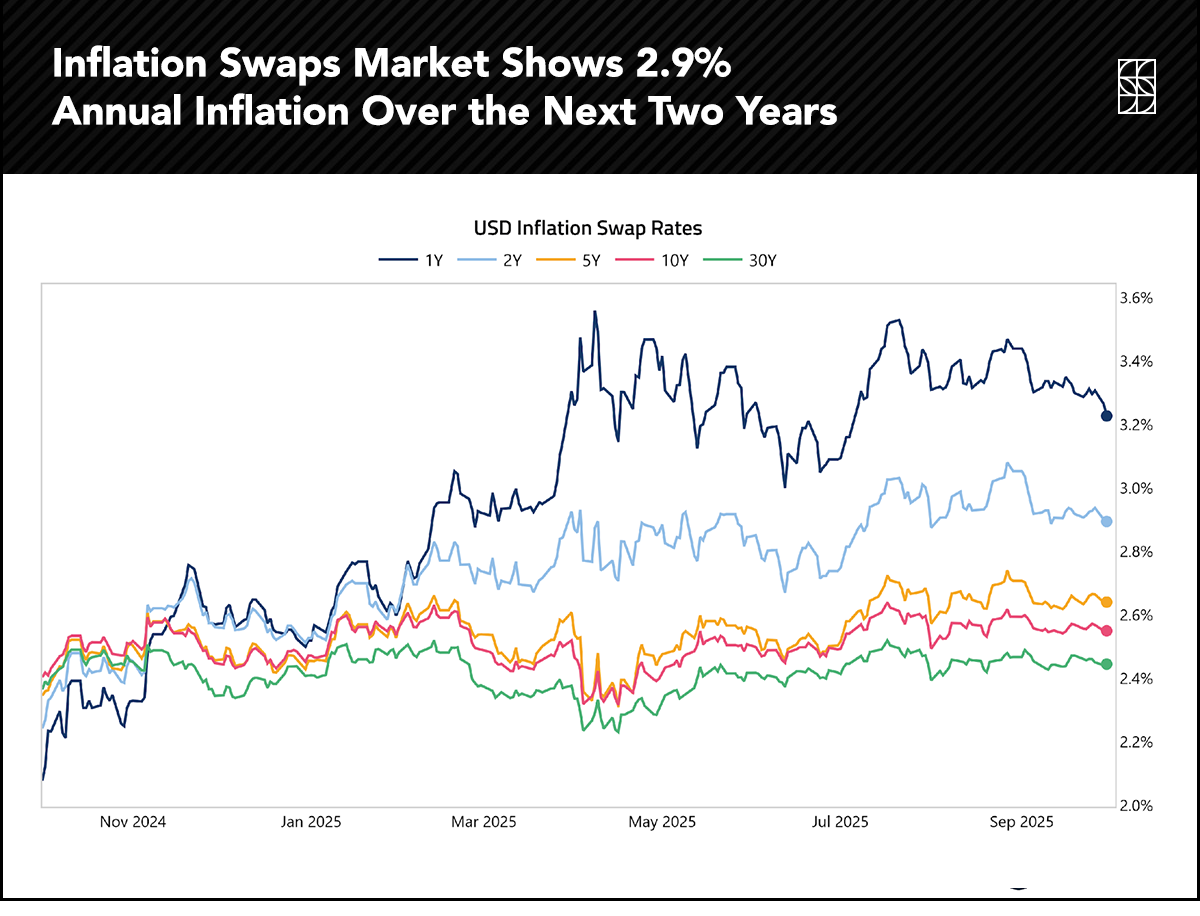

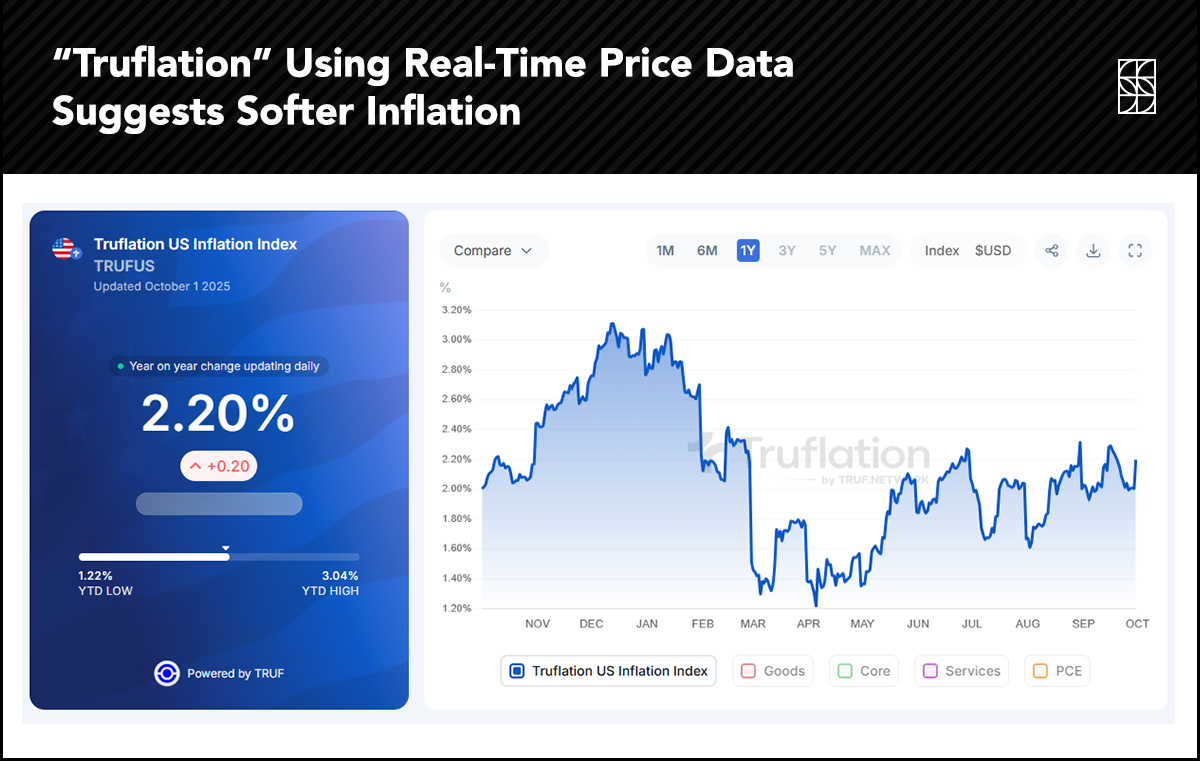

Taking a step back, we have the Fed cutting rates and intense corporate investment. That’s often a combination that stokes inflation. (We haven’t even mentioned tariffs.) Ironically, inflation expectations are stable. According to the bond and derivatives markets, traders expect the cost of living to rise by about 2.9% annually over the next two years. That’s above the 2% Fed goal, but it’s a far cry from the inflationary shock of 2021 and 2022.

Source: Augur Infinity

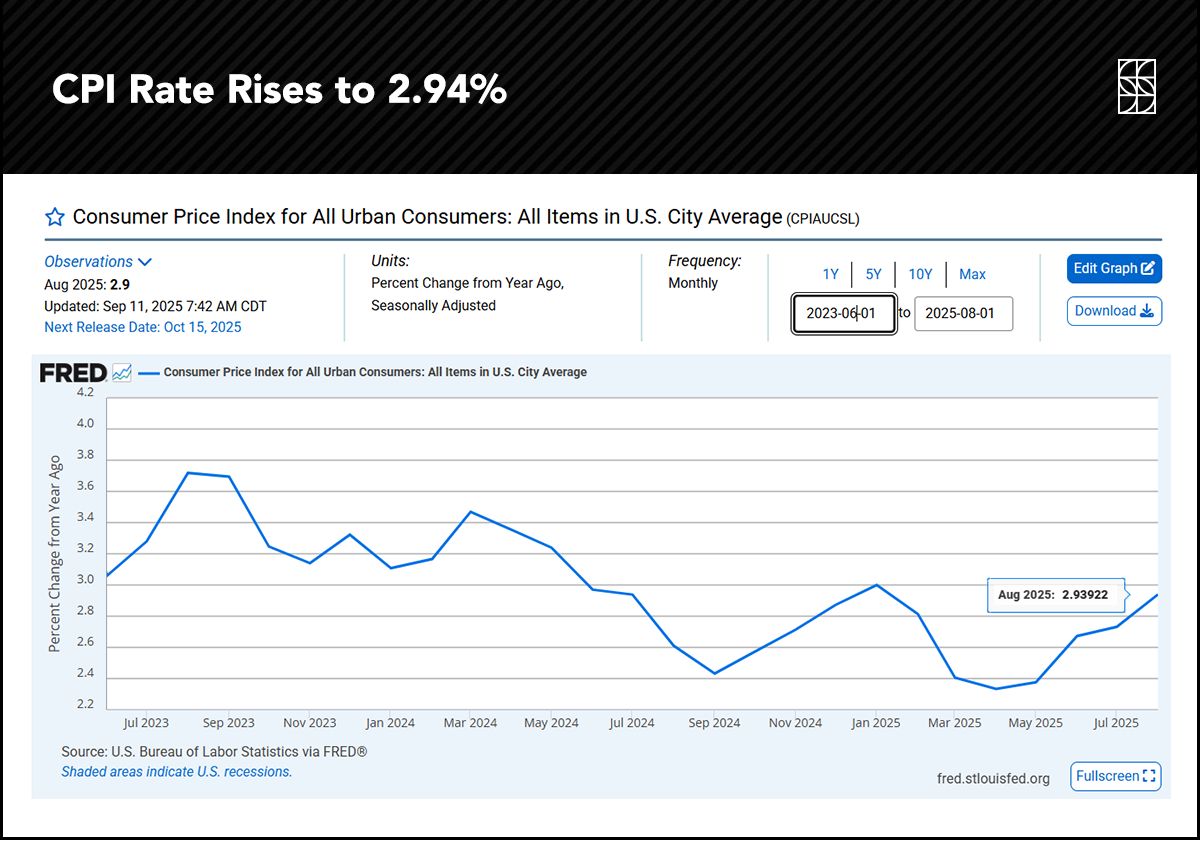

As it stands, the year-on-year CPI rate has ranged from 2.3% to 3.0% since June of last year. While nothing is for sure, we could see it bump up above 3% as the tariffs trickle down to store shelves, but most indicators suggest that a major inflationary period won’t pan out. It’s something to watch, and it impacts families and businesses, but inflation on its own may not be the biggest challenge facing the economy and markets heading into 2026.

Source: U.S. BLS via FRED

Lingering rent and housing inflation props up the CPI rate, but those data are slow to update. In fact, if we apply real-time shelter data, U.S. inflation may be closer to 2%. All the while, the more technology infiltrates our everyday lives, the more downward pressure could be put on the pace of overall price growth.

Chart courtesy of Stockcharts.com

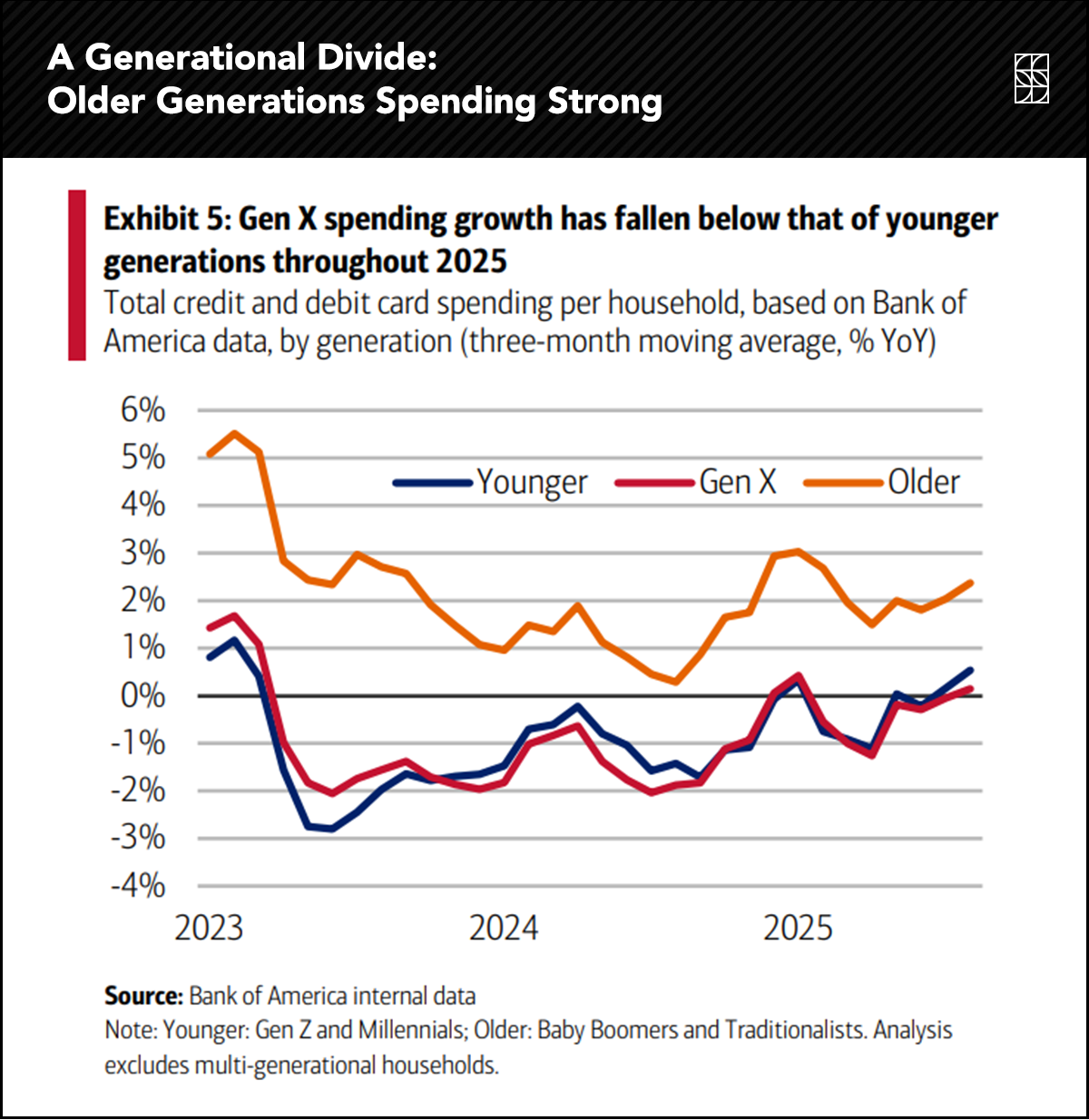

Countering “deflationary” factors is baby boomer spending. Bank of America Institute pointed out that older generations, flush with $106 trillion in collective net worth, keep spending regardless of what’s happening at the macro level. Their consumption may be supporting the broader economy to an extent.

Source: Bank of America Institute

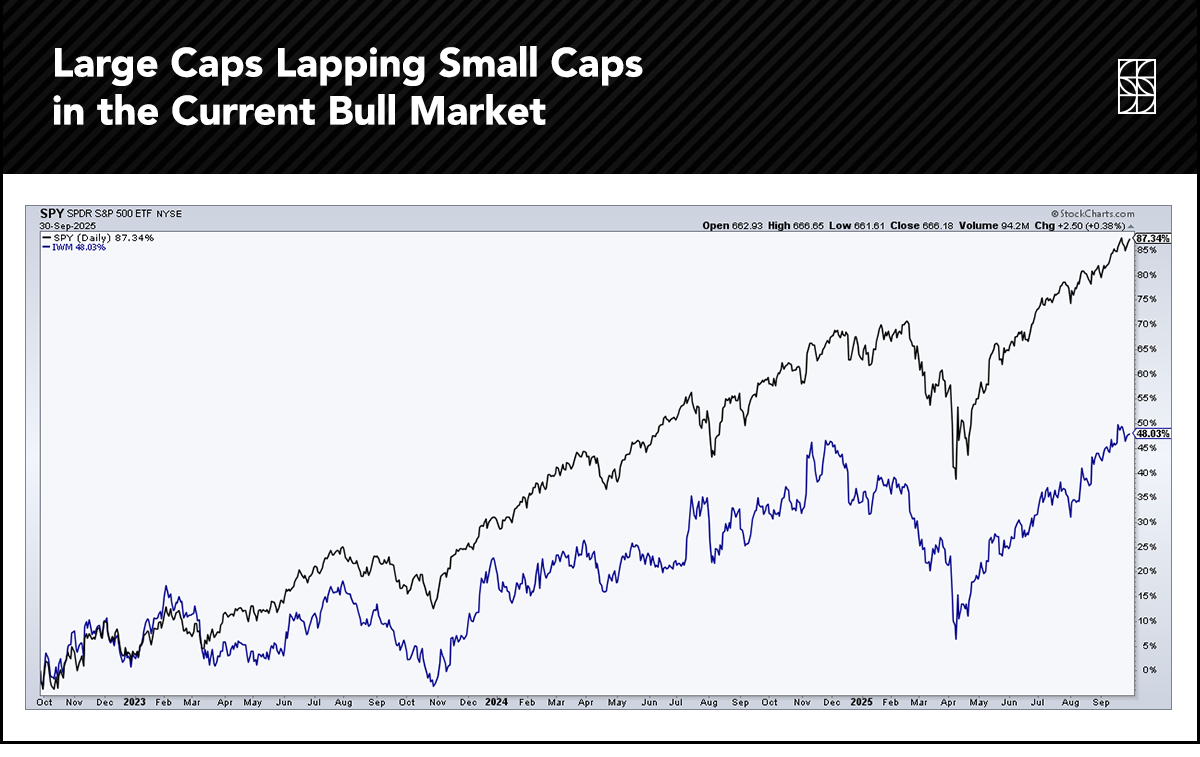

Pivoting back to markets and your investments, there’s much debate regarding large-cap stocks versus small caps. Which is optimal? Well, recent history clearly shows that bigger has been better. The S&P 500 large-cap ETF (SPY) has outperformed the Russell 2000 small-cap ETF (IWM) over many timeframes. The gap is almost 40 percentage points on the three-year performance chart.

Chart courtesy of Stockcharts.com

Some analysts assert that if interest rates keep falling, the more debt-dependent small-cap niche could benefit. Just as a homeowner can refinance their mortgage when borrowing costs drop, so too can leveraged small-cap companies. Small caps also trade significantly cheaper on a price-to-earnings (P/E) basis. The S&P 500’s P/E ratio is above 22x, while the S&P SmallCap 600’s multiple is closer to 16x. As Warren Buffett says, “Price is what you pay, value is what you get.”

The Oracle of Omaha also understands that growth expectations can matter just as much as valuation. Large caps, powered by the AI hyperscalers and Magnificent Seven stocks, boast impressive and seemingly durable profit growth that small caps lack. The solution may be to simply stay diversified by owning both value stocks and shares of growth companies.

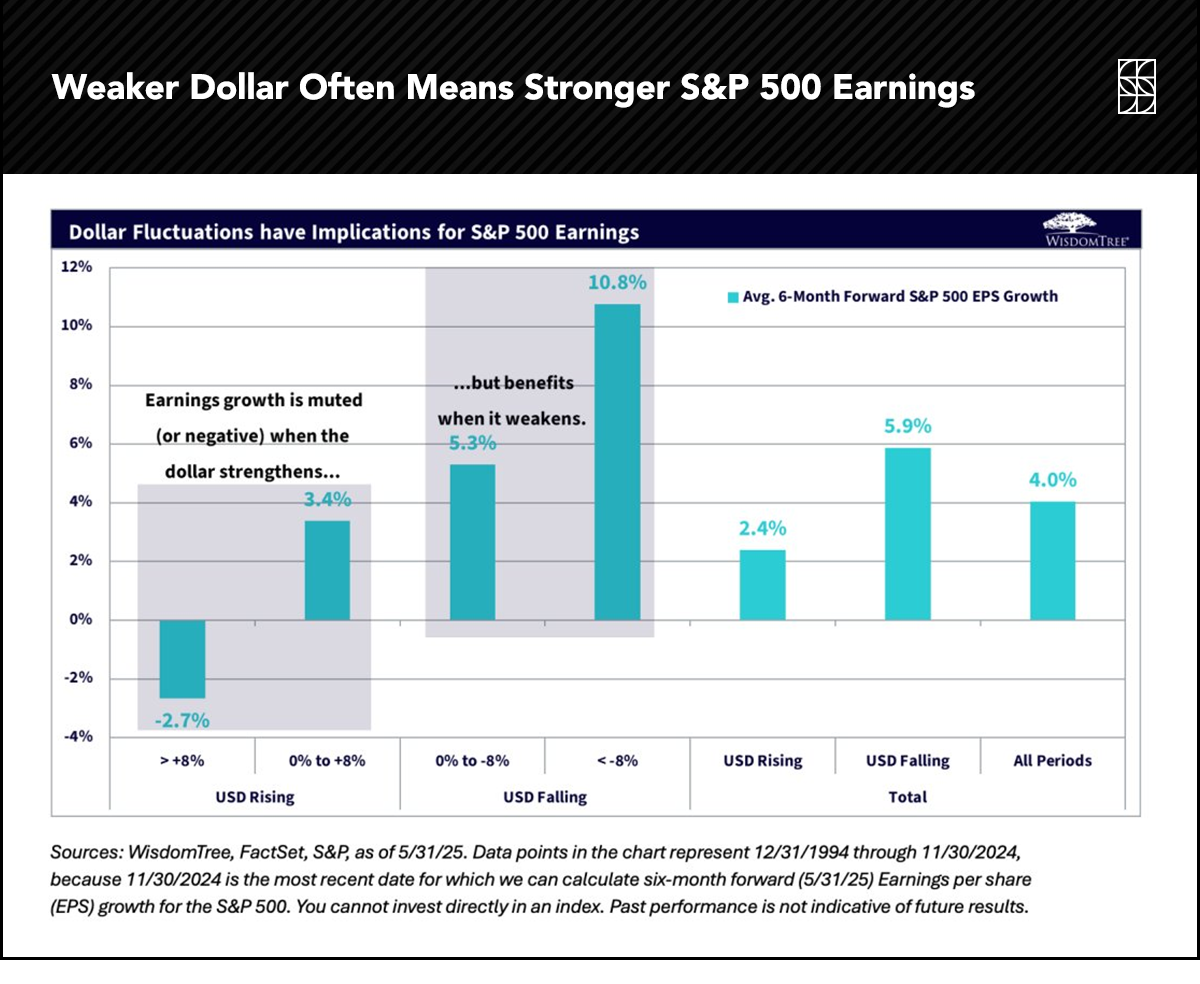

On that note, diversification has worked wonders in 2025 from a geographical perspective. International markets have collectively outperformed the U.S., mainly due to the dollar’s dreadful first-half performance cited earlier. The DXY actually staged a Q3 recovery. Don’t call it a comeback, but the buck rose 1% over the summer months, helping to quiet the “sell America” trade that gained steam earlier in 2025.

Chart courtesy of Stockcharts.com

A weaker dollar is often a tailwind for ex-U.S. stocks and commodities. Foreign markets lagged domestic stocks slightly in Q3, but some hard assets didn’t slow as the DXY tread water. Gold, silver, copper, and other metals outperformed, while crude oil lagged badly.

The currency market remains in focus, particularly as economies around the world increase their defense spending and promote more shareholder-friendly policies. Much of Europe is coming to grips with the reality that it may have to shoulder more of the burden to protect itself. Japan, meanwhile, has adopted a more capitalistic stance by encouraging companies to invest and reward shareholders with stock buybacks.

A result is higher interest rates beyond our borders. In the foreign exchange market, interest rate differentials matter greatly to currency values. It’s unknown what the dollar’s next move will be, but it may have significant implications for stocks, bonds, and commodities.

Source: WisdomTree

There are plenty of risks facing investors today (hint: there always are!), but stocks have been resilient in recent months. Early indicators point to a strong 3% GDP growth rate this quarter, just as corporate earnings log record levels. A bullish tone comes even as the federal government shuts down to begin October.

Investors should focus on the controllables and stick with a diversified portfolio that stands a better chance of weathering macro curveballs that could be tossed our way.

Stokes Family Office is 100% Family Owned, and has been continually operating in the New Orleans Area for over 35 years. As a family office, we are focused on family wealth, financial planning, and tax planning. We are your local experts for Gulf South wealth management. Want to hear more from our team? Check out the Lagniappe Podcast.

*Stokes Family Office does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.