Lots of AI Bubble Talk

December 4, 2025

Each week, the Stokes Family Office staff puts together a list of our favorite news and updates on all things wealth management. From financial planning, portfolio construction, tax and estate planning, retirement plan services to anything we found interesting. Enjoy this week’s curated list for your weekend reading!

Data Centers Are a ‘Gold Rush’ for Construction Workers

Te-Ping Chen, WSJ: Surging demand means six-figure pay and more perks.

America’s Great Build-A-Thon Comes With a Price Tag

David Parsons: The United States is on the brink of an industrial transformation that could redefine its economic trajectory. The question for investors and policymakers is whether this investment renaissance will reignite inflationary pressures which might lead to a newly reconstituted Federal Reserve signalling a willingness to run the economy “hot”.

A Vision for Healthcare AI in America

Joe Lonsdale: 8VC’s battle plan to upend a broken system.

Related:

Jose Ordonez: Gold has jumped from sleepy sideshow to dominant market narrative in a short span of time. Today, after a parabolic mid-summer move followed by a short correction, investors are now asking themselves: is it too late to buy gold?

The Railway Bubble vs. the AI Bubble

Ben Carlson: The siren song of innovation means there will invariably be a new gold rush every time we collectively get excited about a shiny new toy. Those innovations may change the way we live but that doesn’t necessarily mean they’re going to make you wealthy in the process.

A Trillion Reasons We’re Not in an AI Bubble

Owen A. Lamont: Is the U.S. stock market currently in an AI bubble? My favorite indicator says no. If corporate executives thought that stock prices were too high, they’d be issuing equity. Instead, they’re repurchasing it, to the tune of $1T in the past year.

Related:

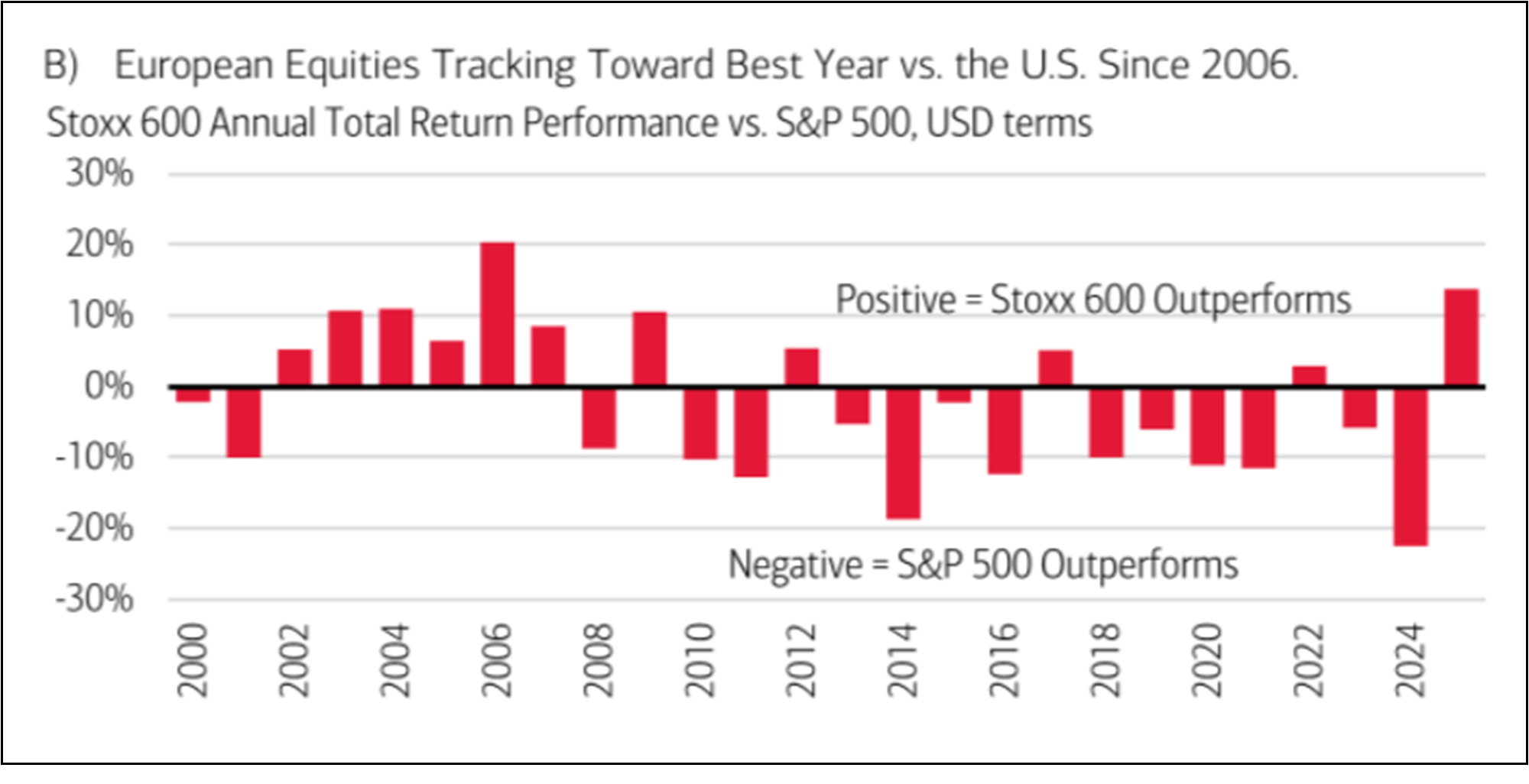

Via Mike Zaccardi, European stocks are tracking for their best year vs the U.S. since 2006.

Stokes Family Office is 100% Family Owned, and has been continually operating in the New Orleans Area for over 35 years. As a family office, we are focused on family wealth, financial planning, and tax planning. We are your local experts for Gulf South wealth management. Want to hear more from our team? Check out the Lagniappe Podcast.

*Stokes Family Office does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.